- United States

- /

- Machinery

- /

- NYSE:MTOR

Meritor (NYSE:MTOR) Shareholders Have Enjoyed A Whopping 341% Share Price Gain

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. For example, the Meritor, Inc. (NYSE:MTOR) share price is up a whopping 341% in the last half decade, a handsome return for long term holders. This just goes to show the value creation that some businesses can achieve. Also pleasing for shareholders was the 24% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 14% in 90 days).

Check out our latest analysis for Meritor

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

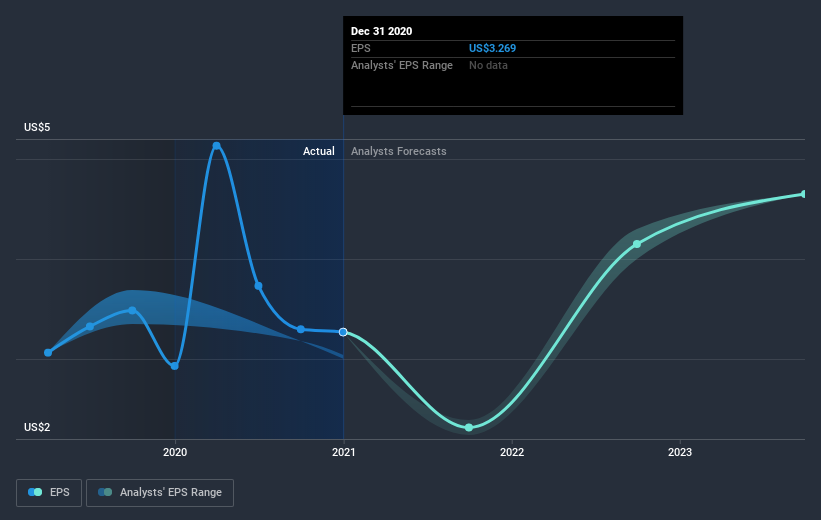

During five years of share price growth, Meritor achieved compound earnings per share (EPS) growth of 39% per year. So the EPS growth rate is rather close to the annualized share price gain of 35% per year. This indicates that investor sentiment towards the company has not changed a great deal. In fact, the share price seems to largely reflect the EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Meritor has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

Meritor shareholders have received returns of 29% over twelve months, which isn't far from the general market return. It has to be noted that the recent return falls short of the 35% shareholders have gained each year, over half a decade. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes Meritor a stock worth watching. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Meritor (including 1 which is potentially serious) .

Of course Meritor may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Meritor, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:MTOR

Meritor

Meritor, Inc. designs, develops, manufactures, markets, distributes, sells, services, and supports integrated systems, modules, and components in North America, South America, Europe, and the Asia Pacific.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives