- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

Howmet Aerospace (HWM): Assessing Valuation After Upbeat Q3 Results and Upgraded 2025 Guidance

Reviewed by Simply Wall St

Howmet Aerospace (HWM) delivered strong third quarter earnings, with sales and net income both climbing compared to the same period last year. The company also boosted its 2025 outlook and signaled further growth ahead into 2026.

See our latest analysis for Howmet Aerospace.

Howmet’s shares have soared in 2025, jumping 2.1% after earnings and riding a wave of upbeat news and strong momentum. The company’s 85.9% year-to-date share price return and a 106.5% total shareholder return over the past year put it firmly among the market’s top performers, signaling steady investor confidence as new guidance and a completed buyback reinforce the growth story.

With aerospace and defense stocks buzzing, it could be the perfect moment to discover standout names across the sector. See the full list here: See the full list for free.

Despite stellar returns and new guidance, the question remains: is Howmet Aerospace's recent rally running ahead of fundamentals, or could this be the ideal entry point before another leg of growth is fully priced in?

Most Popular Narrative: 2.8% Undervalued

Compared to Howmet Aerospace’s last close price of $205.95, the most widely followed narrative now puts its fair value at $211.99. This signals the market may be catching up to analyst optimism and sets the tone for a debate over whether increased margin expansion and improved guidance are fully reflected in the stock price.

Strategic investments in automation and digital manufacturing, combined with cost rationalization and product mix optimization, are driving underlying productivity improvements and gross margin expansion, supporting robust long-term earnings growth.

Want to know why analysts are so confident? A bold long-term profit trajectory and margin leap power this narrative. The secret is aggressive growth assumptions you have not seen yet. Dive in to challenge your own expectations.

Result: Fair Value of $211.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the outlook is not without uncertainty. Unexpected demand slowdowns or supply chain disruptions could threaten Howmet's growth trajectory and pressure future earnings.

Find out about the key risks to this Howmet Aerospace narrative.

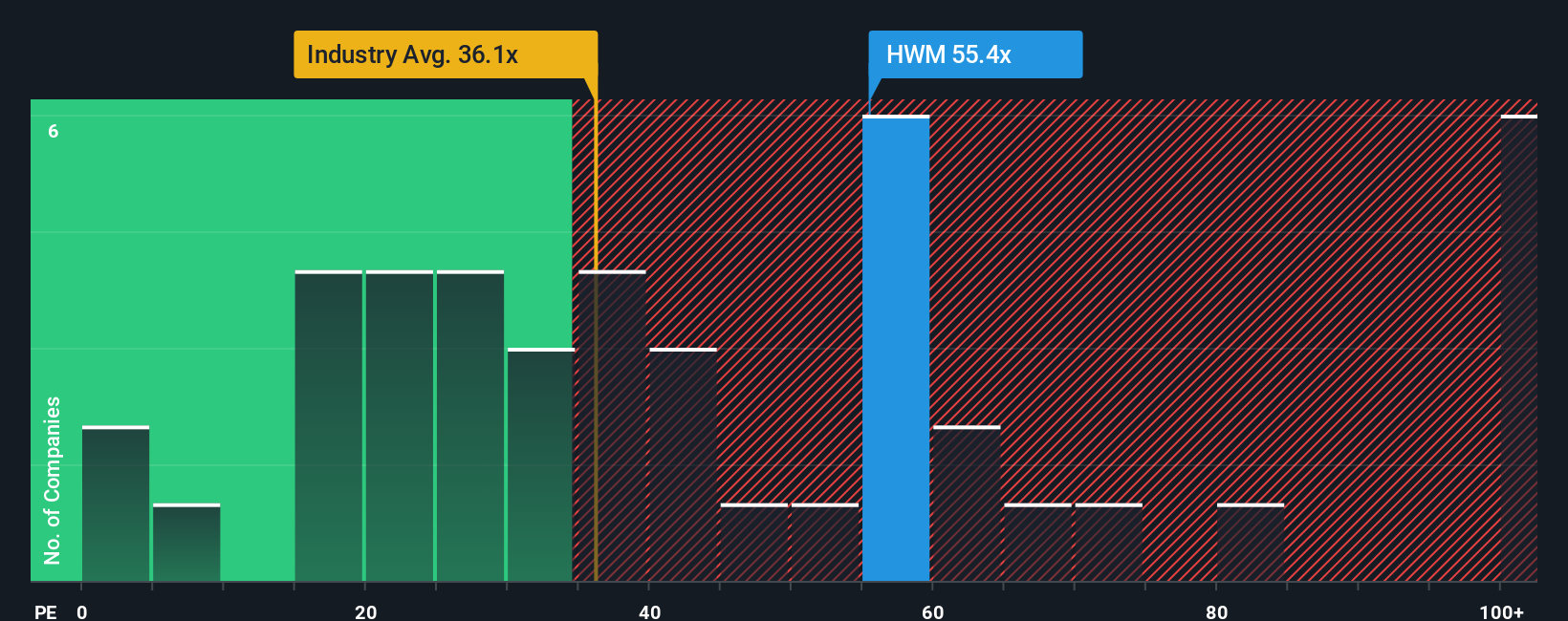

Another View: Price Ratios Raise Risk Flags

Looking through the lens of price-to-earnings, Howmet Aerospace looks pricey. Its current ratio is a steep 57.1x, far above the industry’s 38.9x and the peer average of 28.9x. The fair ratio we estimate is 36x. This could suggest the current price is running too hot. Does this present more risk for investors if sentiment changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Howmet Aerospace Narrative

If you have a different perspective or want to take a hands-on approach, you can craft your own narrative using the data and insights provided, all in just a few minutes. Do it your way

A great starting point for your Howmet Aerospace research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one stock when the market is full of contenders ready to deliver big results. Seize your opportunity with these three powerful investing angles:

- Uncover the most undervalued opportunities and spot future standouts by leveraging these 832 undervalued stocks based on cash flows for stocks trading at remarkably attractive prices.

- Tap into the future of medicine with these 33 healthcare AI stocks, featuring innovative companies harnessing AI to transform healthcare and patient outcomes.

- Supercharge your portfolio growth by examining these 28 quantum computing stocks, packed with companies on the forefront of groundbreaking quantum computing technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives