- United States

- /

- Construction

- /

- NYSE:PRIM

Does the Recent 14.9% Dip Make Primoris Services a Value Play in 2025?

Reviewed by Bailey Pemberton

- Curious whether Primoris Services is a bargain pick or priced to perfection? Let's dig into what makes this stock catch the eye of savvy investors, especially if value is on your mind.

- After surging 51.8% year-to-date and outperforming the market by 40.8% over the past year, Primoris Services recently took a breather and dipped 14.9% in the last month.

- This recent pullback did not come out of nowhere, as news about new project wins and market activity in infrastructure and energy contracting have added fuel to both optimism and volatility. Analysts and market-watchers are observing how these developments could shift the company's growth trajectory going forward.

- On our 6-point value scorecard, Primoris Services currently racks up a 4/6, signaling it is undervalued in several key areas. Up next, we will break down the usual ways investors value stocks, and there is an even smarter way to approach valuation that you may want to consider.

Approach 1: Primoris Services Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. In short, it tries to figure out what all of Primoris Services’ future profits are worth right now.

Currently, Primoris Services generates free cash flow of $486.7 million. Analyst forecasts provide estimates for several years ahead, with free cash flow projected to grow to $368.1 million by the end of 2028. Beyond the explicit analyst estimates, projections are extended out to 2035, with values extrapolated using long-term assumptions.

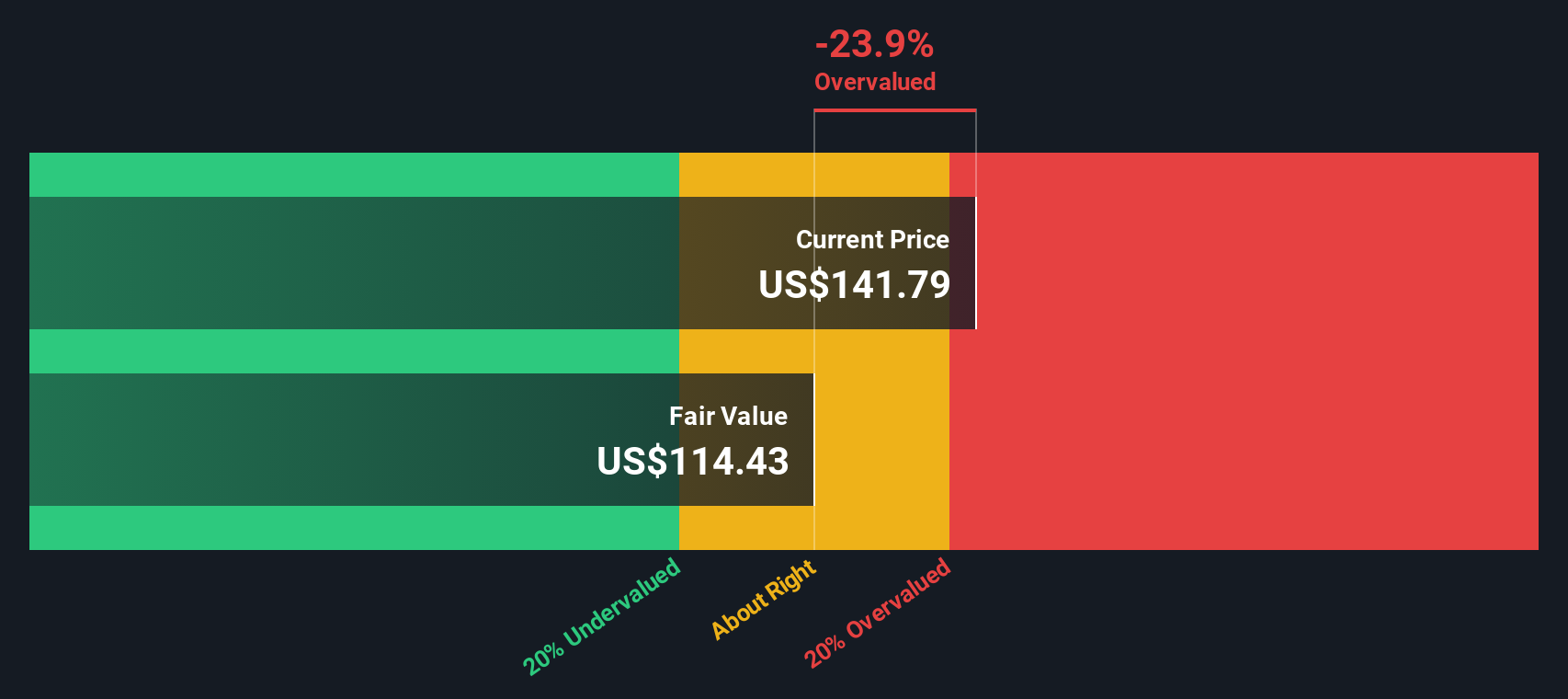

Based on the two-stage Free Cash Flow to Equity model, the calculated fair value for the company stands at $110.77 per share. Comparing this to the latest share price, the model suggests the stock is about 5.4% overvalued right now. That margin is small and well within the range where other factors and normal market moves could come into play.

Result: ABOUT RIGHT

Primoris Services is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Primoris Services Price vs Earnings

The price-to-earnings (PE) ratio is often considered the go-to metric for valuing profitable companies like Primoris Services because it directly connects a company’s share price to its bottom-line earnings. A well-chosen PE ratio offers a real-world snapshot of how much investors are willing to pay today for each dollar of current earnings.

However, what qualifies as a “normal” or “fair” PE ratio is not one-size-fits-all. It depends on expectations for future growth and the risks unique to the business and industry. Fast-growing companies or stable industry leaders often receive a higher PE ratio, while firms facing headwinds or elevated risks typically trade at lower multiples.

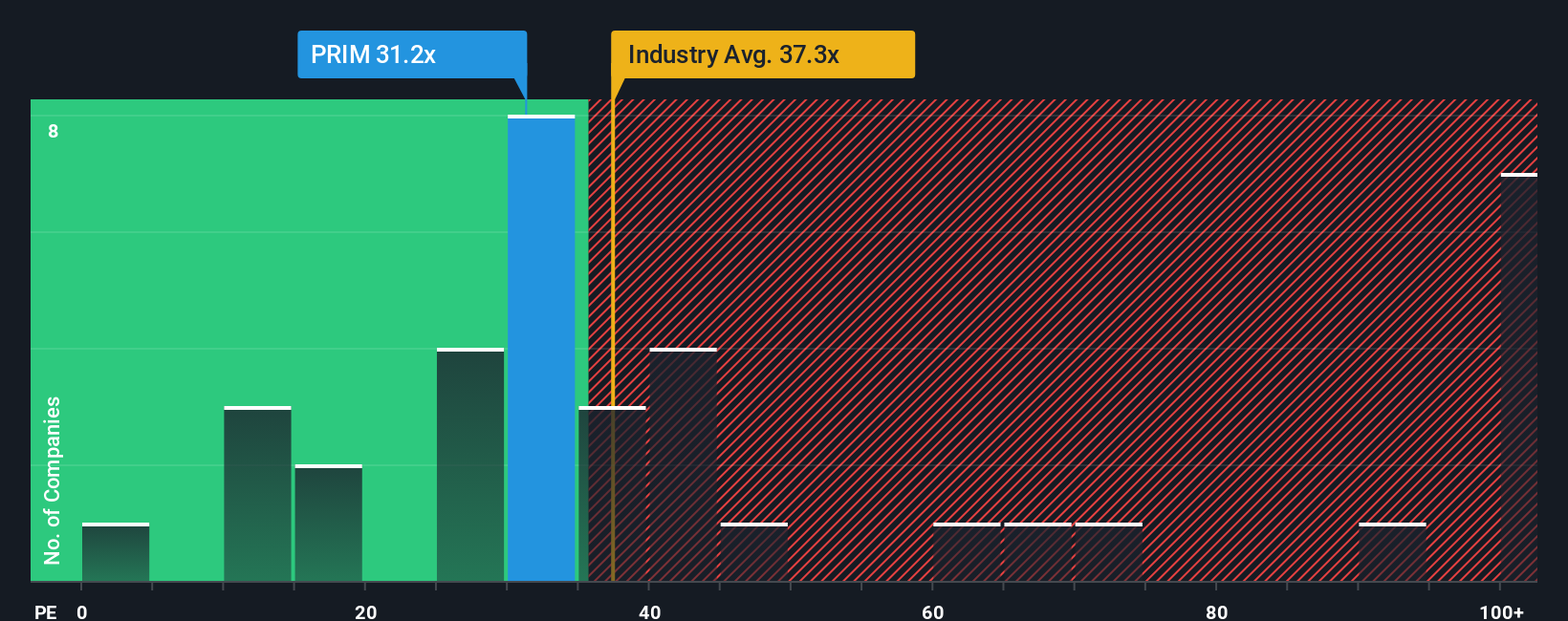

Primoris Services currently trades at a PE ratio of 22.76x. That compares to an industry average of 31.03x and a peer group average of 33.96x. At first glance, this suggests the stock is valued more conservatively than its sector peers.

