- United States

- /

- Machinery

- /

- NYSE:PNR

Pentair (PNR): Valuation in Focus Following Strong Q3 Earnings and Upgraded Analyst Targets

Reviewed by Simply Wall St

Pentair (PNR) delivered third quarter results that outperformed expectations, with both adjusted earnings per share and revenue coming in ahead of forecasts. This strong performance has caught the attention of analysts and has prompted renewed optimism around the stock.

See our latest analysis for Pentair.

Pentair’s strong earnings update has injected some new energy into its stock, helping to reverse recent underperformance. While the share price return is up 3.26% over the past day and has climbed 4.37% year-to-date, the total shareholder return for the past year remains slightly negative at -1.93%. However, longer-term investors have been well rewarded, with Pentair delivering a remarkable 144% total return over three years. This reflects robust business momentum and growing optimism about its future prospects.

If you’re interested in tracking other standout names with impressive momentum and management ownership, it’s a great time to discover fast growing stocks with high insider ownership

With shares still trading below several analyst price targets despite the recent rally and robust earnings growth, the key question is whether Pentair remains undervalued or if the market has already priced in the company’s future potential. Is this a buying opportunity, or is all the good news already reflected in the stock?

Most Popular Narrative: 13.9% Undervalued

Pentair’s most widely followed narrative points to a fair value that is notably higher than the latest closing price, suggesting meaningful upside potential if the forecasts prove accurate. The narrative connects fast-rising demand and strategic business moves as the basis for this optimistic estimate.

Secular shifts toward stricter regulations on water quality and sustainability, along with rising investments in ESG and resource-efficient water infrastructure, are increasing global demand for Pentair's advanced purification and filtration technologies. This supports future top-line and margin growth.

Curious about the bold calculations powering that higher price target? The narrative’s math rests on ambitious revenue growth, larger profit margins, and a future earnings multiple that might surprise you. Want to see the assumptions? Dive into the full narrative to uncover the market-moving factors behind this valuation.

Result: Fair Value of $121.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Pentair’s core residential segments or a slowdown in pricing momentum could present challenges to the optimistic outlook and put pressure on future returns.

Find out about the key risks to this Pentair narrative.

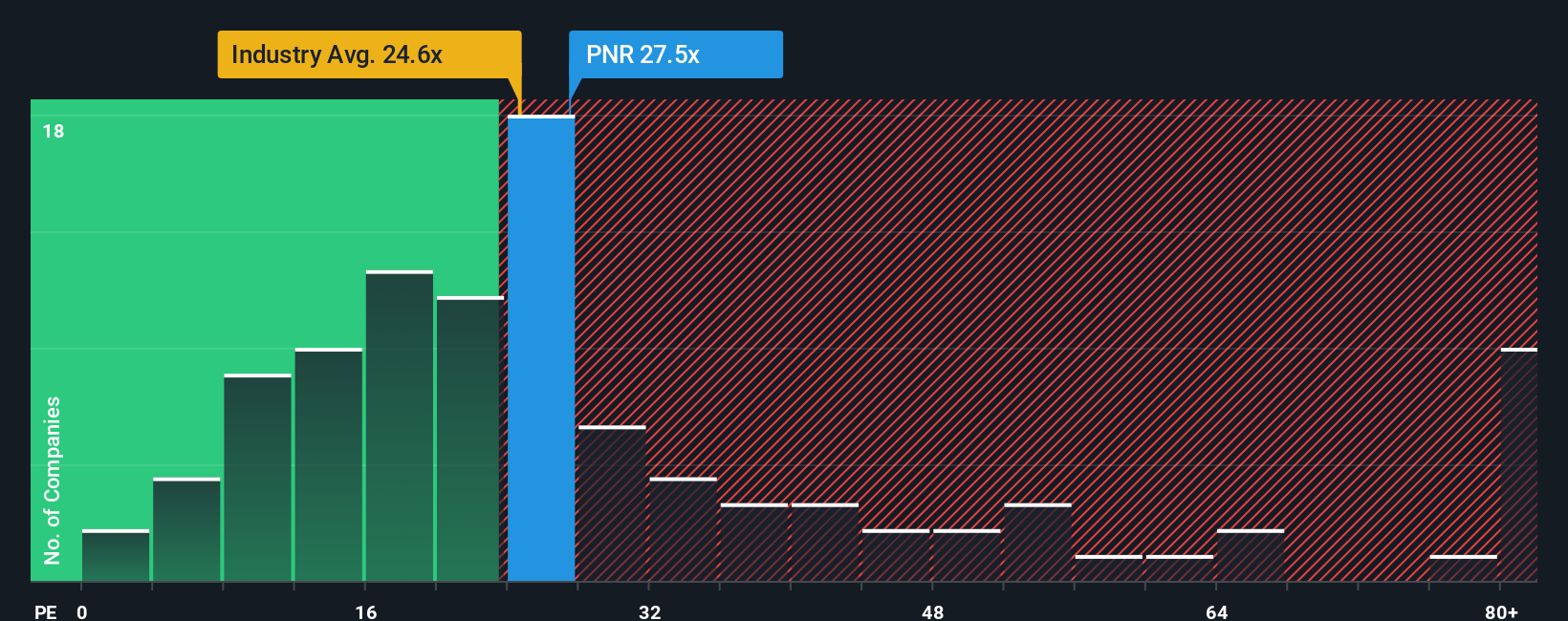

Another View: Looking at Market Multiples

While analyst forecasts suggest Pentair trades below fair value, a glance at its price-to-earnings ratio reveals a different story. The company’s PE ratio stands at 26.2x, which is higher than both its peer average of 23.1x and the US Machinery industry’s average of 23.7x. The fair ratio is estimated at 25.6x. That gap suggests the stock is more expensive than many similar businesses. This raises the question: Are investors right to pay a premium, or does this signal increased valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pentair Narrative

If the conclusions above don’t match your own insights, there’s nothing stopping you from investigating the fundamentals and building a personal outlook. Your own perspective could be ready in just minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pentair.

Looking for More Investment Ideas?

Don’t let opportunity pass you by while others uncover tomorrow’s winners. Supercharge your watchlist by taking a closer look at these unique stock picks below:

- Spot emerging technologies set to change entire industries by browsing these 26 AI penny stocks, which have real-world impact and high growth potential.

- Unlock compelling value plays before they go mainstream by targeting these 927 undervalued stocks based on cash flows, featuring companies often overlooked by the wider market.

- Maximize cash flow with these 15 dividend stocks with yields > 3%, which reward investors with reliable income and strong financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNR

Pentair

Provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives