- United States

- /

- Machinery

- /

- NYSE:IR

Ingersoll Rand (IR): Evaluating Valuation Following Lowered Guidance and Margin Pressures in Recent Quarterly Results

Reviewed by Simply Wall St

Ingersoll Rand (IR) released its third quarter results, highlighting modest sales and profit growth compared to last year. Management signaled caution by lowering full-year earnings guidance, citing ongoing tariff pressures and softer organic growth.

See our latest analysis for Ingersoll Rand.

After a tough year for industrial stocks, Ingersoll Rand’s share price tells the story: it’s down over 14% year-to-date, and the one-year total shareholder return stands at -24%. Despite the company buying back shares and posting modest sales gains, investor sentiment has cooled as margin pressures and lowered guidance have weighed on expectations. Still, with total shareholder returns of more than 80% over five years, the long-term trend remains positive. However, current momentum is clearly fading.

If your strategy involves seeking out what’s next in industrials and beyond, this could be the time to discover fast growing stocks with high insider ownership

Given the recent dip in share price and lowered expectations, is Ingersoll Rand now trading at a discount, or are the headwinds already fully reflected in the stock, leaving little room for upside from here?

Most Popular Narrative: 13.6% Undervalued

With a fair value estimate of $89.67 per share and a last close just under $78, the most widely followed narrative points to meaningful upside for Ingersoll Rand if its future plays out as projected.

Ingersoll Rand is capitalizing on accelerating global demand for energy-efficient and sustainable industrial equipment, supported by new breakthroughs such as the CompAir Ultima oil-free compressor and the EVO Series electric diaphragm pump, both delivering notable efficiency gains. These innovations reinforce pricing power and are anticipated to drive revenue growth and margin expansion as regulatory and customer focus on sustainability intensifies.

Want to know what numbers could justify this optimism? The narrative lays out ambitious profit margin improvements and a share price multiple that could surprise you. Curious what future growth and margin leap are essential to these projections? Unlock the full narrative to see the crucial details behind the target.

Result: Fair Value of $89.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained global tariffs or a slowdown in key compressor markets could challenge these projections and create additional margin pressure for Ingersoll Rand.

Find out about the key risks to this Ingersoll Rand narrative.

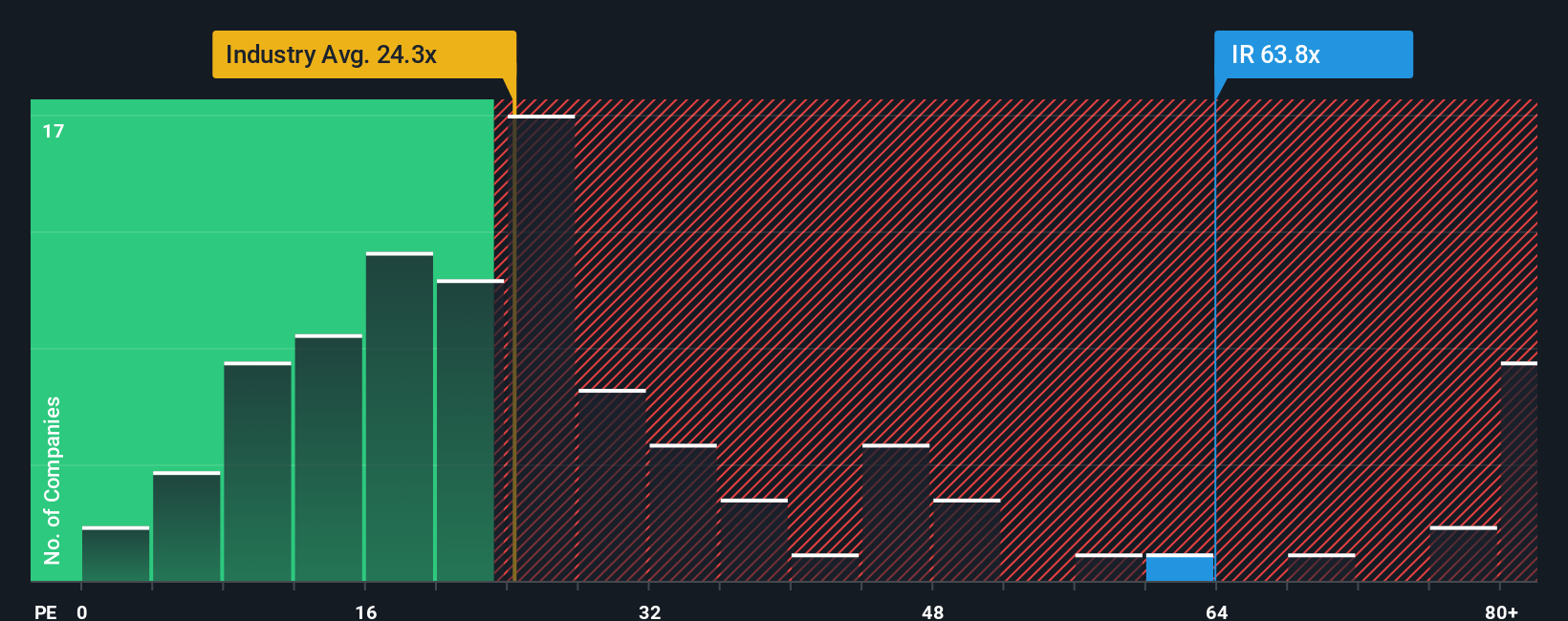

Another View: High Price Tag by Earnings Ratio

While the fair value estimate suggests potential upside for Ingersoll Rand, its earnings ratio presents a different perspective. At 56.2 times earnings, the stock appears expensive compared to both the US Machinery industry average of 24.1x and the peer group at 26.5x. Even in relation to the fair ratio of 38.9x, IR's current valuation remains notably high. This suggests a significant premium and potentially greater downside risk if growth does not accelerate. Is the market placing too much optimism in IR, or is it considering factors that others are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ingersoll Rand Narrative

If you would rather dig into the numbers yourself or want a fresh perspective, you can build your own analysis in just a few minutes. Do it your way

A great starting point for your Ingersoll Rand research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself when other unique opportunities are just a click away? Smart investors are already taking advantage of tailored stock ideas to get ahead of the curve.

- Boost your portfolio's income potential with stable companies offering strong yields when you check out these 16 dividend stocks with yields > 3%.

- Seize the AI revolution by uncovering forward-thinking businesses through these 25 AI penny stocks, which are shaping tomorrow’s technology landscape.

- Capture big growth stories early by targeting these 3588 penny stocks with strong financials with robust financials and breakout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IR

Ingersoll Rand

Provides various mission-critical air, fluid, energy, and medical technologies services and solutions worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives