- United States

- /

- Aerospace & Defense

- /

- NYSE:KRMN

Karman Holdings (NYSE:KRMN): Evaluating Valuation Following Strong Growth and a Sideways Share Price

Reviewed by Simply Wall St

See our latest analysis for Karman Holdings.

Karman Holdings has been on a wild ride, with its 99.9% year-to-date share price return leaving most of the market in the dust. While the recent 30-day share price return dipped sharply, momentum remains strong when you zoom out. This suggests investors are reassessing growth prospects amid volatile sentiment and high expectations.

If rapid shifts in the market have you thinking bigger, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with Karman’s share price already soaring and analysts’ targets suggesting further upside, the key question remains: is there still value on the table or has the market already priced in every ounce of future growth?

Price-to-Sales of 18.6x: Is it justified?

Karman Holdings trades at a price-to-sales ratio of 18.6x, which is well above both its industry and peer averages. At a last close of $60.07, this valuation signals that investors are paying a significant premium for each dollar of revenue the company generates.

The price-to-sales ratio compares a company’s market price to its revenues, giving a sense of how much investors are willing to pay for a share of sales. In the aerospace and defense sector, this metric can be telling, particularly for firms with fast growth and evolving profitability. A higher ratio may reflect optimism about future performance, but it can also be a warning sign of stretched expectations.

Relative to the US Aerospace & Defense industry average of 2.9x and a peer average of 4.6x, Karman Holdings looks expensive by this metric. Even when compared with an estimated fair price-to-sales ratio of 5.2x, the company’s current valuation leaves little margin for error. The market could demand strong growth and execution to support these levels in the long run.

Explore the SWS fair ratio for Karman Holdings

Result: Price-to-Sales of 18.6x (OVERVALUED)

However, if revenue momentum slows or the company fails to meet lofty expectations, investor confidence could be shaken and Karman Holdings shares could be sharply re-rated.

Find out about the key risks to this Karman Holdings narrative.

Another View: DCF Model Paints a Different Picture

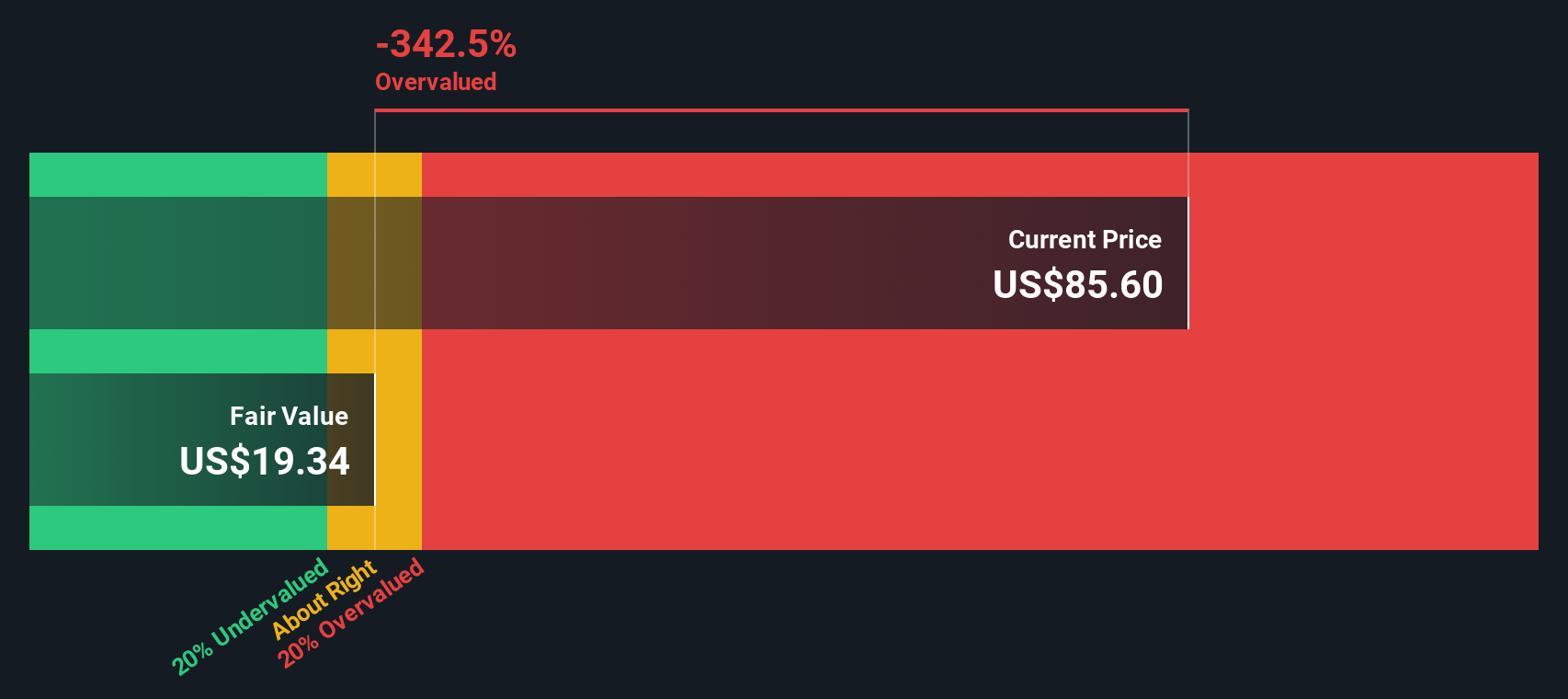

Taking a step back from the price-to-sales ratio, the SWS DCF model suggests Karman Holdings is trading well above its estimated fair value of $27.56 per share. This indicates a potential overvaluation, even when future cash flows are considered. Are market hopes outpacing actual fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Karman Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Karman Holdings Narrative

If you’re not convinced by these results or prefer to dig into the numbers yourself, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Karman Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next opportunity could be just a click away. Benefit from exclusive insights across different sectors and themes with the Simply Wall Street Screener. These trends are moving fast, and you don’t want to miss out.

- Spot high-yield income by tapping into these 16 dividend stocks with yields > 3% and uncovering companies with robust dividend payouts above 3%.

- Ride the momentum of artificial intelligence growth and check out these 26 AI penny stocks that are making headlines through innovation and rapid expansion.

- Capture tomorrow’s market leaders by reviewing these 3597 penny stocks with strong financials with strong underlying financials and immense growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRMN

Karman Holdings

Through its subsidiary, engages in designing, testing, manufacturing, and sale of mission-critical systems in the United States.

High growth potential with low risk.

Market Insights

Community Narratives