- United States

- /

- Building

- /

- NYSE:JBI

Janus International Group (JBI): Assessing Current Valuation After Recent Share Price Movement

Reviewed by Kshitija Bhandaru

See our latest analysis for Janus International Group.

After a strong run so far this year, Janus International Group’s share price has gained nearly 35% year-to-date, even as the latest 1-day and 7-day returns show only modest progress. However, total shareholder return over the past year is just 1%, suggesting that recent momentum is building off a low base rather than reflecting sustained longer-term outperformance.

If this recent uptick has you wondering what other opportunities could be emerging, consider broadening your search and discover fast growing stocks with high insider ownership.

With the share price now just below the average analyst target and the company posting impressive earnings growth, investors are left to wonder if the stock is still undervalued or if future upside is already accounted for.

Most Popular Narrative: 12.6% Undervalued

Compared to the recent closing price, the most widely followed narrative places Janus International Group’s fair value at $11.40 per share. This suggests notable upside remains. This view is based on weighing the company’s growth potential, margin trends, and industry context against its current stock price.

Ongoing urbanization and densification trends are fueling stable, long-term demand for modern storage and commercial solutions. This is evidenced by Janus's robust project backlog and market share gains, providing a runway for steady top-line revenue growth.

Curious about what’s fueling this bullish target? Dive into the narrative’s bold forecasts for margin expansion and revenue growth. See which ambitious operational improvements could drive impressive shareholder returns over the next several years.

Result: Fair Value of $11.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on the self-storage sector and persistent macroeconomic headwinds could pose challenges to sustained revenue growth for Janus International Group.

Find out about the key risks to this Janus International Group narrative.

Another View: What Do Market Multiples Say?

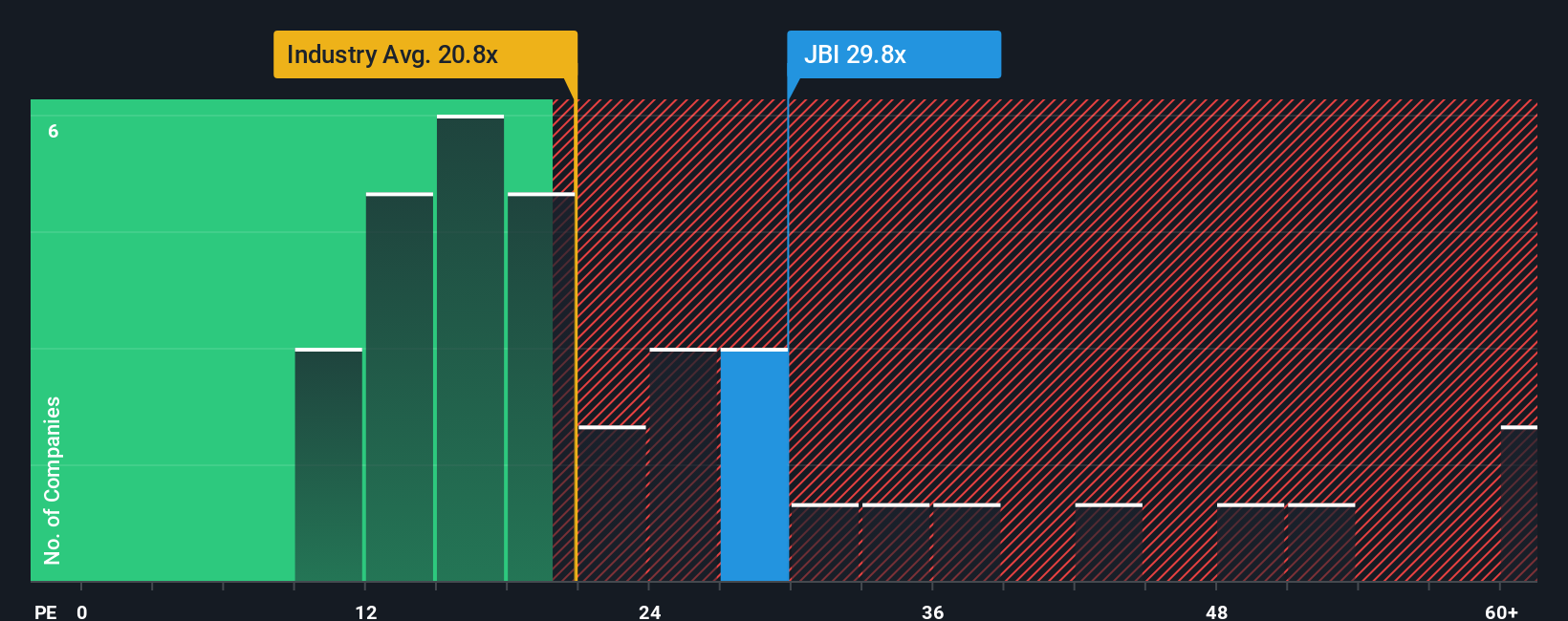

While analyst targets suggest Janus International Group could be undervalued, the company trades at a price-to-earnings ratio of 31.7x. This is well above both the US Building industry average of 22.1x and the peer average of 15.6x. Even relative to its fair ratio of 38.9x, investors are paying a premium compared to much of the market. Does this premium reflect justified optimism, or could it put returns at risk if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Janus International Group Narrative

If you have a different perspective or want to form your own conclusions, you can quickly build your own Janus International Group story using key data in just a few minutes. Do it your way.

A great starting point for your Janus International Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize opportunities before the crowd. Uncover your next big winner by checking out handpicked lists of stocks with exciting growth or income potential on Simply Wall Street.

- Start generating reliable income as you examine these 19 dividend stocks with yields > 3% offering attractive yields and consistent payouts.

- Capitalize on rapid advances in artificial intelligence by researching these 25 AI penny stocks driving innovation and shaping tomorrow’s economy.

- Catalyze long-term gains by investigating these 887 undervalued stocks based on cash flows trading at compelling prices based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBI

Janus International Group

Janus International Group, Inc. manufacturers and supplies turn-key self-storage, commercial, and industrial building solutions in North America and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives