- United States

- /

- Machinery

- /

- NYSE:PNR

Pentair (PNR): Is Steady Growth Hiding an Undervalued Opportunity?

Reviewed by Simply Wall St

Pentair (PNR) shares edged slightly higher today, closing at $107.18. Investors seem to be taking a measured approach as the stock has posted a modest 7% gain since January. This reflects steady sentiment despite broader market swings.

See our latest analysis for Pentair.

With Pentair’s share price climbing over 6% year-to-date and a total shareholder return of nearly 6% for the past year, momentum appears steady following last year’s impressive multi-year run. While recent weeks saw some modest volatility, long-term shareholders have benefited handsomely, with gains surpassing 100% over five years.

If you want to spot more companies with a history of strong growth and key insider backing, consider widening your search to fast growing stocks with high insider ownership

But with Pentair trading below analyst price targets and growth trending steadily upward, the big question is whether investors are looking at an undervalued prospect or if the market has already factored in future gains.

Most Popular Narrative: 10.9% Undervalued

Pentair’s fair value, according to the most widely followed narrative, stands at $120.28, which is significantly higher than the last close price of $107.18. This emerging gap has caught attention as analysts upgrade their projections and point toward improving growth drivers.

Secular shifts toward stricter regulations on water quality and sustainability, alongside rising investments in ESG and resource-efficient water infrastructure, are increasing global demand for Pentair's advanced purification and filtration technologies, supporting future top-line and margin growth.

What’s really fueling this bullish price target? The narrative is built on aggressive future margin gains, top-line stability, and a bold earnings outlook well above recent company performance. Want to know the financial levers analysts believe will lift the stock? The full narrative exposes just how ambitious their underlying assumptions truly are.

Result: Fair Value of $120.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including weak demand in core residential segments and exposure to cyclical markets. Both of these factors could limit Pentair’s growth momentum.

Find out about the key risks to this Pentair narrative.

Another View: Are Shares Pricing in Too Much Optimism?

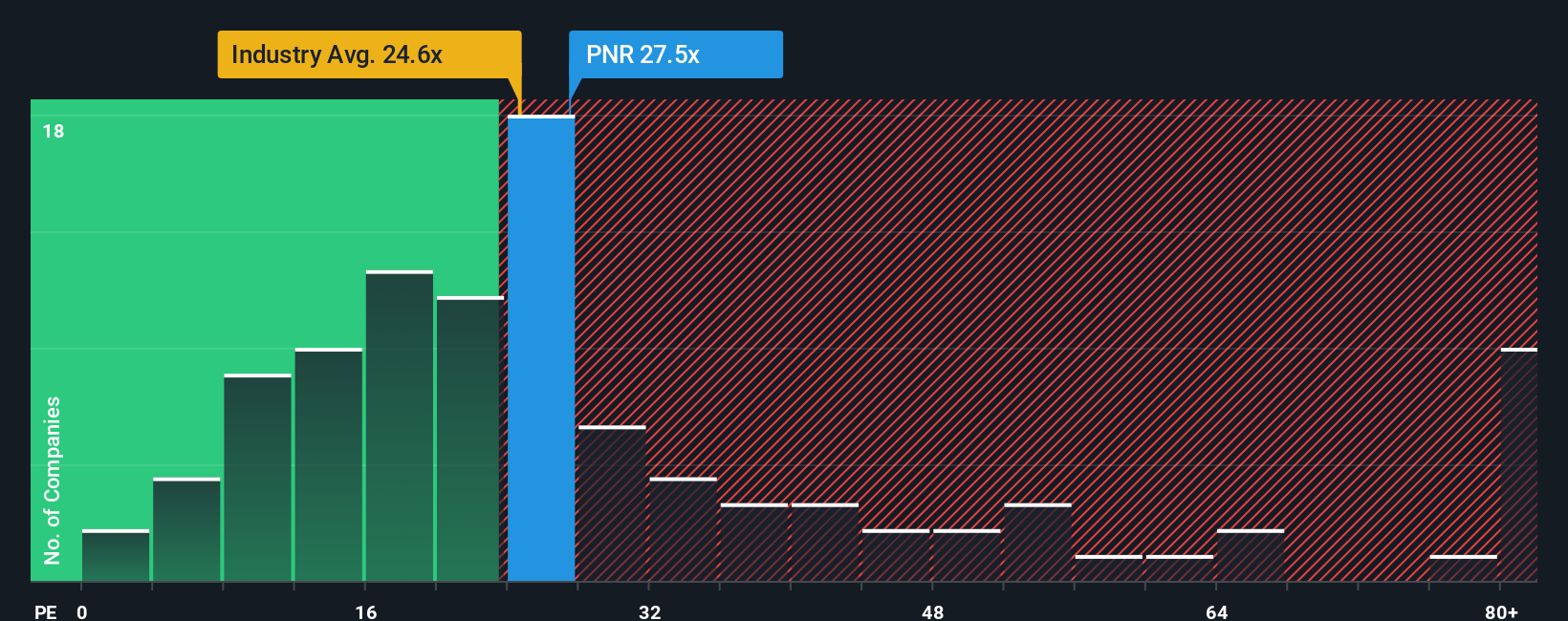

Looking beyond analyst targets, Pentair’s current price-to-earnings ratio of 26.8x stands well above its industry average of 23.9x, its peer group average of 22.2x, and even the estimated fair ratio of 25.6x. This premium suggests investors are paying a higher price for potential growth compared to competitors. Is the optimism justified, or are expectations getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pentair Narrative

If you see the story differently or want to dig into the data yourself, you can assemble your own narrative quickly and easily: Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pentair.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. If you want to take your portfolio further, these handpicked strategies can help you spot the next big winner before everyone else.

- Uncover companies poised for outsized returns when you evaluate these 840 undervalued stocks based on cash flows with robust cash flows and attractive valuations.

- Capture the next wave of innovation by targeting these 26 AI penny stocks that excel in artificial intelligence breakthroughs and smart automation.

- Secure steady returns and income potential with these 20 dividend stocks with yields > 3% that offer yields above 3% and a consistent dividend history.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNR

Pentair

Provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives