- United States

- /

- Industrials

- /

- NYSE:MMM

Does 3M’s Recent 33% Rally Leave More Room for Upside in 2025?

Reviewed by Bailey Pemberton

- Curious if 3M could be a hidden value play or if you've missed the rally? Let's dive into what really matters for potential investors and those interested in valuation.

- After a strong 33.5% gain over the past year and a 28.4% rise year-to-date, 3M's stock has seen both excitement and a bit of a pullback, with a recent 1.2% dip over the last week.

- Much of this recent movement has been driven by management's ongoing restructuring strategy and positive updates on the resolution of long-standing legal challenges. Investor optimism has followed announcements around successful cost-saving initiatives, alongside settlements that helped clear a path for future growth.

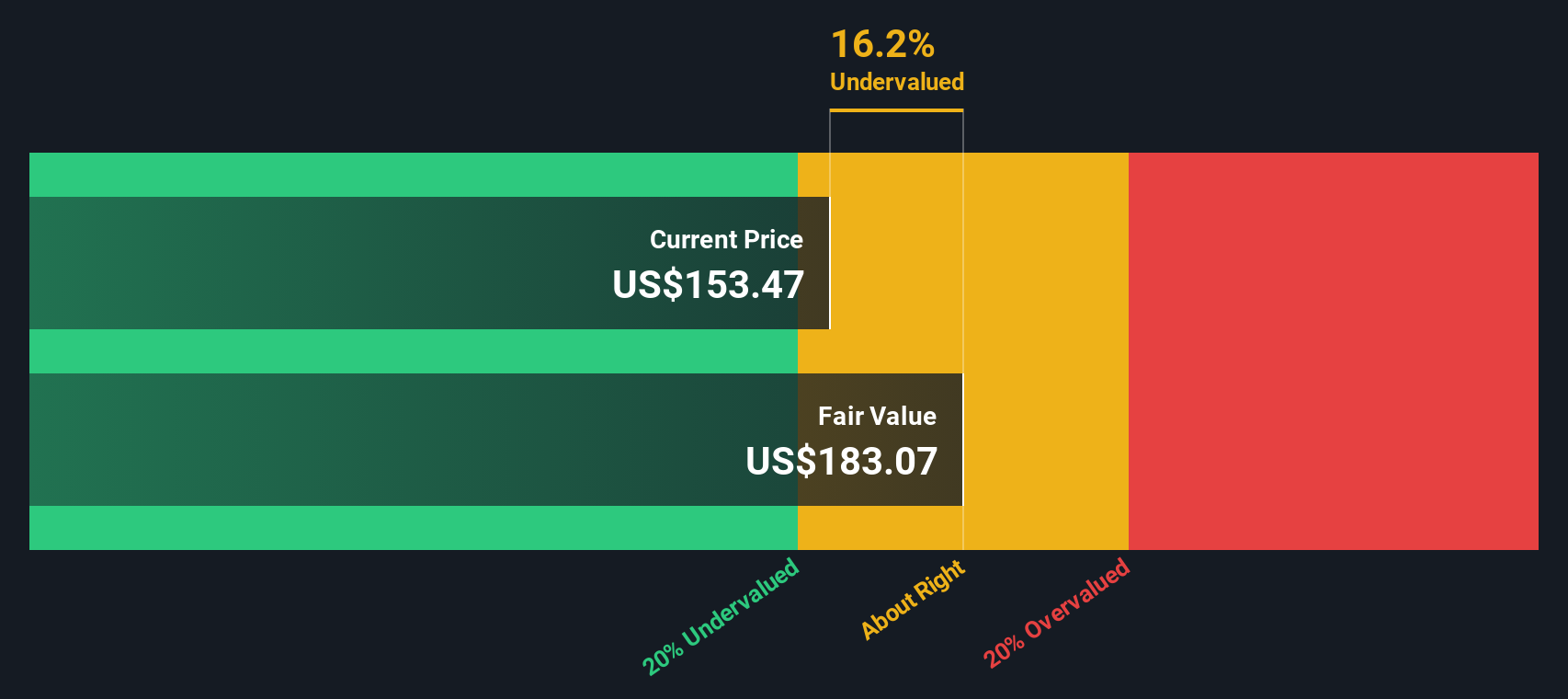

- According to our valuation checks, 3M scores 2 out of 6 for being undervalued. This gives us a starting point, but as you'll see, there are different ways to assess what 3M is really worth, and an even better perspective awaits at the end of this article.

3M scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: 3M Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future free cash flows and discounting them back to today's value. This technique helps investors understand the intrinsic value of a business based on the money it is expected to generate over time.

