- United States

- /

- Aerospace & Defense

- /

- NYSE:KRMN

The Bull Case For Karman Holdings (KRMN) Could Change Following $130M Loan and Five Axis Acquisition

Reviewed by Sasha Jovanovic

- In October 2025, Karman Holdings Inc. amended its existing credit agreement to secure a new US$130,000,000 incremental term loan, with proceeds designated for repayment of revolving credit, working capital, corporate purposes, and acquisitions including the recent purchase of Five Axis Industries Inc. for US$83,000,000 in cash and shares.

- This move highlights Karman Holdings’ expanding role as a vital supplier in flagship defense programs and fast-growing markets such as hypersonics and commercial space subsystems.

- We’ll explore how Karman’s enhanced access to capital and sector leadership shape its investment narrative and future opportunities.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Karman Holdings' Investment Narrative?

Karman Holdings’ recent US$130,000,000 debt financing and the acquisition of Five Axis Industries mark a timely pivot in the company’s growth story. For a shareholder, the investment premise centers on believing in sustained U.S. defense and space demand, where Karman is an increasingly crucial supplier. The extra capital bolsters the balance sheet and enables further expansion, signaling management’s confidence in capitalizing on sector tailwinds. However, with the company trading at a high price-to-sales ratio against industry peers, and with a relatively inexperienced board, questions around execution risk and integration of Five Axis come to the surface. The immediate impact of the financing appears material: it could magnify Karman’s short-term catalysts if integration is smooth and defense demand holds, yet also raises risks tied to leverage and delivery. Investors should weigh these shifting factors carefully as the narrative evolves for Karman Holdings.

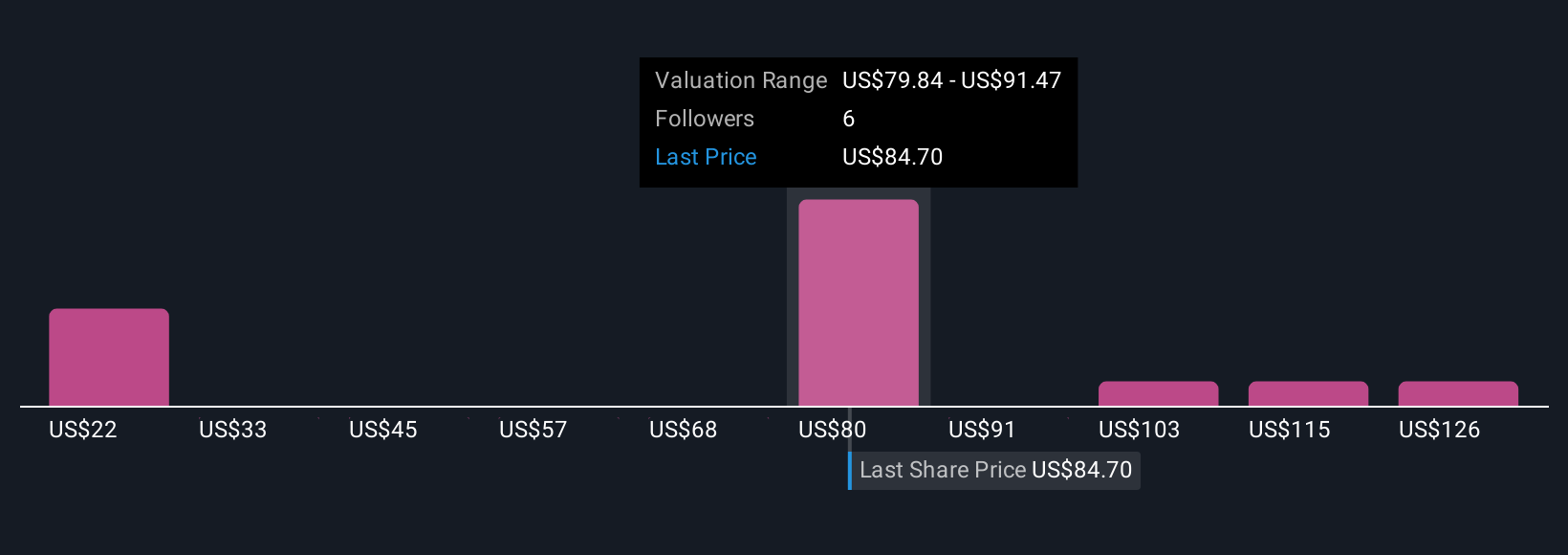

Yet with all its momentum, board inexperience remains a crucial point to watch. Karman Holdings' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on Karman Holdings - why the stock might be worth less than half the current price!

Build Your Own Karman Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Karman Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Karman Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Karman Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRMN

Karman Holdings

Through its subsidiary, engages in designing, testing, manufacturing, and sale of mission-critical systems in the United States.

High growth potential with very low risk.

Market Insights

Community Narratives