Stock Analysis

- United States

- /

- Industrials

- /

- NYSE:MMM

3M Company's (NYSE:MMM) Business Is Yet to Catch Up With Its Share Price

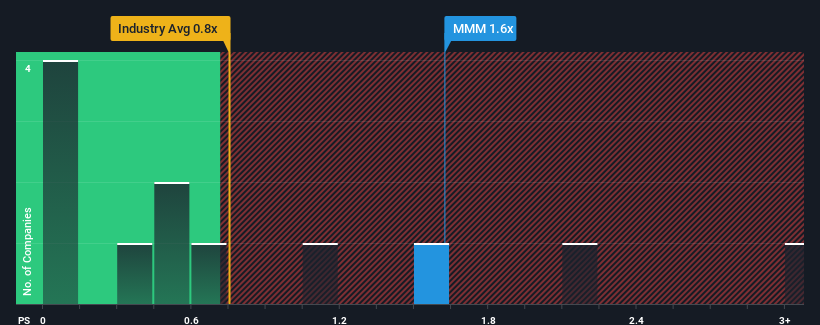

When you see that almost half of the companies in the Industrials industry in the United States have price-to-sales ratios (or "P/S") below 0.6x, 3M Company (NYSE:MMM) looks to be giving off some sell signals with its 1.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for 3M

How 3M Has Been Performing

There hasn't been much to differentiate 3M's and the industry's retreating revenue lately. One possibility is that the P/S ratio is high because investors think the company can turn things around and break free from the broader downward trend in revenue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think 3M's future stacks up against the industry? In that case, our free report is a great place to start.How Is 3M's Revenue Growth Trending?

In order to justify its P/S ratio, 3M would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.5%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 2.3% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.5% per annum, which is noticeably more attractive.

With this information, we find it concerning that 3M is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for 3M, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 2 warning signs for 3M that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether 3M is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NYSE:MMM

3M

3M Company provides diversified technology services in the United States and internationally.

Established dividend payer with reasonable growth potential.