For 3M, the current Free Cash Flow sits at approximately $1.25 Billion (last twelve months). According to analysts, free cash flows are expected to rise steadily, reaching nearly $4.90 Billion by 2029. Beyond those analyst estimates, further growth is extrapolated by Simply Wall St, with projections through 2035 that continue to build on this upward trend.

Using these cash flow projections, the DCF model calculates a fair value of $194.23 per share. Compared to its current market price, this implies that 3M's stock is trading at a 14.3% discount. In other words, 3M may be undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests 3M is undervalued by 14.3%. Track this in your watchlist or portfolio, or discover 833 more undervalued stocks based on cash flows.

Approach 2: 3M Price vs Earnings

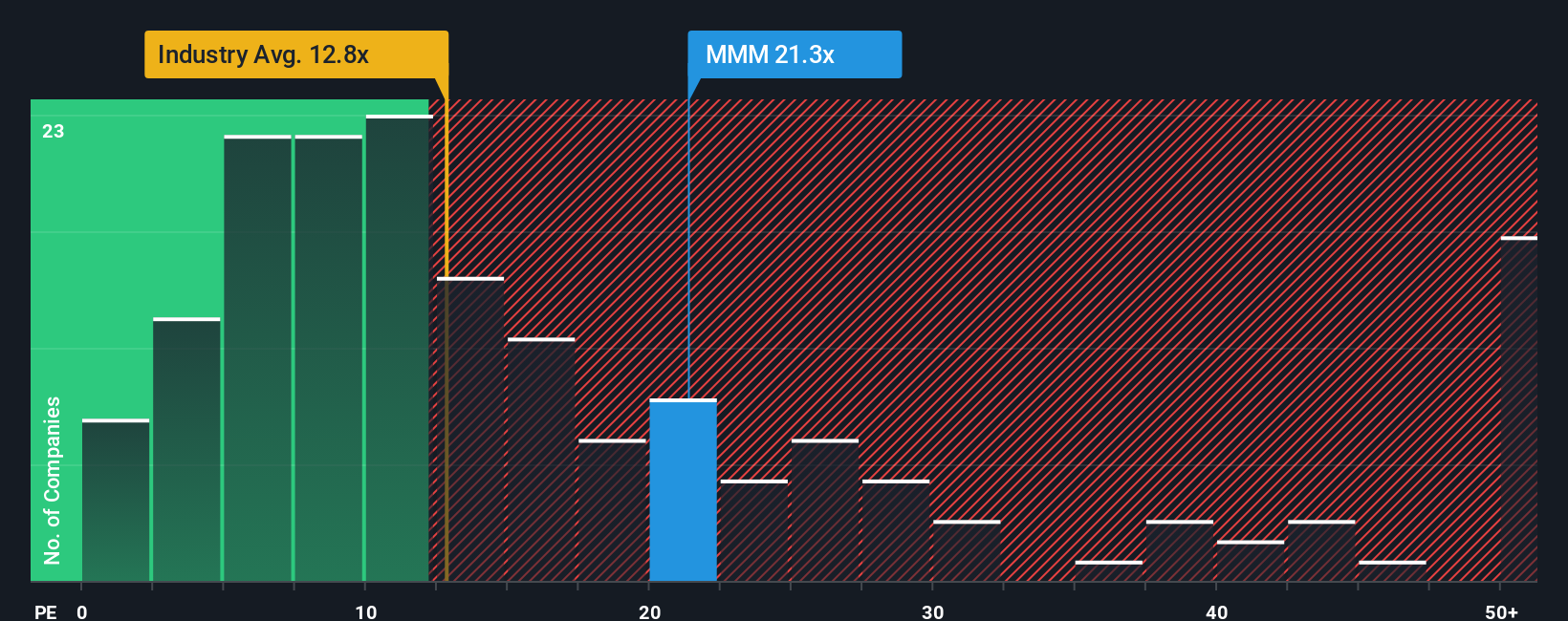

The price-to-earnings (PE) ratio is a go-to valuation method for profitable companies like 3M because it offers a direct look at how much investors are willing to pay for each dollar of earnings. It provides a clear perspective on a company's profit-making ability and market confidence, making it an especially relevant metric for mature, cash-generating businesses.

It's important to understand that the "normal" or "fair" PE ratio for a company is shaped not just by its earnings but also by its growth prospects and risk profile. High-growth, lower-risk companies typically command higher PE ratios, while slower growers or riskier firms see lower valuations.

3M currently trades at a PE ratio of 26x. For context, this is just above the Industrials sector average of 12.9x and slightly higher than its peer average of 25.7x. However, comparing only to these benchmarks can sometimes mislead, since they do not fully reflect 3M's unique growth outlook and risk factors.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. This Fair Ratio, calculated at 31.2x for 3M, aims to identify what a reasonable PE multiple should be when incorporating the company's earnings growth, industry, profit margins, market cap, and risk profile. It serves as a more tailored estimate than simply looking at competitors or sector averages, providing a clearer sense of how the market should be valuing the business.

Comparing 3M's current PE of 26x to its Fair Ratio of 31.2x, the stock trades below what would be justified by these combined factors. This suggests that, on a PE basis, 3M appears undervalued relative to its fundamentals and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your 3M Narrative

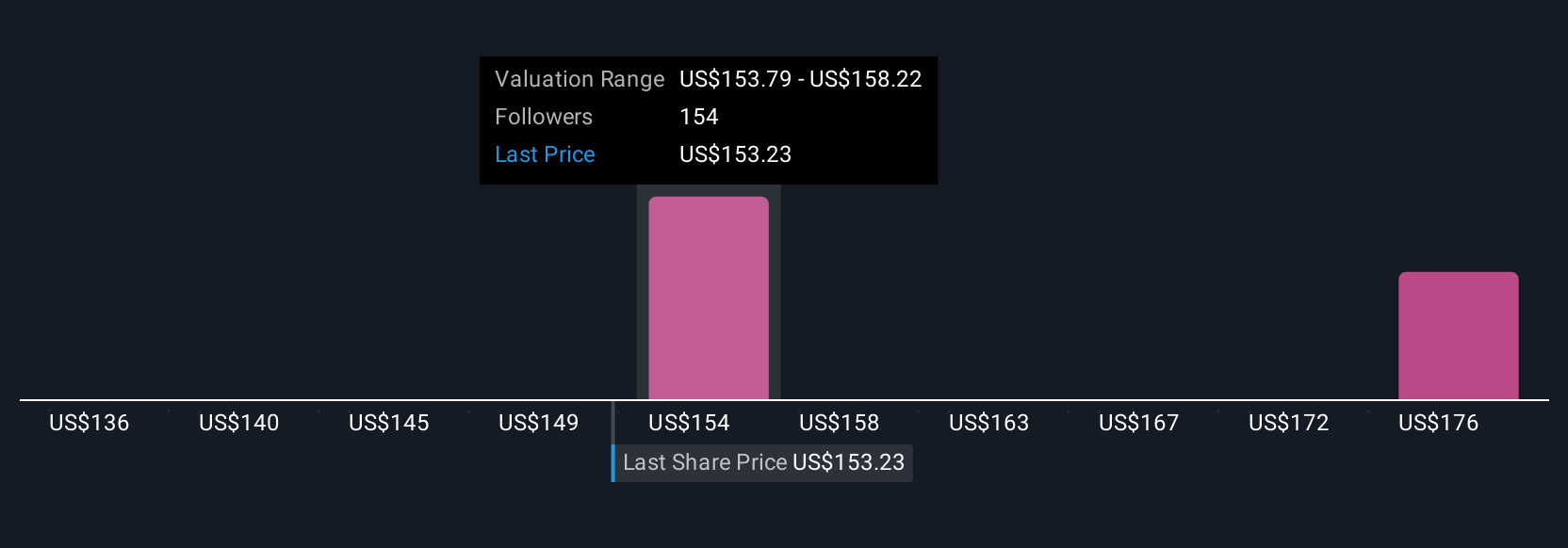

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company: it's where you connect your expectations and reasoning to the numbers by outlining how you think 3M’s future revenue, earnings, and profit margins will unfold. Narratives bridge the gap between what’s happening in the business and a financial forecast, guiding you to an estimated fair value based on your beliefs.

On Simply Wall St’s Community page, millions of investors are already creating and updating Narratives. It’s an intuitive tool that lets you adjust assumptions such as future revenue growth or profit margins, and instantly see how these changes impact 3M’s fair value and whether today’s share price represents a buying or selling opportunity. Best of all, Narratives update automatically as new information, like earnings announcements or fresh legal outcomes, comes in, so your view always stays current.

For example, some 3M Narratives in the Community reflect strong optimism, using bullish revenue and margin growth assumptions and setting fair value near $187 per share. More cautious Narratives focus on legal and operational risks, putting fair value closer to $101. This flexible, interactive approach helps you make better-informed decisions that fit your perspective, not just the market's.

You can compare, debate, and even create your own Narrative for 3M in just a few clicks, making valuation more transparent and actionable than ever before.

Do you think there's more to the story for 3M? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMM

3M

Provides diversified technology services in the Americas, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives