- United States

- /

- Trade Distributors

- /

- NYSE:MSM

Is MSC Industrial Direct Still Attractive After 6.9% Weekly Share Price Drop?

Reviewed by Bailey Pemberton

- Ever wondered if MSC Industrial Direct is a smart buy at today’s price? If you are looking for value in this market, it pays to look a little closer.

- The stock recently dipped, falling 6.9% over the past week and 5.1% this month, though it's still up 11.0% year-to-date and 3.5% over the past year.

- Lately, the shares have responded to a mix of industry news. Supply chain improvements have helped distributors like MSC Industrial Direct, but ongoing uncertainty in manufacturing has kept sentiment balanced. Headlines about broader economic trends and distribution sector activity have largely driven these short-term moves.

- Right now MSC Industrial Direct scores 0 out of 6 on our valuation checklist, suggesting it doesn't look undervalued on traditional measures, but simple checklists can miss the full picture. Let’s look closer at these methods, and keep an eye out for an even better approach at the end.

MSC Industrial Direct scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MSC Industrial Direct Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by forecasting its future cash flows and then discounting those amounts back to today's value. This helps investors understand what the business may truly be worth based on its ability to generate cash in the years ahead.

For MSC Industrial Direct, the latest reported Free Cash Flow stands at $241.3 million. Analyst forecasts suggest this figure will fluctuate over the coming years, with projections reaching $248 million by 2030. The next five years rely on analysts' estimates, while numbers beyond that are based on extrapolations. In total, projected Free Cash Flows from 2026 to 2035 range from $214.9 million up to $306 million before gradually declining, as estimated by Simply Wall St.

According to the DCF calculation, the fair value for MSC Industrial Direct shares sits at $60.74. Compared to the current trading price, this implies the stock is about 37.5% overvalued at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MSC Industrial Direct may be overvalued by 37.5%. Discover 921 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: MSC Industrial Direct Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it puts the stock price in direct context with the company's earnings. For investors, a lower PE ratio may suggest a stock is undervalued relative to its profit potential, while a higher figure could indicate optimism about future growth or possibly overvaluation.

What makes a “normal” or “fair” PE ratio varies between companies and industries. Typically, higher growth expectations or lower business risk will justify a higher PE, while slow growth or higher risk will drag it down. Comparing to industry peers helps, but every business has its own story and prospects.

Right now, MSC Industrial Direct trades at a PE of 23.37x. This is above the Trade Distributors industry average PE of 18.44x and the peer group average of 19.67x. However, Simply Wall St calculates a proprietary “Fair Ratio” for each stock. For MSC Industrial Direct, the Fair Ratio is 20.18x, factoring in company-specific elements such as expected earnings growth, profit margins, size and relevant sector risks.

Unlike standard industry or peer comparisons, the Fair Ratio considers more of the nuances that really matter to an investor, such as how fast a business is likely to grow and the risks it faces. This tailored approach gives a truer sense of value than simply looking at averages.

Comparing MSC Industrial Direct’s current PE ratio (23.37x) to its Fair Ratio (20.18x), the stock is trading at a noticeable premium. This suggests the shares may be a bit on the expensive side right now, even after accounting for the company’s growth and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MSC Industrial Direct Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is an easy-to-use feature that lets you bring your unique perspective to the numbers by tying together your view on a company's future, including revenue and margin forecasts, with a concrete estimate for fair value.

Rather than relying solely on traditional ratios or analyst estimates, Narratives allow you to craft your own story behind the business, connecting what you believe about a company’s prospects directly to financial forecasts and what you think the stock should be worth. Available on the Simply Wall St Community page and used by millions of investors, Narratives let you quickly see if your outlook (or another investor’s) would suggest it’s time to buy, hold, or sell by comparing your fair value with the current share price.

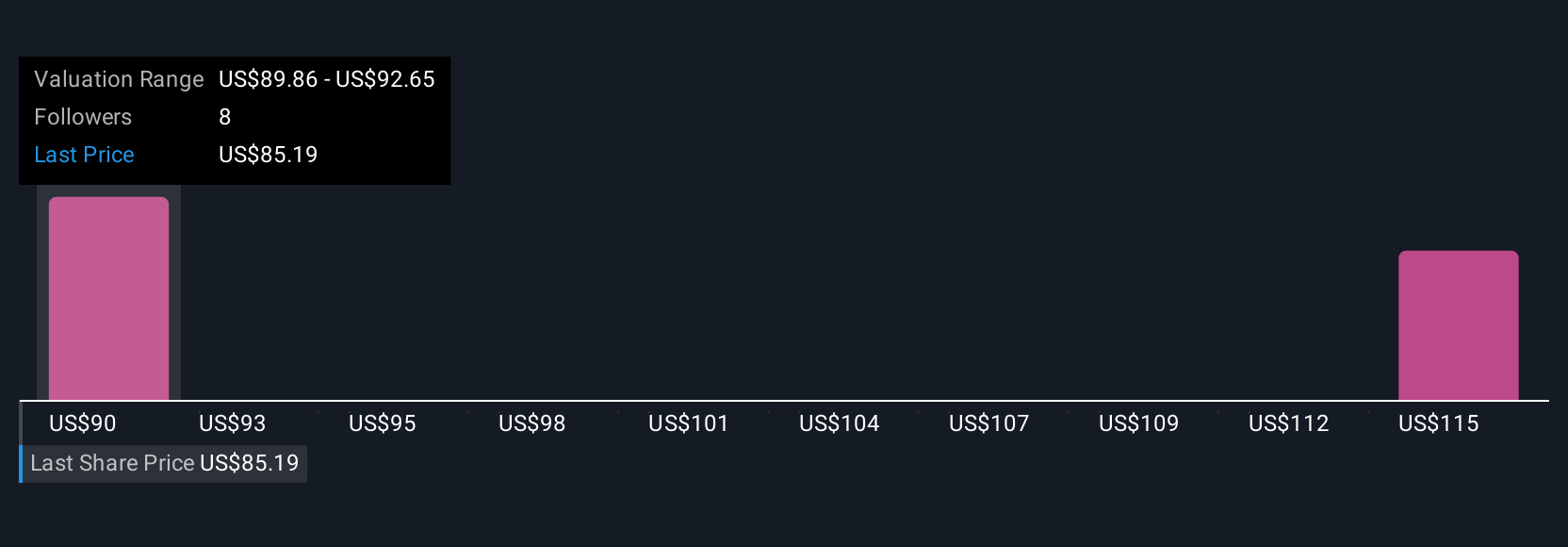

What’s more, Narratives update automatically when important news, earnings, or company developments come out, keeping your assessments current. For MSC Industrial Direct, for example, one investor might believe that strong in-plant program expansion and technology upgrades will drive significant growth, supporting a higher fair value of $105.00, while another might worry about demand softness and margin pressures, setting their fair value at just $81.00. Narratives help you make more dynamic, personalized investment decisions, always grounded in real numbers and up-to-date data.

Do you think there's more to the story for MSC Industrial Direct? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSM

MSC Industrial Direct

Engages in the distribution of metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, the United Kingdom, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives