- United States

- /

- Trade Distributors

- /

- NYSE:NPKI

Could NPKI’s Leadership Streamlining Reflect a Shift in Management Priorities at NPK International?

Reviewed by Sasha Jovanovic

- On November 10, 2025, NPK International Inc. announced that Gregg S. Piontek, its Senior Vice President and CFO, assumed additional responsibilities as the company’s principal accounting officer as part of an organizational streamlining initiative; outgoing Chief Accounting Officer Douglas L. White will remain as a non-executive employee through Spring 2026 to aid the transition.

- This consolidation of executive financial roles highlights NPK International’s ongoing efforts to streamline management structure and improve cost efficiency.

- We’ll examine how the expanded responsibilities for Gregg S. Piontek could influence NPK International’s investment narrative and cost structure outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

NPK International Investment Narrative Recap

Investors in NPK International need to believe in sustained demand for infrastructure and utility projects, which underpins the company’s current revenue visibility and growth outlook. The recent consolidation of executive financial roles appears immaterial to the short-term catalyst, infrastructure-driven rental revenue growth, but could impact operating cost structure efficiency. The main risk remains exposure to project timing and sector cyclicality, which can introduce revenue volatility if project pipelines slow or shift.

One recent announcement particularly relevant in this context is the raised full-year 2025 revenue guidance. By increasing revenue expectations multiple times this year, NPK International has shown confidence in project backlogs and execution, reinforcing the same demand catalysts that drive the investment narrative. However, execution on cost management, especially following management changes, will be closely watched.

By contrast, investors should be aware that if infrastructure project timelines slip, this could quickly affect...

Read the full narrative on NPK International (it's free!)

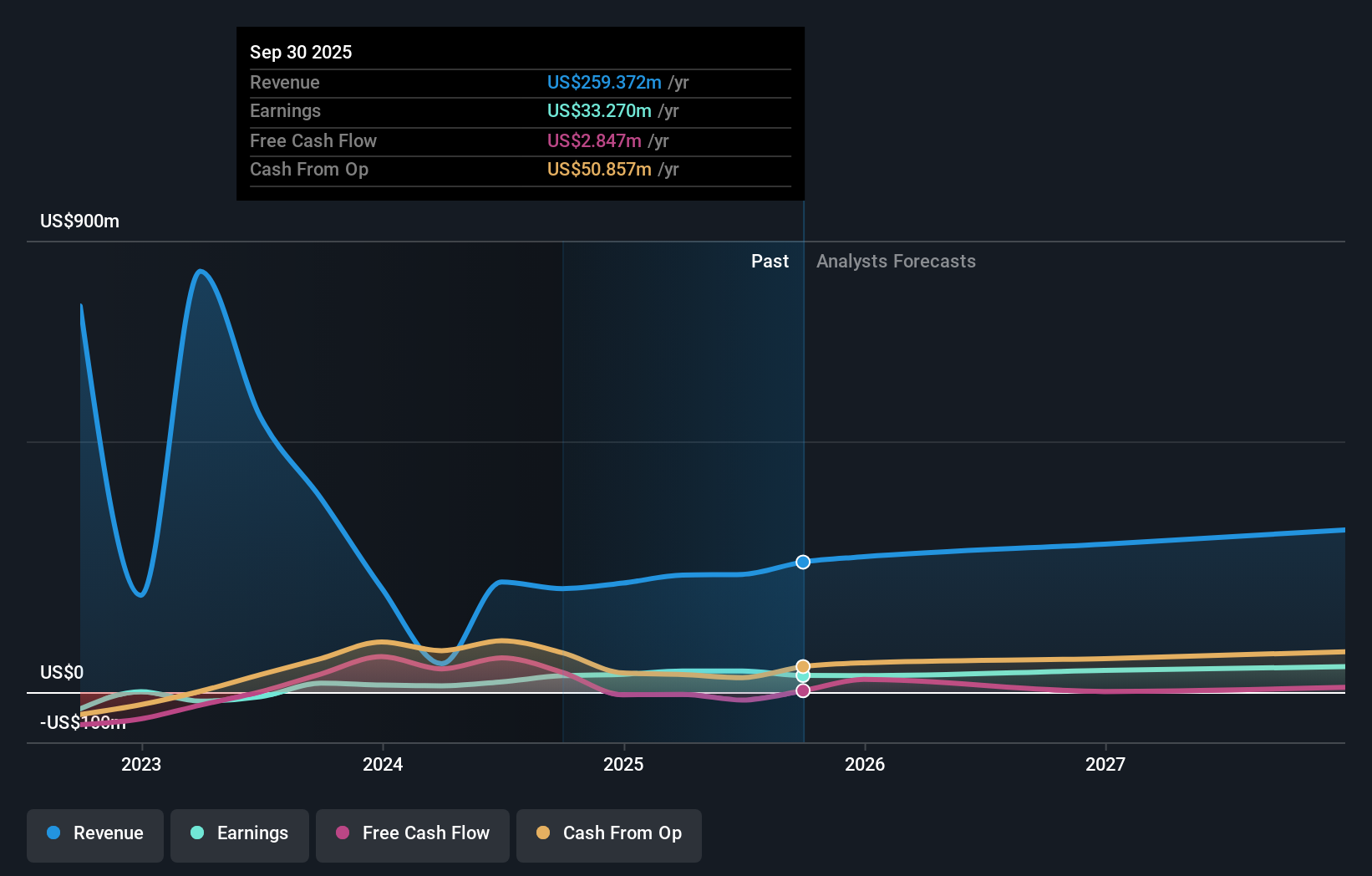

NPK International's outlook anticipates $329.6 million in revenue and $42.8 million in earnings by 2028. This reflects a 12.0% annual revenue growth rate and a modest $0.7 million increase in earnings from the current $42.1 million level.

Uncover how NPK International's forecasts yield a $16.50 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community users have posted two independent fair value estimates for NPK International ranging from US$1.13 to US$10.50. While these analyses differ dramatically, many are focused on the potential revenue volatility tied to project delays or sector shifts, suggesting you may want to compare multiple views before forming an opinion.

Explore 2 other fair value estimates on NPK International - why the stock might be worth as much as $10.50!

Build Your Own NPK International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NPK International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free NPK International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NPK International's overall financial health at a glance.

No Opportunity In NPK International?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NPK International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPKI

NPK International

A temporary worksite access solutions company, manufactures, sells, and rents recyclable composite matting products.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success