- United States

- /

- Machinery

- /

- NYSE:KMT

Kennametal (KMT): Evaluating Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Kennametal.

After a bumpy period earlier this year, Kennametal’s recent 17.8% 1-month share price return and a strong 24.6% gain over the past quarter suggest momentum is building again, even if the total shareholder return over the past year remains slightly negative. Investors seem to be responding to renewed optimism and a shifting risk outlook as the stock seeks firmer footing.

If Kennametal's recent surge has you watching the broader market, this could be the perfect time to discover fast growing stocks with high insider ownership.

With Kennametal’s shares rallying sharply in recent weeks, investors are left weighing an important question: Is this momentum a sign the stock is still undervalued, or are expectations for future growth already reflected in the current price?

Most Popular Narrative: 6% Overvalued

Kennametal’s narrative fair value sits just above last close, hinting that recent optimism still may have run slightly ahead of fundamentals. This sets the stage for a deeper look into the drivers behind the latest fair value estimate.

Portfolio optimization actions, including the divestiture of non-core assets and focus on higher-growth sectors like Aerospace & Defense, are expected to enhance the company's competitive positioning and earnings resilience, supporting future margin expansion and earnings growth.

Curious about the numbers and strategy fueling this valuation? The real story is built on bold upgrades in margin forecasts and a wager that the right business mix will help Kennametal outperform expectations. Discover exactly which financial levers analysts are betting on and see the hidden assumptions inside.

Result: Fair Value of $25.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in end markets and unresolved cost challenges could quickly undermine current optimism if volumes do not rebound as expected.

Find out about the key risks to this Kennametal narrative.

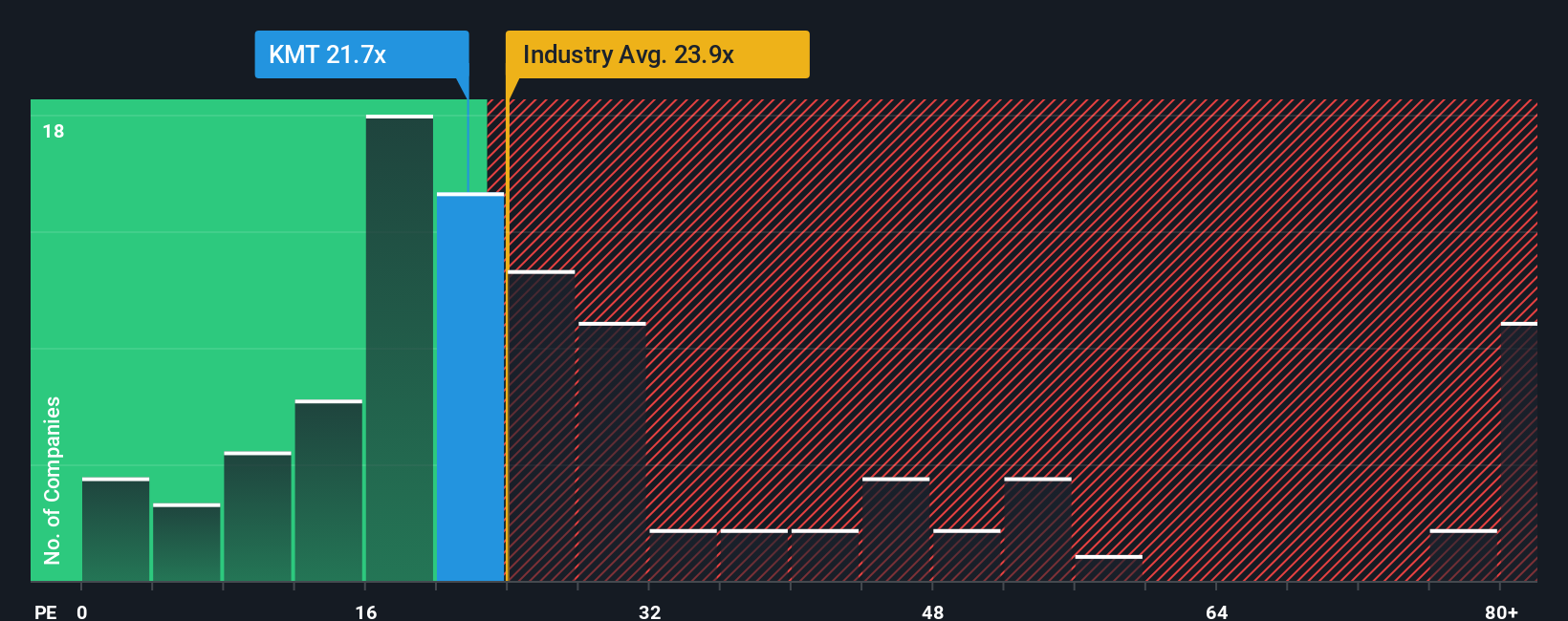

Another View: Multiples Tell a Different Story

While the fair value suggests Kennametal might be a bit overvalued at today's share price, a look at typical market ratios hints at a more nuanced picture. Kennametal’s price-to-earnings ratio stands at 21.6x, which is lower than the peer average of 42.5x and only slightly above its fair ratio of 21.1x. This suggests the stock could be trading close to where the market expects, neither a glaring bargain nor especially risky compared to similar companies. Does this difference in perspective point to an overlooked opportunity, or does it signal that upside is limited?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kennametal Narrative

If you have a different perspective or want to dig into the numbers yourself, you'll find it's easy to shape your own narrative in just a few minutes as well. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kennametal.

Looking for more investment ideas?

Make your next smart move by uncovering stocks packed with potential. Don’t let exciting opportunities slip past when you can seize them first.

- Start building passive income streams by tapping into these 16 dividend stocks with yields > 3%, offering reliable yields and a cushion against market swings.

- Supercharge your watchlist with these 26 AI penny stocks, championing artificial intelligence, automation, and future-ready solutions across high-growth industries.

- Jump on the latest advancements in secure digital assets and financial revolutions through these 81 cryptocurrency and blockchain stocks, powering blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and hard materials and solutions worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives