- United States

- /

- Aerospace & Defense

- /

- NYSE:MOG.A

Moog (MOG.A) Is Up 9.6% After Reporting Record Results and Expanding Defense Backlog

Reviewed by Sasha Jovanovic

- Moog Inc. recently reported record fourth-quarter and full-year results, highlighted by US$1.05 billion in quarterly sales and a 20% increase in backlog to US$3 billion, while also reaffirming its commitment to acquisitions, particularly in the defense sector.

- This combination of strong earnings growth, robust order backlog, and management's intentions to expand through targeted acquisitions signals greater momentum in the company's aerospace and defense segments.

- We'll examine how Moog's record backlog and acquisition focus could reshape its investment narrative and future growth prospects.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Moog Investment Narrative Recap

To hold Moog shares, you need confidence in the company's ability to capitalize on rising global defense spending and execute on expansion, both organically and through acquisitions. The record backlog and intensifying acquisition focus provide support for near-term order stability, but do not substantially change the risk tied to large inventory levels and the ongoing challenge of turning growing sales into stronger cash flow; this remains the most important short-term catalyst and biggest risk, respectively.

The fresh guidance for fiscal 2026, projecting US$4.2 billion in net sales and US$10 in diluted earnings per share, is especially relevant. This outlook connects directly to order growth and margin resilience, serving as a key benchmark for whether recent backlog wins and acquisition plans can translate into improved profitability and earnings momentum.

Yet, despite the operational momentum, investors should be especially mindful of ongoing pressure from persistent and rising tariffs on key input materials...

Read the full narrative on Moog (it's free!)

Moog's narrative projects $4.4 billion revenue and $401.7 million earnings by 2028. This requires 5.7% yearly revenue growth and a $190 million earnings increase from $211.6 million today.

Uncover how Moog's forecasts yield a $228.75 fair value, a 7% upside to its current price.

Exploring Other Perspectives

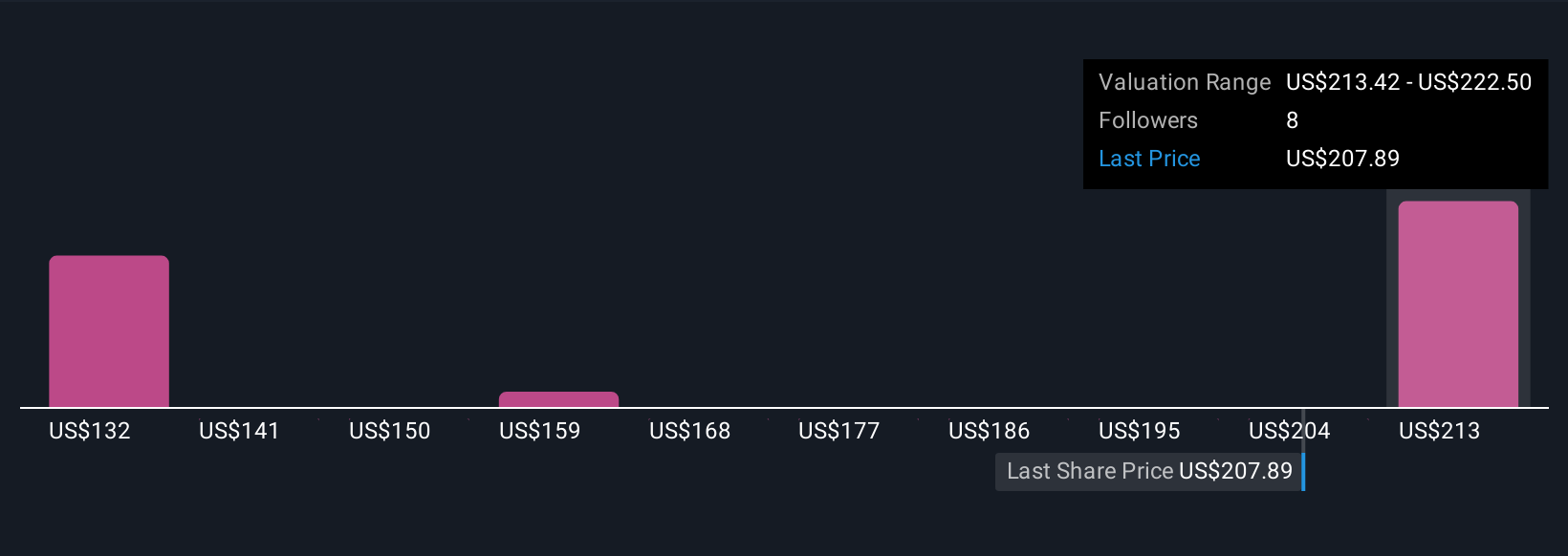

Three fair value estimates compiled by the Simply Wall St Community vary widely, ranging from US$162.12 to US$370.38 per share. With Moog’s record backlog but elevated working capital needs, it is clear that perspectives on the company’s ability to drive sustained, efficient growth are far from unanimous, be sure to consider the breadth of opinion before making your own judgments.

Explore 3 other fair value estimates on Moog - why the stock might be worth 25% less than the current price!

Build Your Own Moog Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moog research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Moog research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moog's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOG.A

Moog

Designs, manufactures, and integrates precision motion and fluid controls and controls systems for original equipment manufacturers and end users in the aerospace, defense, and industrial markets in the United States, Germany, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives