- United States

- /

- Aerospace & Defense

- /

- NYSE:HXL

Hexcel (HXL): Evaluating Valuation After Recent Share Gains and Buyback Announcement

Reviewed by Simply Wall St

See our latest analysis for Hexcel.

Hexcel’s momentum has picked up lately, with a notable 11.4% share price return over the past month and a solid one-year total shareholder return of 13.3%. This gain adds to a longer-term track record of steady performance, suggesting growing investor confidence and a positive outlook as the company builds on recent growth.

If you’re thinking about other companies with strong capital goods momentum, this is the perfect moment to discover See the full list for free.

But with strong returns already posted and Hexcel’s valuation not far below analyst targets, investors may wonder if there is still room for upside or if the market has already priced in expectations for future growth.

Most Popular Narrative: 7.3% Undervalued

Hexcel’s fair value estimate stands above its recent closing price, setting the stage for a potential upside that’s catching investor attention. The following excerpt is a key catalyst shaping the valuation debate right now.

Renewed share buyback activity with a recently announced $600M buyback program is viewed as a significant signal of management's confidence and commitment to shareholder returns. Strong free cash flow projections, with expectations of generating over $1B in free cash flow over the next four years, support a higher valuation and provide financial flexibility.

What underpins this bullish outlook? It hinges on forecasts of accelerating profits, fatter margins, and a big step up in future shareholder payouts. The narrative builds its target using optimistic assumptions that insiders believe could remap Hexcel’s market value. Want to see exactly what numbers and milestones unlock this higher fair value? Dive into the full narrative to uncover all the financial drivers.

Result: Fair Value of $74.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain issues or a slowdown at key customers like Boeing could quickly challenge Hexcel’s current growth outlook and investor optimism.

Find out about the key risks to this Hexcel narrative.

Another View: What Do Multiples Say?

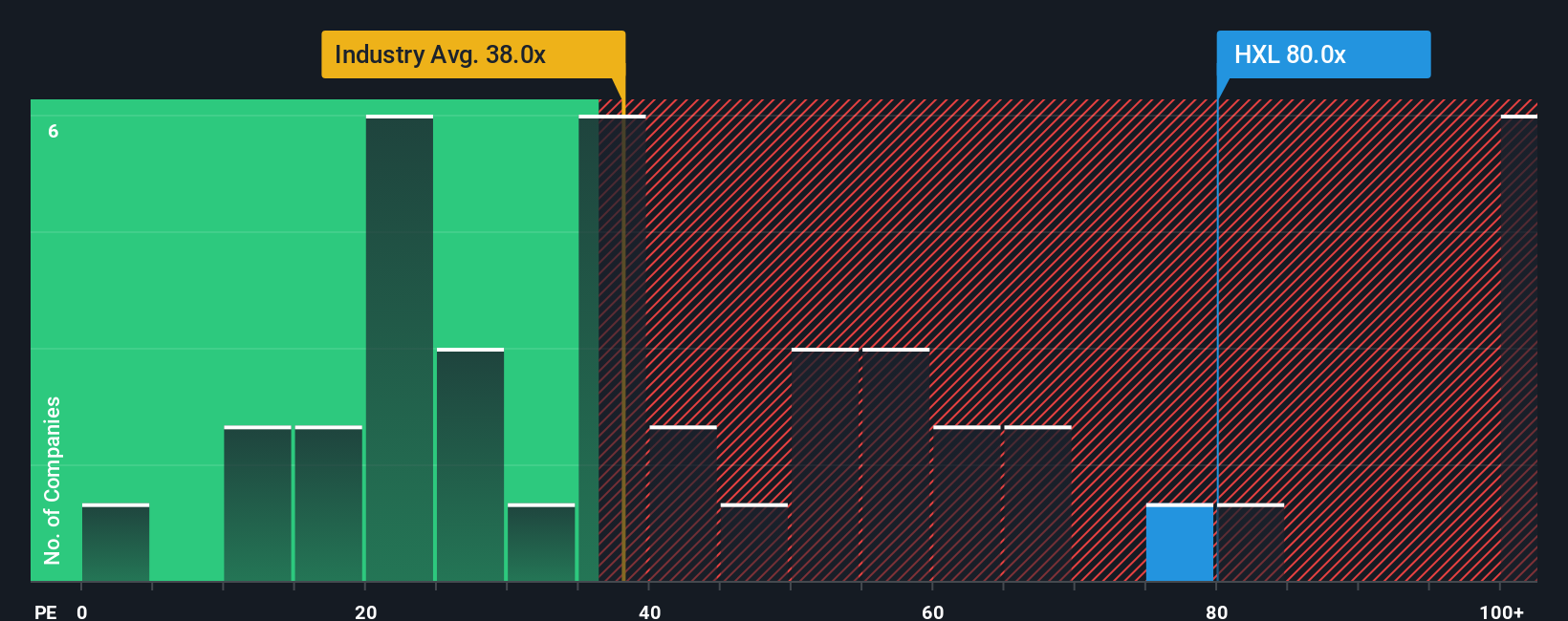

Looking at Hexcel through the lens of its price-to-earnings ratio tells a different story. The company trades at 80 times earnings, which is higher than both the industry average of 38.5 and its peer average of 72.6. The current valuation is also well above the fair ratio of 37.7. This wide gap suggests investors are pricing in a lot of growth, which could potentially introduce more risk if those expectations do not materialize. Could this premium hold up if market sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hexcel Narrative

If you see things differently or want to dig into the numbers on your own, you can craft your own story in just a few minutes. Do it your way

A great starting point for your Hexcel research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. The Simply Wall Street Screener puts powerful investment ideas right at your fingertips, helping you stay ahead with fresh strategies.

- Capture higher yields in your portfolio by harnessing these 16 dividend stocks with yields > 3%, which consistently reward shareholders with dividends above 3%.

- Tap into tomorrow’s technology breakthroughs by checking out these 25 AI penny stocks driving advancements in artificial intelligence and automation.

- Fuel your investment with emerging growth stories by exploring these 3588 penny stocks with strong financials that combine strong financials and bold upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hexcel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HXL

Hexcel

Develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials and parts for use in commercial aerospace, space and defense, and industrial applications.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives