- United States

- /

- Machinery

- /

- NYSE:PNR

Should Pentair’s (PNR) Strong Q3 Earnings and Upbeat Analyst Outlook Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Pentair reported third-quarter 2025 earnings that surpassed both revenue and adjusted earnings per share forecasts, prompting multiple analysts to raise their outlook on the company.

- Heightened analyst confidence reflects Pentair's perceived strength in core markets and its ability to deliver quality earnings and improved returns on invested capital.

- Analysts' optimism about Pentair's strengthening earnings quality sets an important backdrop for assessing its evolving investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Pentair Investment Narrative Recap

To be a shareholder in Pentair, you need to believe in the company's ability to capture multi-year growth through innovation in water solutions, infrastructure, and filtration, even as it faces challenges from soft residential demand and industry cyclicality. The latest earnings beat and uplift in analyst price targets have reinforced confidence in Pentair’s market position, but the impact on its most important short-term catalyst, recovery in residential pool equipment volumes, is limited, as the segment still faces headwinds from high interest rates and delayed renovations. One of the most relevant recent announcements is Pentair’s raised 2025 earnings and sales guidance, targeting GAAP EPS of $3.98 to $4.03 and a reported sales increase of 2% for the year. This updated outlook builds on the strong third-quarter performance and signals management’s ongoing focus on operational efficiency, cost control, and balanced exposure beyond residential markets, even as risks like margin pressure from pricing and input costs remain in view. Yet, investors should watch for signs of demand softness in core residential channels as rising prices could...

Read the full narrative on Pentair (it's free!)

Pentair's narrative projects $4.6 billion revenue and $943.8 million earnings by 2028. This requires 3.7% yearly revenue growth and a $334.4 million earnings increase from the current $609.4 million.

Uncover how Pentair's forecasts yield a $121.68 fair value, a 16% upside to its current price.

Exploring Other Perspectives

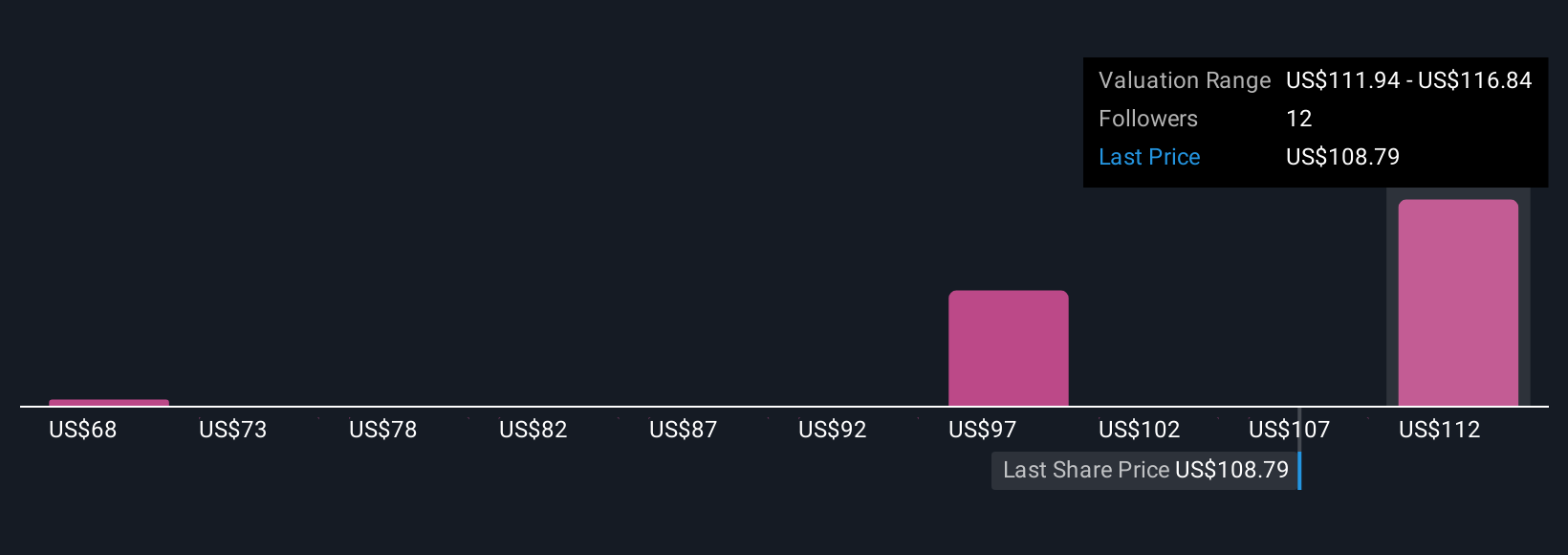

Three members of the Simply Wall St Community have issued Pentair fair value estimates ranging from US$67.78 to US$121.68. While these opinions span nearly double, residential sector risks and margin pressures are key factors likely weighing on the company’s future performance; consider reviewing several viewpoints.

Explore 3 other fair value estimates on Pentair - why the stock might be worth 35% less than the current price!

Build Your Own Pentair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pentair research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Pentair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pentair's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNR

Pentair

Provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives