- United States

- /

- Building

- /

- NYSE:JELD

JELD-WEN (JELD): Losses Grow 78% Annually, but Forecasts Eye 131% EPS Growth Turnaround

Reviewed by Simply Wall St

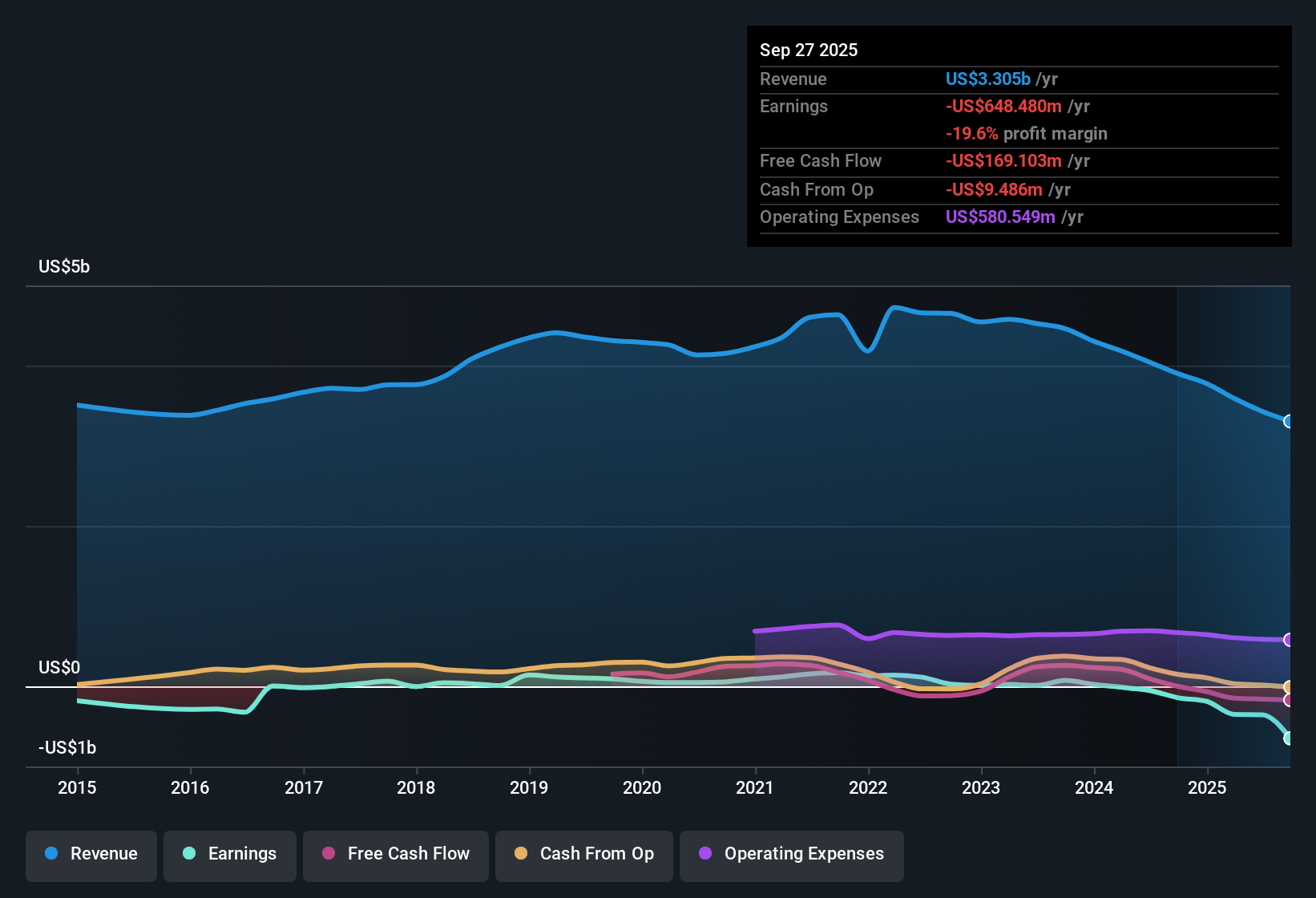

JELD-WEN Holding (JELD) posted another unprofitable quarter, with both its earnings and net profit margin remaining in the red. Over the last five years, losses have widened at a staggering 78.1% per year. The company is projected to swing to profitability within the next three years as earnings are forecast to surge 131.26% per year. Despite slow anticipated revenue growth of just 1.9% annually, the stock trades at a price-to-sales multiple of just 0.1x, far lower than industry and peer averages, drawing interest from value-focused investors.

See our full analysis for JELD-WEN Holding.Next up, we will see how these results stack up against the dominant market narratives and whether the current outlook holds up under the spotlight.

See what the community is saying about JELD-WEN Holding

Margin Targets Point to 2.7% Profit Turnaround

- Analysts expect JELD-WEN's net profit margin to improve from -10.3% today to a positive 2.7% within three years. This suggests a sizeable move toward profitability for a building products manufacturer that is currently operating at a loss.

- According to the analysts' consensus view, this margin recovery is based on

- over $100 million in annual cost savings from automation and transformation initiatives, and

- the expectation that profit margins will rise even if top-line growth lags the overall market. This directly challenges the headwinds from persistent inflation and underutilized capacity in core markets.

- The consensus narrative notes that management targets EBITDA improvement through operational efficiency. However, risks remain if cost pressures in labor and materials continue to outpace price increases or if volume recovery falls short of projections.

Find out where bulls and bears still disagree over the profit turnaround in the full consensus narrative. 📊 Read the full JELD-WEN Holding Consensus Narrative.

Share Price Sits Above Consensus Target

- With a current share price of $2.92, JELD-WEN trades 33.8% higher than the consensus analyst price target of $4.41. This suggests analysts remain cautious about near-term gains even though long-term improvement forecasts exist.

- The consensus narrative identifies this valuation gap as a material risk for contrarian investors:

- bulls might see strong future earnings growth (to $91.6 million by 2028) as a reason to pay up,

- but most analysts caution that the market may be pricing in too much recovery. This is especially relevant since revenue is predicted to fall 0.6% annually over the next three years and future growth remains below the industry average.

Price-to-Sales Ratio Flags Relative Value

- JELD-WEN’s price-to-sales multiple is 0.1x, far below the US building industry average of 1.5x and significantly below the peer average of 3.2x. This underscores how discounted the stock is compared to its broader sector and closest competitors.

- The analysts' consensus view argues this deep discount heavily supports the value thesis:

- even modest progress toward profitability or market share stabilizing could trigger a re-rating as investors seek lower-multiple cyclical stocks,

- but sustained structural headwinds such as inflation and modular construction trends could also keep multiples depressed if JELD-WEN’s turnaround falters.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for JELD-WEN Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells a different story? Share your view and shape your own narrative in just a few minutes. Do it your way

A great starting point for your JELD-WEN Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

JELD-WEN’s ongoing losses, muted revenue growth, and risk of missing profit margin targets make its road to consistent performance uncertain.

If you want more predictable results, focus on our stable growth stocks screener (2083 results) to spot companies delivering steady earnings and revenue regardless of market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JELD

JELD-WEN Holding

Designs, manufactures, and sells wood, metal, and composite materials doors, windows, and related building products in North America and Europe.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives