Stock Analysis

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Hillenbrand, Inc. (NYSE:HI) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Hillenbrand

What Is Hillenbrand's Net Debt?

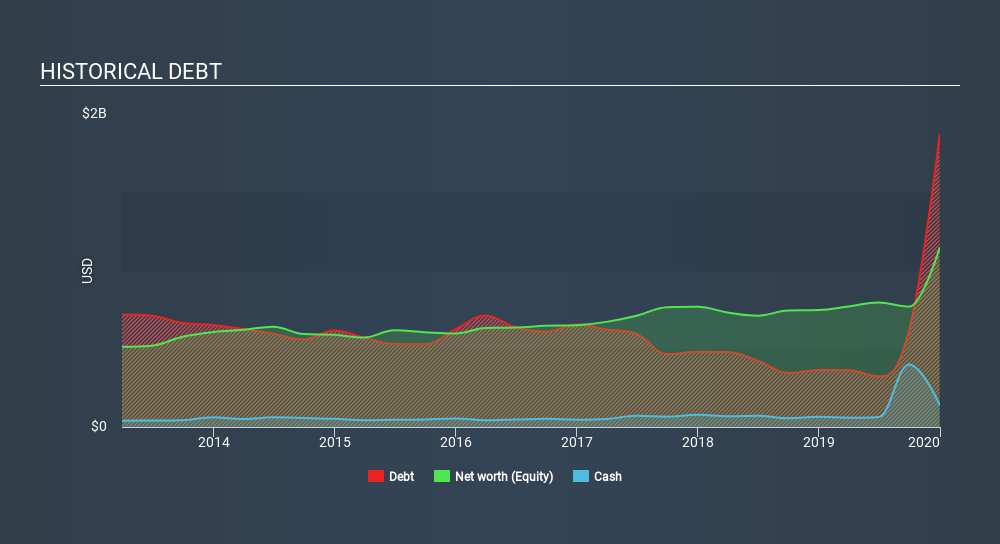

As you can see below, at the end of December 2019, Hillenbrand had US$1.86b of debt, up from US$364.8m a year ago. Click the image for more detail. On the flip side, it has US$142.4m in cash leading to net debt of about US$1.72b.

How Strong Is Hillenbrand's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hillenbrand had liabilities of US$879.8m due within 12 months and liabilities of US$2.40b due beyond that. Offsetting these obligations, it had cash of US$142.4m as well as receivables valued at US$550.2m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.58b.

When you consider that this deficiency exceeds the company's US$1.74b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 5.3, it's fair to say Hillenbrand does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 6.0 times, suggesting it can responsibly service its obligations. We saw Hillenbrand grow its EBIT by 6.5% in the last twelve months. That's far from incredible but it is a good thing, when it comes to paying off debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Hillenbrand's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Hillenbrand recorded free cash flow worth a fulsome 91% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

Neither Hillenbrand's ability to handle its total liabilities nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Taking the abovementioned factors together we do think Hillenbrand's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Hillenbrand has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:HI

Hillenbrand

Operates as an industrial company in the United States and internationally.

Good value average dividend payer.