- United States

- /

- Electrical

- /

- NYSE:NVT

Is nVent’s (NVT) Liquid Cooling Innovation Shifting Its Role in Data Center Infrastructure Growth?

Reviewed by Sasha Jovanovic

- nVent Electric plc recently unveiled new modular data center liquid cooling solutions, including enhanced coolant distribution units, advanced cooling system manifolds, and updated racks tailored for current and emerging chipmaker requirements, collaborating with industry leaders like Siemens and participating in Project Deschutes at SC25.

- This launch highlights nVent's increasing alignment with hyperscale AI infrastructure trends and positions the company as a key player in supporting evolving data center cooling standards.

- We'll take a look at how nVent's expanded liquid cooling portfolio and industry collaborations could influence its investment narrative built on growing data center demand.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

nVent Electric Investment Narrative Recap

To be a shareholder in nVent Electric, one should expect that ongoing demand for advanced data center infrastructure and electrification will support multi-year growth, underpinned by the AI and digital transformation trends. The recent unveiling of modular liquid cooling solutions strengthens this theme by addressing evolving hyperscale data center needs. However, this announcement does not fully remove the company’s biggest short-term risk: reliance on sustained AI and data center investment, where any slowdown could significantly affect revenue growth.

Recent expansion of manufacturing capacity in Blaine, Minnesota, focused on scaling liquid cooling production, directly complements nVent’s latest launch. This move not only supports near-term demand but also adds resilience to its supply chain, an important element given the elevated backlog and rapid order growth tied to data centers and AI infrastructure.

But even with rising demand, investors should keep in mind the potential effects if major customers begin to...

Read the full narrative on nVent Electric (it's free!)

nVent Electric's narrative projects $4.5 billion revenue and $651.5 million earnings by 2028. This requires 10.4% yearly revenue growth and a $395.4 million earnings increase from $256.1 million today.

Uncover how nVent Electric's forecasts yield a $121.09 fair value, a 16% upside to its current price.

Exploring Other Perspectives

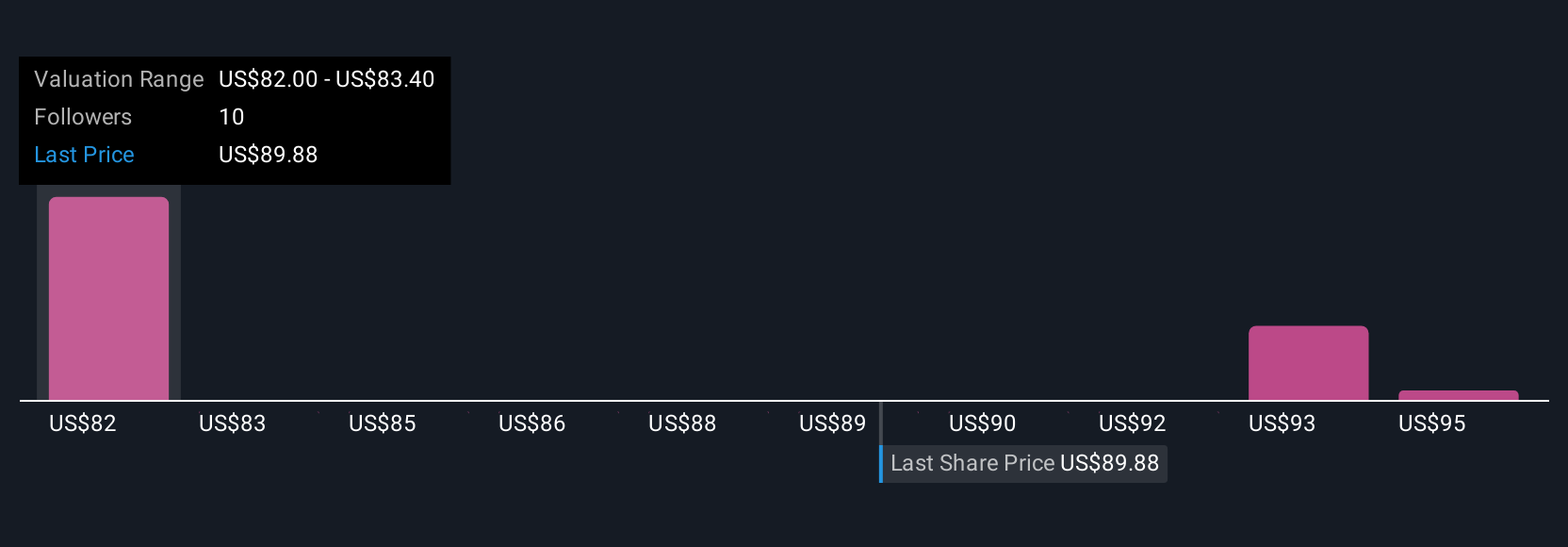

Five different Simply Wall St Community estimates place nVent Electric’s fair value anywhere from US$73.37 to US$121.09 per share. While beliefs about future growth vary, expanding production capacity for next-gen liquid cooling underscores how sensitive performance could be to shifts in AI data center investment.

Explore 5 other fair value estimates on nVent Electric - why the stock might be worth 30% less than the current price!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVT

nVent Electric

Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives