- United States

- /

- Electrical

- /

- NYSE:HUBB

Should Investors Revisit Hubbell After This Week’s 9% Dip?

Reviewed by Bailey Pemberton

- Ever wondered if Hubbell’s current share price actually lines up with its real value? If you’re weighing up whether now is the time to buy in or hold off, you’re in the right place.

- After racing to new highs earlier in the year, Hubbell’s shares have pulled back in the short term, with a 9.0% dip this week and essentially flat performance so far in 2024.

- Several analyst upgrades and sector-wide optimism about U.S. infrastructure spending have put the spotlight on Hubbell lately, fueling both excitement and volatility. The shifting market mood is linked to broader developments in electrification and grid modernization, which often move stocks like Hubbell as much as company-specific progress does.

- On our Simply Wall St valuation checks, Hubbell scored just 2 out of 6 for being undervalued. There are definitely some red flags to dig into. Next, we will walk through those valuation methods, and stick around for an even better way to see if the price makes sense in today’s market.

Hubbell scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hubbell Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future cash flows and then discounting those amounts back to today's dollars. This method looks beyond current profits and seeks to capture Hubbell’s long-term earnings power.

For Hubbell, the latest Free Cash Flow sits at $841.6 million. Analysts project this number will continue rising, with Simply Wall St’s DCF model forecasting Free Cash Flow reaching $1.06 billion by 2027. Further extrapolated estimates put the 10-year figure around $1.48 billion. All of these future cash flows are then discounted to reflect their present value, using the 2 Stage Free Cash Flow to Equity approach.

After crunching the numbers, the DCF model sets Hubbell’s estimated intrinsic fair value at $336.86 per share. Compared to the current share price, the stock appears roughly 24.9% overvalued based on this methodology. In short, DCF suggests the market might be getting ahead of itself at these levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hubbell may be overvalued by 24.9%. Discover undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hubbell Price vs Earnings

For strong, consistently profitable companies like Hubbell, the Price-to-Earnings (PE) ratio is often the primary valuation metric. It measures how much investors are willing to pay today for each dollar of current earnings, making it especially relevant when the business generates healthy profits.

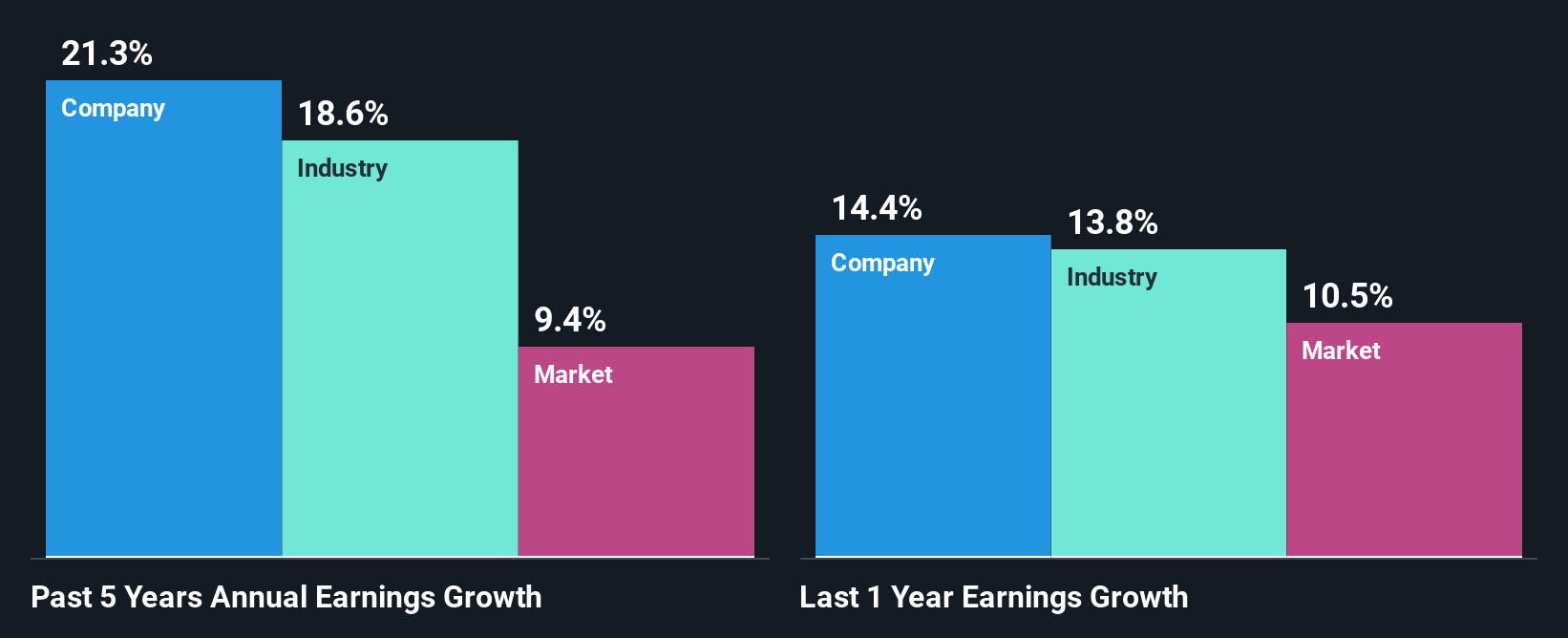

Growth expectations and perceived business risks play a significant role in shaping what counts as a "fair" or "normal" PE ratio. If investors expect higher future earnings growth or see the company as less risky, they tend to pay a higher PE multiple. The opposite is true if growth expectations are lower or risks are higher.