But raw comparisons can overlook important factors. That is where the Fair Ratio comes in. Simply Wall St calculates a tailored benchmark (here, 27.15x) that takes into account Primoris’s earnings growth, industry group, profit margins, market cap, and company-specific risks. This deeper analysis helps cut through the noise and aligns valuation with company fundamentals rather than just broad averages.

With the Fair Ratio at 27.15x and the actual PE at 22.76x, Primoris Services is trading slightly below what would be expected given its financial and industry realities. The difference is not huge but does indicate a mild discount, supporting the view that the stock is fairly valued with a tilt toward being undervalued.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Primoris Services Narrative

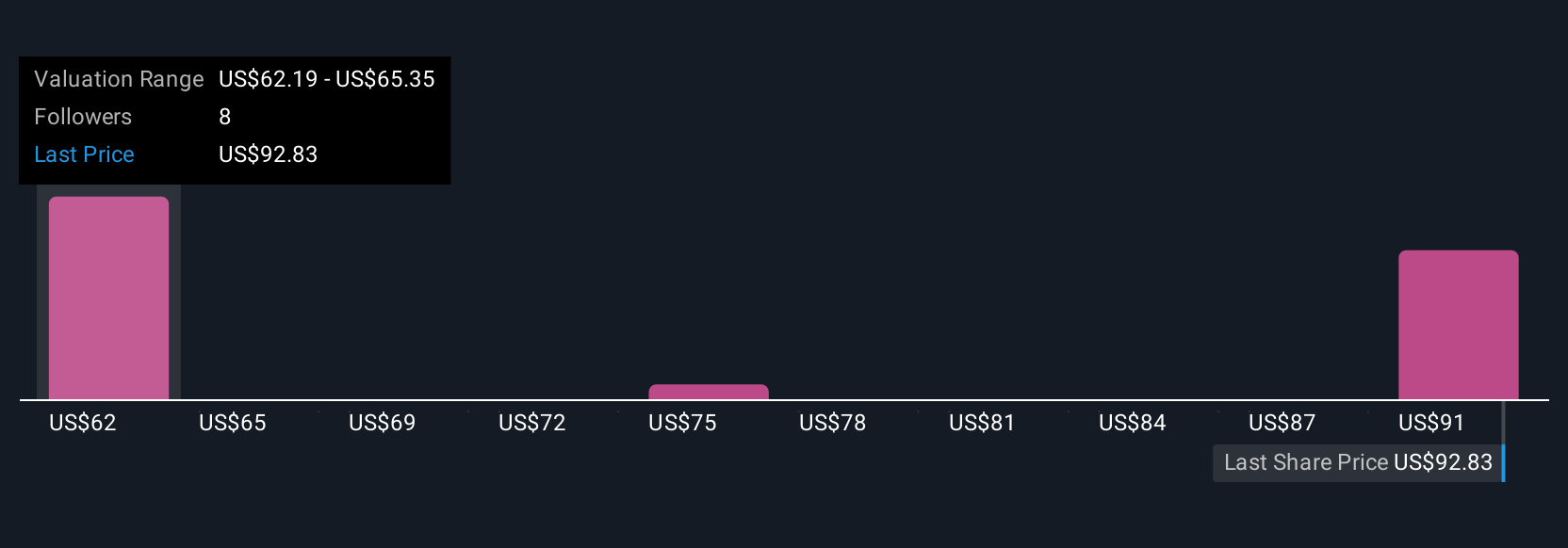

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story and outlook about a company; it is how you connect your expectations for Primoris Services’ future revenue, earnings, and margins to a specific fair value, explaining not just what you think the company is worth, but why you believe that story will play out.

By tying together a company’s story, financial forecast, and estimated fair value, Narratives give clarity to your investment thesis and allow you to visualize how your assumptions compare to both the broader market and the latest analyst consensus. Narratives are simple to use, built directly into Simply Wall St’s Community page, and are actively used by millions of investors to make smarter decisions.

With Narratives, you can see at a glance whether Primoris Services is a buy or a sell by comparing your Fair Value calculation with the current share price, helping you decide with confidence. Importantly, these Narratives update automatically as new information such as news or earnings is released, keeping your perspective relevant and up to date.

For example, one investor might build a Narrative projecting robust renewables growth and see a fair value of $135 per share, while another takes a more cautious view citing margin risks and estimates fair value at $110, showing how everyone can build and share their own story behind the numbers.

Do you think there's more to the story for Primoris Services? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRIM

Primoris Services

Provides infrastructure services primarily in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives