- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

A Fresh Look at Howmet Aerospace (HWM) Valuation Following Preferred Stock Redemption and Capital Structure Moves

Reviewed by Simply Wall St

Howmet Aerospace (HWM) just announced plans to redeem all shares of its $3.75 Cumulative Preferred Stock. The company aims to streamline its capital structure and reduce interest costs, with an eye toward future flexibility.

See our latest analysis for Howmet Aerospace.

The preferred stock redemption comes on the heels of notable analyst upgrades and a recent $500 million refinancing, which is set to lower interest expenses. That momentum has caught the market’s eye: Howmet Aerospace’s share price climbed 5.6% over the past month and boasts a remarkable 80.8% price return year-to-date, with a total shareholder return of 77.4% over one year and 734.8% over five years. The trend suggests momentum is building as investors warm to the company’s capital moves and sustained growth.

If you want to see what’s happening elsewhere in the sector, there is a whole universe of aerospace and defense stocks worth exploring in See the full list for free.

With shares up more than 80% this year and valuation metrics appearing reasonable compared to industry peers, the question arises: Is Howmet Aerospace still trading at a discount, or has all the upside been priced in by the market?

Most Popular Narrative: 11.2% Undervalued

Howmet Aerospace’s last close at $200.28 sits noticeably below the most widely followed fair value estimate of $225.50, suggesting that the stock could still hold upside as expectations for margin growth and future cash flows intensify.

Strategic investments in automation and digital manufacturing, combined with cost rationalization and product mix optimization, are driving underlying productivity improvements and gross margin expansion. This supports robust long-term earnings growth.

Want to know what’s driving the analysts’ bullish price target? There is a surprising blend of future margin expansion, advanced manufacturing, and optimistic profit assumptions woven into this narrative. Discover what numbers power this fair value and whether the company’s growth bets stack up.

Result: Fair Value of $225.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on strong aerospace demand and potential supply chain disruptions remain key risks that could quickly alter the bullish outlook.

Find out about the key risks to this Howmet Aerospace narrative.

Another View: What Do Valuation Ratios Reveal?

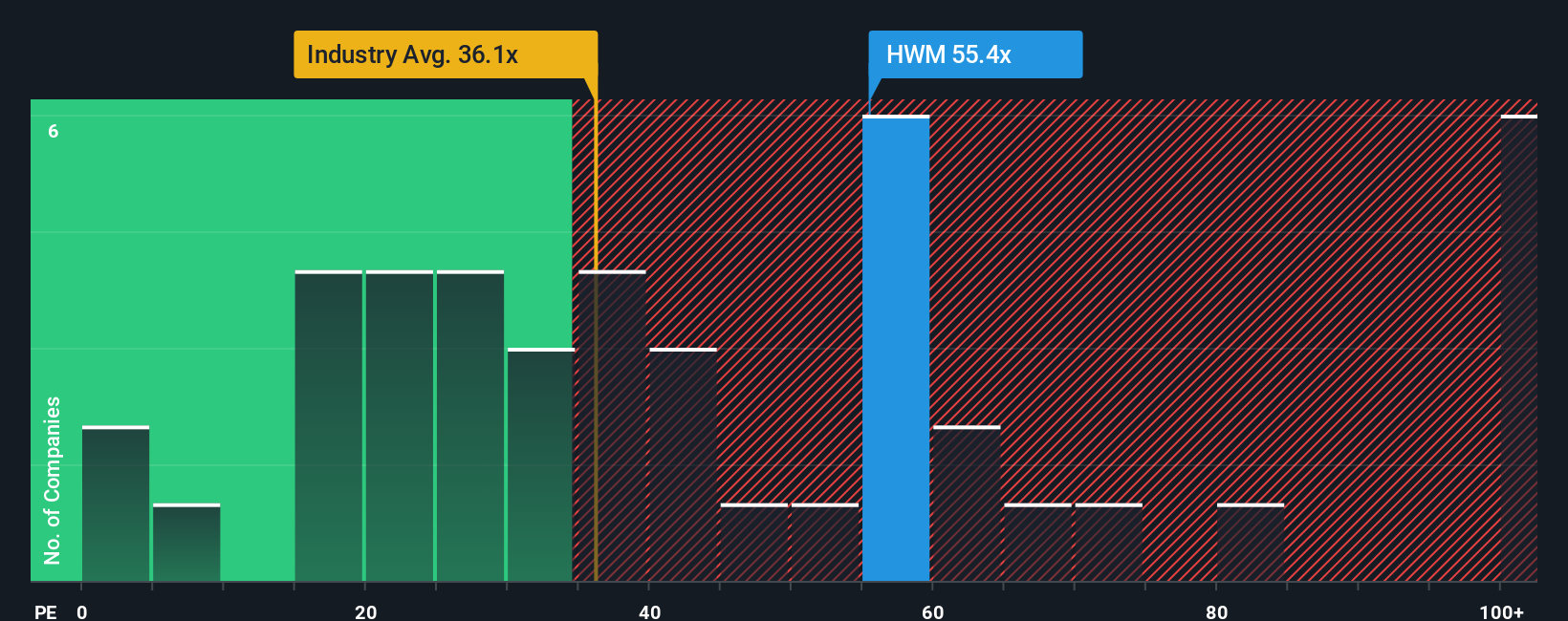

While analysts see upside for Howmet Aerospace, looking at the price-to-earnings ratio shows a different picture. The company's ratio stands at 55.6x, much higher than the US Aerospace & Defense industry average of 37.7x and its own fair ratio of 35.5x. This suggests the market is already pricing in a lot of future growth and optimism, leaving less room for upside if expectations fall short. Could this premium signal valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Howmet Aerospace Narrative

If you have a different perspective or want to dig into the numbers yourself, you can assemble your own version of the story in just a few minutes. Do it your way

A great starting point for your Howmet Aerospace research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stick to just one play when you could uncover your next standout investment? The market is packed with hidden gems others are missing. Get ahead and secure your opportunity now.

- Unlock compounding potential by starting with these 18 dividend stocks with yields > 3% that offer high yields and strong financials, ideal for steady income seekers.

- Capitalize on the impact of artificial intelligence by targeting growth opportunities among these 27 AI penny stocks, which are changing the face of tomorrow’s industries.

- Tap into overlooked companies trading below their true value and position yourself for possible outsized returns with these 896 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives