- United States

- /

- Aerospace & Defense

- /

- NYSE:HEI

HEICO (HEI): Assessing Valuation Following Recent Share Price Stability

Reviewed by Simply Wall St

HEICO (HEI) shares have seen modest movement this week, steadying after a slight rebound in recent sessions. Investors are keeping an eye on the company’s underlying growth trends and considering how they might impact future stock performance.

See our latest analysis for HEICO.

HEICO’s share price has gained more than 32% year-to-date, suggesting that investor optimism is building, especially as recent sessions show a gentle uptick. Its longer-term total shareholder return remains impressive at over 145% across the past five years, highlighting the company’s robust growth engine.

If this momentum has you wondering what else is out there, now is a great opportunity to broaden your investing perspective and discover See the full list for free.

But with HEICO’s solid gains and analyst targets just 12 percent above its current price, the question stands: is further upside still on the table, or is the market already pricing in much of the growth story?

Most Popular Narrative: 10.9% Undervalued

HEICO’s widely tracked narrative places its fair value at $353.00, a notable premium over the last close at $314.58. The story behind this price is driven by expectations for sustained top-line expansion and margin gains.

“Sustained global growth in air travel, especially driven by rising middle-class populations in Asia-Pacific, and the ongoing recovery and expansion of airline fleets worldwide are fueling robust demand for HEICO's aftermarket components and services. This directly supports double-digit organic revenue growth seen across both core segments and sets the stage for continued top-line expansion.

The worldwide trend of aging commercial and military aircraft fleets, combined with increasing pressure for cost-effective maintenance solutions, strongly favors HEICO's business model. As airlines and governments seek alternatives to expensive OEM parts, HEICO's FAA-approved PMA parts and repairs continue to gain market share and drive margin expansion, as reflected in rising operating and EBITA margins.”

Want the inside story behind this bullish outlook? The narrative banks on aggressive organic growth, margin expansion, and market dominance in a surging aviation aftermarket. The real surprise comes from ambitious projections and the financial leap they fuel. Ready for the full picture?

Result: Fair Value of $353.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from OEMs or unexpected regulatory changes could quickly challenge HEICO’s margins and momentum and could alter the bullish outlook investors hold today.

Find out about the key risks to this HEICO narrative.

Another View: Comparing Industry Ratios

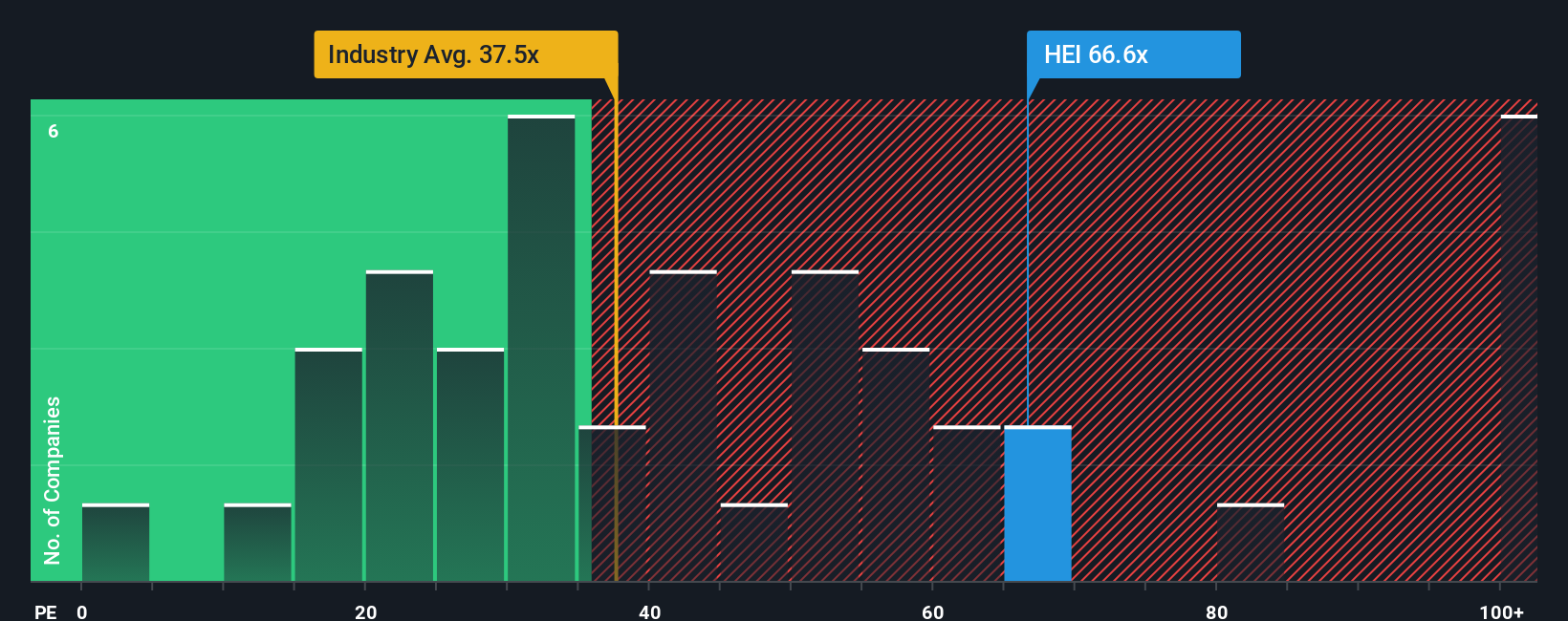

While analyst forecasts and fair value estimates point to a bullish outlook, the company's price-to-earnings ratio presents a more cautious picture. HEICO trades at 68.2x earnings, which is higher than the US Aerospace & Defense industry average of 36.6x and also above the market-implied fair ratio of 29.6x. This premium may reflect high quality and growth, but it also leaves little room for disappointment. Will the market reward such optimism, or is it a risk for new investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HEICO Narrative

If you want to dig deeper, analyze the numbers, and craft your own perspective in just a few minutes, Do it your way

A great starting point for your HEICO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let the next big win slip away. Use the Simply Wall Street Screener to confidently find compelling stocks that fit your strategy and financial goals.

- Multiply your income potential with strong yields by targeting these 14 dividend stocks with yields > 3%, which offers reliable payouts and a track record of rewarding loyal shareholders.

- Stay ahead of the next major advancement in tech by exploring these 26 AI penny stocks, where artificial intelligence drives growth and positions businesses at the forefront of innovation.

- Position your portfolio for growth and value with these 932 undervalued stocks based on cash flows, highlighting companies that the market may have overlooked but have strong future prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HEICO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HEI

HEICO

Provides aerospace, defense, and electronic related products and services in the United States and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success