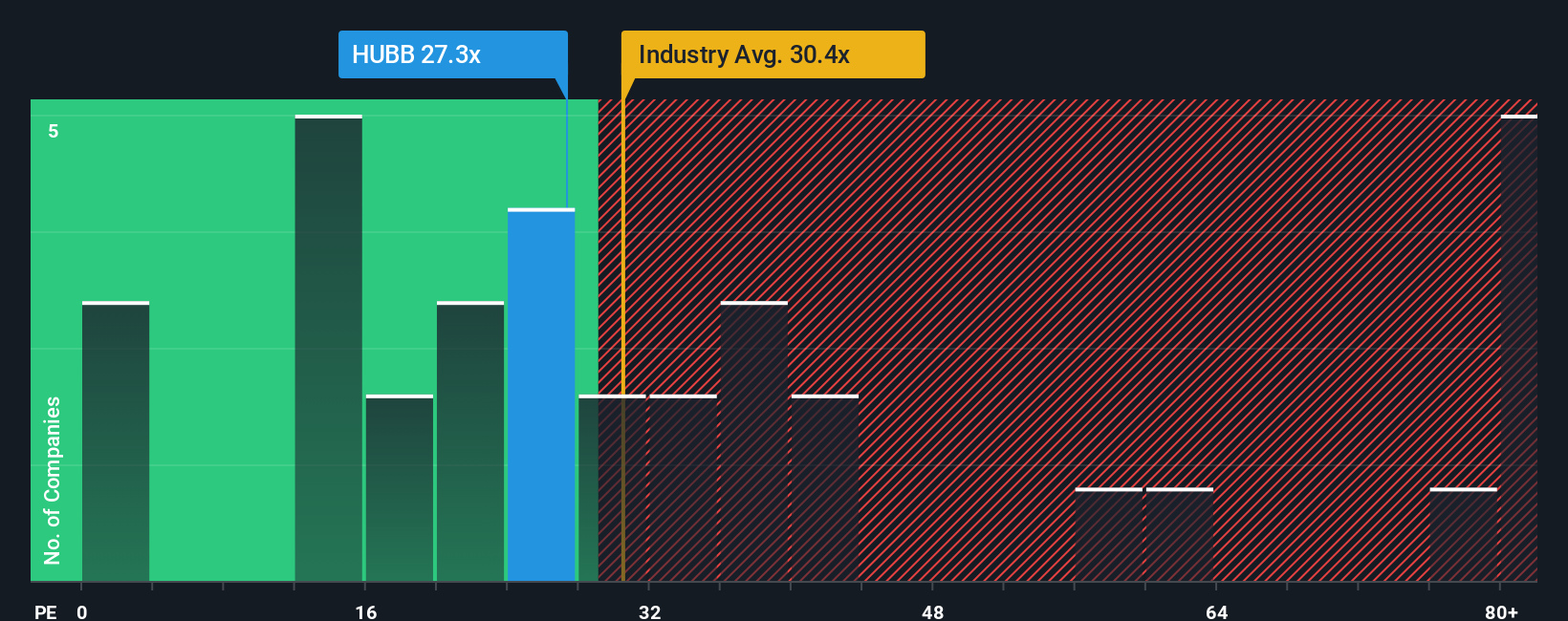

Hubbell is currently trading at 26x earnings. This is closely aligned with the Electrical industry average of 26.4x, but is well below the average of its publicly traded peers at 40.2x. At face value, this suggests the market is valuing Hubbell at a typical level for the sector, but more conservatively than some peers.

To provide a more precise benchmark, Simply Wall St calculates a "Fair PE Ratio," which accounts for Hubbell’s unique earnings growth profile, profit margins, industry characteristics, and company size. This deeper analysis aims to avoid the pitfalls of peer and industry comparisons by recognizing each business’s individuality.

For Hubbell, the Fair PE Ratio is estimated at 25.1x. Comparing this with the current PE of 26x, the difference is narrow. Ultimately, this implies the stock is trading about in line with its fair value based on earnings power and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hubbell Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal, story-driven way of connecting the “why” behind Hubbell’s business to your own view of its future performance. Essentially, it is your financial forecast and fair value estimate, backed by your understanding of what drives the company.

Instead of relying solely on basic ratios or consensus targets, Narratives combine real business developments, news, and your perspective into one easy-to-build framework. By linking Hubbell’s story, your assumptions about future revenues and profits, and the resulting fair value, Narratives make investment decisions far more actionable and meaningful.

On Simply Wall St’s Community page, millions of investors use Narratives as a quick, dynamic tool to compare their estimated fair value with the current price and decide whether to buy or sell. Narratives automatically update as new earnings or news emerge, helping you stay ahead of the curve without constant manual research.

For instance, with Hubbell, one Narrative might forecast $1.1 billion in earnings and a $511 share price if growth remains robust and margins expand. Another might see lower margins and assign a value closer to $383 per share. Narratives let you capture your convictions and see instantly how they stack up against the market.

Do you think there's more to the story for Hubbell? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubbell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBB

Hubbell

Designs, manufactures, and sells electrical and utility solutions in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives