- United States

- /

- Machinery

- /

- NYSE:HLIO

Helios Technologies (HLIO): $31.1M One-Off Loss Challenges Bullish Margin Narratives

Reviewed by Simply Wall St

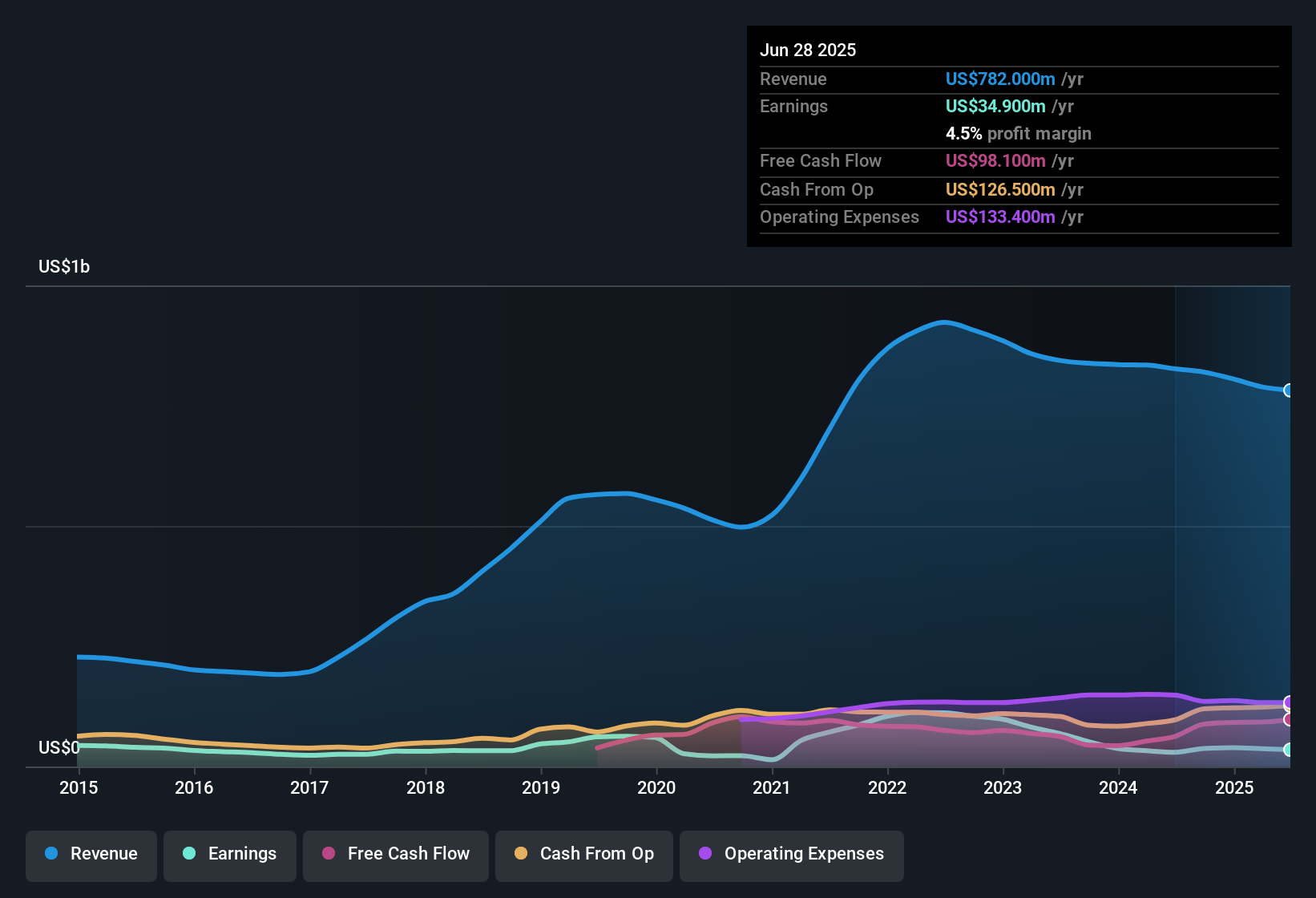

Helios Technologies (HLIO) posted a 12.2% annual decline in earnings over the past five years, with net profit margin slipping to 4.2% in the most recent period from 4.6% a year earlier. The results for the twelve months to 27th September 2025 included a significant one-off loss of $31.1 million that shaped overall profitability. Looking ahead, the company is forecast to deliver annual earnings growth of 24% for the next three years, which is higher than the broader US market's expected rate of 16% per year and may draw attention despite recent volatility.

See our full analysis for Helios Technologies.Next, we will see how Helios Technologies’ numbers compare to the prevailing market narratives, and whether recent results reinforce or challenge those opinions.

See what the community is saying about Helios Technologies

Profitability Impacted by One-Off Loss

- Net profit margin slipped to 4.2% for the 12 months ending September 2025, as a substantial one-off loss of $31.1 million weighed down core profitability figures.

- Consensus narrative notes that, while operational restructuring and diversified revenue streams are positioned to drive future margin expansion, the company’s ongoing exposure to end-market volatility and slow adoption of innovation threaten Helios’s ability to return to a 20%+ margin profile.

- Recent margin levels remain well below targets. Analysts expect profit margins to improve from 4.5% today to 10.8% in three years, but execution risk persists.

- Persistent end-market volatility, highlighted by twelve consecutive quarters of declining sales before recent stabilization, means future margin progress is not guaranteed.

- For a deeper look into how analysts are outlining the tug-of-war between margin outlook and external risks, read the consensus view in the full narrative. 📊 Read the full Helios Technologies Consensus Narrative.

Revenue Growth Lags Market but Analysts Stay Upbeat

- Revenue is projected to grow at 3.9% per year for the next three years, which falls short of the broader US market expected rate of 10.5% per year. Analysts remain confident that new product launches and end-market diversification will still drive overall top-line gains.

- Consensus narrative emphasizes that rapid expansion of IoT-enabled platforms and growth into new industry verticals should help offset competitive and cyclical headwinds.

- Notably, expansion into markets like commercial foodservice and health & wellness could add more recurring and international revenue streams, which may stabilize overall growth even if core industrial demand softens.

- That said, reliance on cyclical segments like construction and agriculture remains a vulnerability if recoveries falter or macro conditions worsen.

Valuation Tension: Premium Versus Peers, Discount to DCF

- Helios Technologies trades at a Price-to-Earnings ratio of 56x, far above the machinery industry average of 23.5x and peer average of 29.5x. The current share price of $56.96 sits below the DCF fair value estimate of $72.74.

- According to the consensus narrative, while strong free cash flow and a return to profit growth could justify a higher multiple, the elevated valuation magnifies any disappointment from execution missteps or profit volatility.

- Analysts set a consensus price target of $62.40, about 9.6% higher than the current price, signaling moderate upside but considerably less than the fair value premium implied by DCF metrics.

- To warrant the current valuation, the outlook assumes profit margin expansion from today’s level up to 10.8% by 2028, which remains an ambitious target given recent results.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Helios Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different perspective on the figures? Craft your own interpretation and contribute your unique viewpoint in just a few minutes. Do it your way

A great starting point for your Helios Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Helios Technologies faces ongoing volatility with slim profit margins, below-average revenue growth, and ambitious targets, which add uncertainty to its outlook.

If you want to focus on companies with more consistent performance and proven resilience, use stable growth stocks screener (2072 results) to find stocks that deliver steady growth even when markets wobble.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helios Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLIO

Helios Technologies

Provides engineered motion control and electronic controls technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives