- United States

- /

- Machinery

- /

- NYSE:MTW

Manitowoc (MTW): $9.7M One-Off Loss Tests Strength of Turnaround Narrative

Reviewed by Simply Wall St

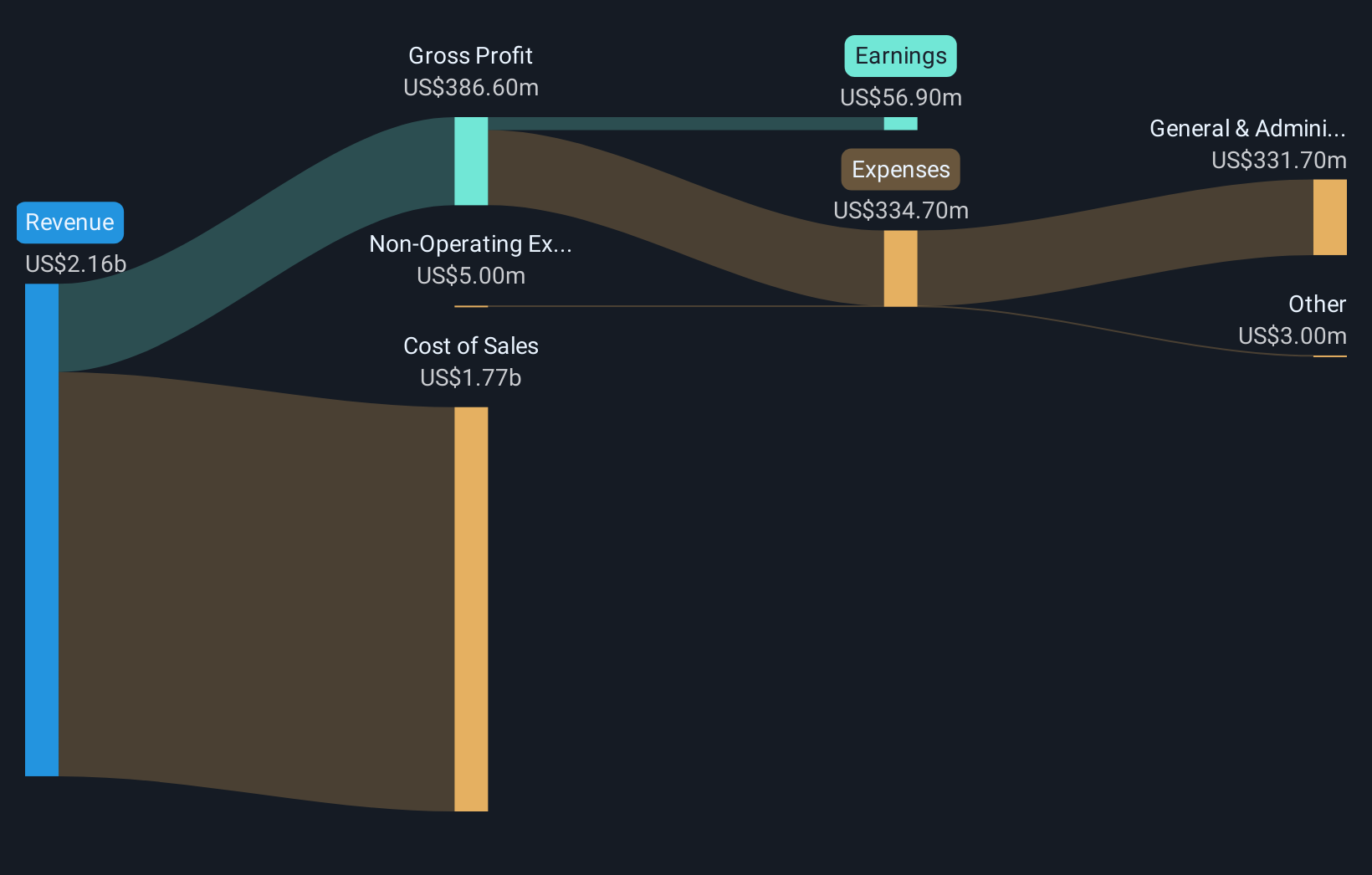

Manitowoc Company (MTW) booked a noteworthy turnaround in its latest twelve months, moving into profitability with a 22.3% annual earnings growth rate over the past five years. The company's EPS in the recent period was shaped by a one-off $9.7 million loss, and its price-to-earnings ratio stands at 7x, substantially below both the US Machinery industry average of 23.9x and its peers at 24.1x. Investors are sizing up MTW's improved net profit margin and headline valuation, balancing the appeal of value and demonstrated growth against the risks presented by the recent non-recurring loss and the company’s overall financial position.

See our full analysis for Manitowoc Company.Now let’s see how these headline results compare to the prevailing narratives. Some perspectives may be reinforced, while others get put to the test.

See what the community is saying about Manitowoc Company

Margins Hold Up Despite Non-Recurring Loss

- Net profit margin turned positive for the first time in the latest twelve months, reflecting a successful swing to profitability even after accounting for the substantial $9.7 million one-off loss that affected reported earnings quality.

- Analysts' consensus view highlights that expansion into high-margin aftermarket services and improved manufacturing flexibility are driving margin stability and mitigating profit swings.

- This supports the case for greater resilience, as recurring service revenues and operational improvements are viewed as cushioning the impact of external shocks and positioning Manitowoc for steadier future gains.

- However, consensus notes that recent operational disruptions and missed deliveries exposed by quarter-over-quarter margin data stress the importance of maintaining these gains through improved execution.

Leverage Up, Cash Flow Guidance Cut

- The company’s net leverage ratio has climbed to 4x (above a targeted 3x). Free cash flow guidance for the full year has been revised down to a range of $10 to $15 million, signaling more pressure on financial flexibility and investment capacity.

- Analysts' consensus view warns that elevated leverage and reduced projected cash flow intensify the risk profile for Manitowoc’s financial health.

- This calls into question how much capacity the company has to invest in growth or weather further downturns, referencing the strain from rising working capital needs and muted order flows.

- Consensus also points to past earnings volatility and high regional revenue concentration as factors compounding these risks, potentially amplifying the impact if sector headwinds persist.

Valuation Discount Remains Stark Versus Industry

- Manitowoc shares trade at a price-to-earnings ratio of 7x, sharply below the US Machinery industry average of 23.9x and peer average of 24.1x. This reflects investor skepticism despite the business turnaround and above-average revenue and earnings growth.

- Analysts' consensus view maintains that the current discount offers an opportunity if the market’s concerns about sustainability and earnings quality are overstated.

- Consensus points out that with the share price at $11.24 versus a price target of $10.0, there is a narrow margin for further upside unless operating and margin stability materialize as anticipated.

- Despite supportive structural trends in global infrastructure and urbanization, the valuation gap signals the market's caution until Manitowoc can prove greater consistency and resilience against sector turbulence.

If you want to see how analysts weave these figures into their complete investment case, dive deeper in the full consensus narrative for Manitowoc Company. 📊 Read the full Manitowoc Company Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Manitowoc Company on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? Shape your interpretation and share your view in just a few minutes. Do it your way

A great starting point for your Manitowoc Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Although Manitowoc has returned to profitability, its rising leverage and lowered cash flow guidance point to heightened financial risk and constrained flexibility.

Prefer sturdier finances? Try solid balance sheet and fundamentals stocks screener (1977 results) to find companies with lower leverage and healthier liquidity that are built to handle stress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTW

Manitowoc Company

Provides engineered lifting solutions in the Americas, Europe, Africa, the Middle East, the Asia Pacific, and internationally.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives