- United States

- /

- Building

- /

- NYSE:HAYW

Hayward Holdings (HAYW) Margin Expansion Surpasses Expectations, Reinforcing Bullish Community Narratives

Reviewed by Simply Wall St

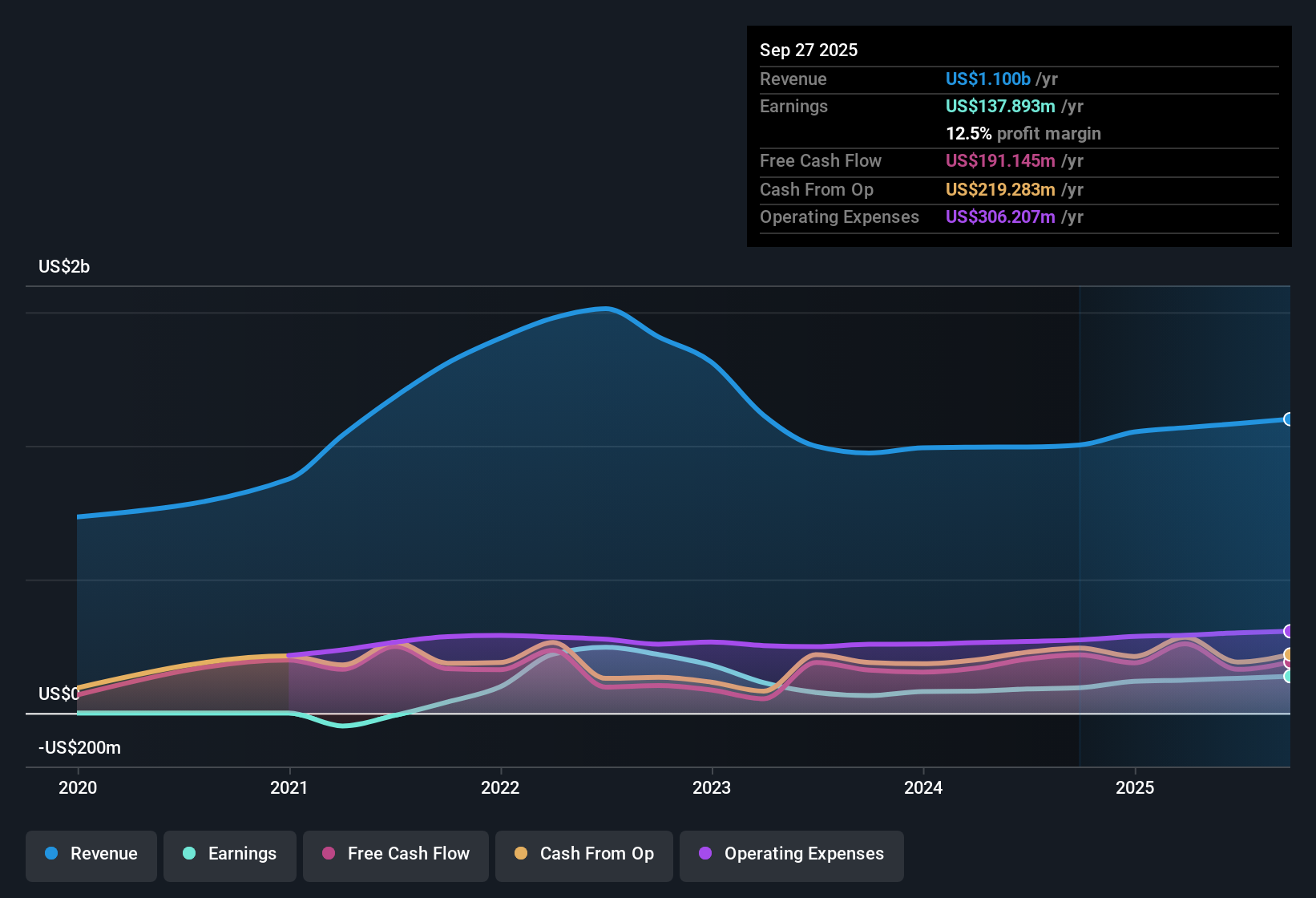

Hayward Holdings (HAYW) posted a net profit margin of 12.5%, up from 9.5% last year, and delivered earnings growth of 45.3% over the past year, well above its five-year average of 14.4% per year. Analysts expect earnings to grow at 11.9% annually moving forward, a pace that trails the broader US market forecast of 15.7%. Revenue growth is also projected to lag behind at 6.1% per year compared to the market's 10.3%. With high quality earnings and consistent profit expansion, but a slower growth forecast and a premium valuation to peers, investors face a balancing act with the latest earnings season results.

See our full analysis for Hayward Holdings.Next up, we will see how this set of results matches up against the ongoing narratives that shape investor expectations. Some themes may be confirmed, while others could be turned on their heads.

See what the community is saying about Hayward Holdings

Margin Expansion Outpaces Industry Norms

- Net profit margin increased from 9.5% to 12.5%, while analysts project further margin growth to 15.4% over the next three years.

- Analysts' consensus view underscores that improvements in operational efficiency and product mix are expected to fuel higher EBITDA margins and reinforce Hayward’s position compared to industry averages.

- Accelerating adoption of connected, automated pool equipment such as the OmniX platform is seen as a key driver supporting revenue growth and margin improvement.

- Efforts to expand US manufacturing and reduce reliance on China-sourced goods are believed to mitigate input cost risks and strengthen profitability over the longer term.

- Momentum in margin growth along with ongoing efficiency gains draws investor attention to whether Hayward can sustain this outperformance even as industry pressures mount. 📊 Read the full Hayward Holdings Consensus Narrative.

Valuation Premium Signals High Expectations

- Hayward trades at a 27.1x Price-to-Earnings ratio, above its own DCF fair value of $11.61 and above the US Building industry average of 19.1x, and near peer levels at 31.1x.

- Analysts' consensus view notes that this premium pricing reflects the market’s confidence in Hayward’s consistent earnings quality and long-term expansion prospects, but suggests there is little room for disappointment if growth falls short.

- The current share price of $17.22 is well above DCF fair value, indicating investors are paying a premium for growth and durability in a competitive sector.

- The consensus price target of 16.93 is only 6% above the present share price, highlighting limited analyst upside and indicating a belief that the stock is fairly valued in the near term.

Aftermarket Reliance Heightens Sensitivity to Cycles

- With around 85% of sales coming from the residential aftermarket, Hayward remains highly dependent on homeowners’ willingness to upgrade rather than simply repair aging equipment.

- Analysts' consensus view highlights that heavy aftermarket concentration creates vulnerability to economic and demographic headwinds. Any shift toward lower-margin repairs or prevailing interest rate pressures could weaken both revenue growth and margin expansion.

- Reduced home affordability and persistent higher rates could cause consumers to focus on repairing existing pools, threatening the pace of revenue and margin improvement.

- Demographic shifts and regulatory concerns for water conservation may also reduce the future addressable market, challenging long-term growth assumptions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hayward Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the latest figures? It only takes a few minutes to build and share your personal view. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hayward Holdings.

See What Else Is Out There

Despite margin gains, Hayward’s premium valuation and reliance on aftermarket sales mean growth is vulnerable if economic or sector conditions worsen.

If overpaying and exposure to cyclical headwinds give you pause, discover more compelling opportunities with these 831 undervalued stocks based on cash flows which may offer stronger value and resilience right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hayward Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAYW

Hayward Holdings

Designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives