- United States

- /

- Industrials

- /

- NYSE:MMM

3M (MMM): Examining Current Valuation After Recent Share Price Strength

Reviewed by Simply Wall St

3M (MMM) shares saw modest movement this week, giving investors another opportunity to observe how the company is trending compared to the broader industrials sector. With recent performance showing resilience, investors are closely monitoring guidance and trends.

See our latest analysis for 3M.

Momentum has been building for 3M, with the share price climbing nearly 30% year to date and a robust 33% total shareholder return over the past year. That positive trend comes after several key company updates, reflecting renewed investor confidence in both its short-term performance and long-term outlook.

If you’re interested in what else is gaining traction among industrials, take the next step and discover See the full list for free.

With this impressive run and solid fundamentals, investors are now asking whether 3M is still trading at an attractive value or if the market has already factored in growth expectations, leaving little room for further upside.

Most Popular Narrative: 3.6% Undervalued

The most widely followed narrative suggests 3M’s current fair value sits above its last close, indicating modest upside potential if the narrative’s projections are realized. With the stock now trading at $168.09 and a fair value cited at $174.31, valuation models suggest there may be more room to run if the long-term assumptions play out as outlined.

Significant operational efficiency gains, such as improved on-time delivery, increased equipment effectiveness, quality cost reductions, and supply chain/process consolidation, are driving structurally higher operating margins and earnings. These benefits are expected to compound as further optimization and automation are rolled out company-wide.

Want to uncover what’s fueling this higher price target? The story hinges on ambitious margin expansion and bold forecasts for revenue and profit growth. Ever wondered just how aggressive analysts are with their future assumptions? See the key drivers and financial leaps that could put this valuation to the test.

Result: Fair Value of $174.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unresolved litigation over PFAS chemicals and ongoing weakness in key global markets could quickly shift sentiment and challenge the bullish long-term case for 3M.

Find out about the key risks to this 3M narrative.

Another View: Multiples Analysis Points to a Higher Valuation Risk

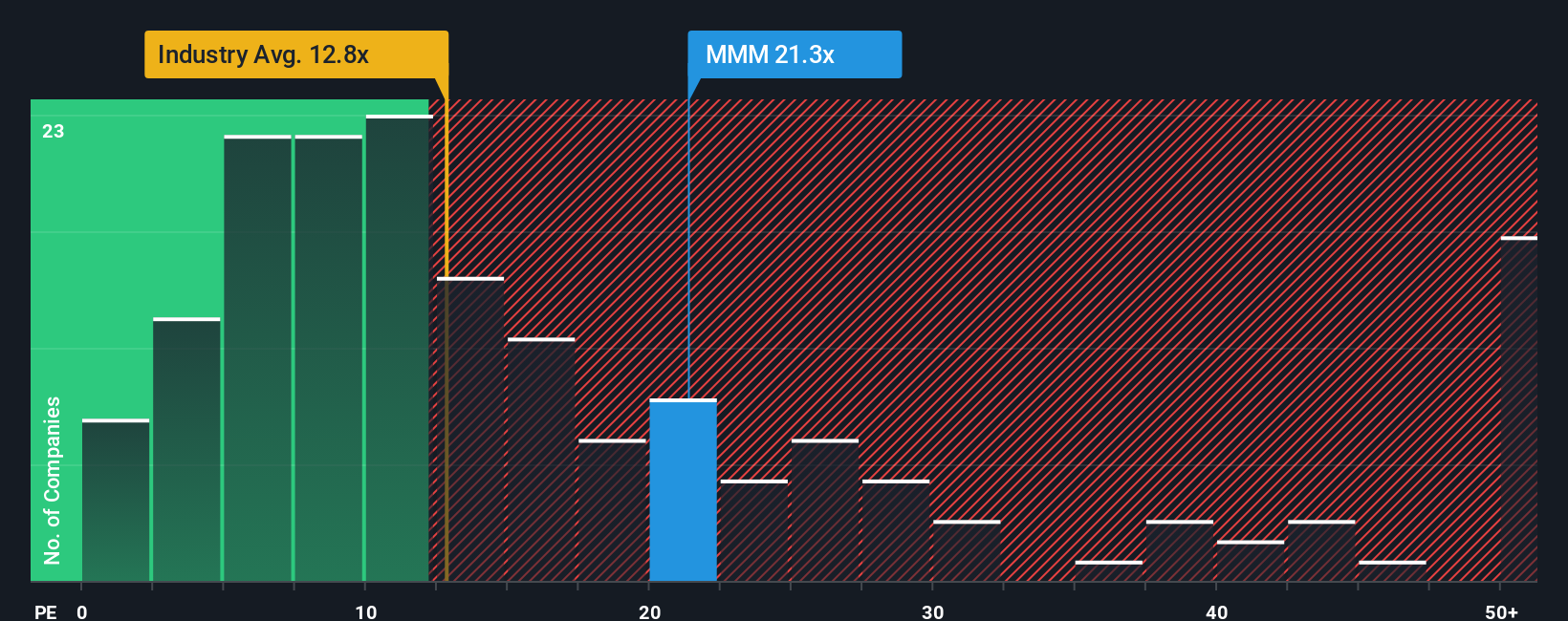

Looking at 3M’s valuation through the lens of its price-to-earnings ratio, shares are trading at 26.3 times earnings, slightly higher than peers and well above the broader Industrials industry average of 12.3. While our fair ratio suggests the market could move as high as 32.3, this premium pricing highlights increased risk if future growth stalls. Will the market continue to support such a lofty valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 3M Narrative

If you’re not convinced by the prevailing narratives or want to dig into the numbers firsthand, creating your own in just minutes is always an option. Do it your way

A great starting point for your 3M research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to spot tomorrow’s winners before the crowd, with unique investing ideas chosen to match every style and risk appetite. Don’t let opportunity pass you by.

- Unlock high-potential gems by scanning these 3598 penny stocks with strong financials that offer compelling financial strength at attractive entry points.

- Capitalize on the unstoppable tech trend and pinpoint innovation leaders among these 26 AI penny stocks shaking up every industry.

- Grow your passive income while limiting risk by targeting these 16 dividend stocks with yields > 3% boasting reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMM

3M

Provides diversified technology services in the Americas, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives