- United States

- /

- Building

- /

- NYSE:HAYW

A Fresh Look at Hayward Holdings (HAYW) Valuation as Shares Drift Gradually Higher

Reviewed by Kshitija Bhandaru

See our latest analysis for Hayward Holdings.

Hayward Holdings has seen modest price gains recently, but the real story is in its longer-term track record. While the 1-year total shareholder return is down slightly, the company boasts an impressive 82% total return over three years. This suggests that momentum may be building again as investors gain confidence in its prospects.

If Hayward’s long-term outperformance has you rethinking your strategy, this is an ideal time to explore fast growing stocks with high insider ownership

With Hayward Holdings currently trading just below analyst targets and showing strong fundamentals, investors are left to wonder whether shares are trading at an attractive discount or if the market has already accounted for the company’s future growth.

Most Popular Narrative: 8.5% Undervalued

Compared to the recent closing price of $15.22, the most widely followed narrative points to a fair value of $16.64. This signals potential upside, fueled by expectations for business transformation and margin expansion.

Operational efficiency and supply chain optimization, particularly the rapid reduction of goods sourced from China and expanded US manufacturing, are expected to lower input costs, reduce exposure to future margin risk, and drive continued gross margin expansion.

Want to see why analysts are predicting a reset for Hayward’s bottom line? There’s a secret ingredient behind these bold new profit expectations. Is it cost-cutting, tech, or something more? Only the full narrative spills the details that led to this eye-catching price target. Don’t miss out on the crucial assumptions that could reshape Hayward’s valuation story.

Result: Fair Value of $16.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weakness in discretionary home spending or a shift toward repairing rather than replacing pool equipment could disrupt Hayward’s expected growth trajectory.

Find out about the key risks to this Hayward Holdings narrative.

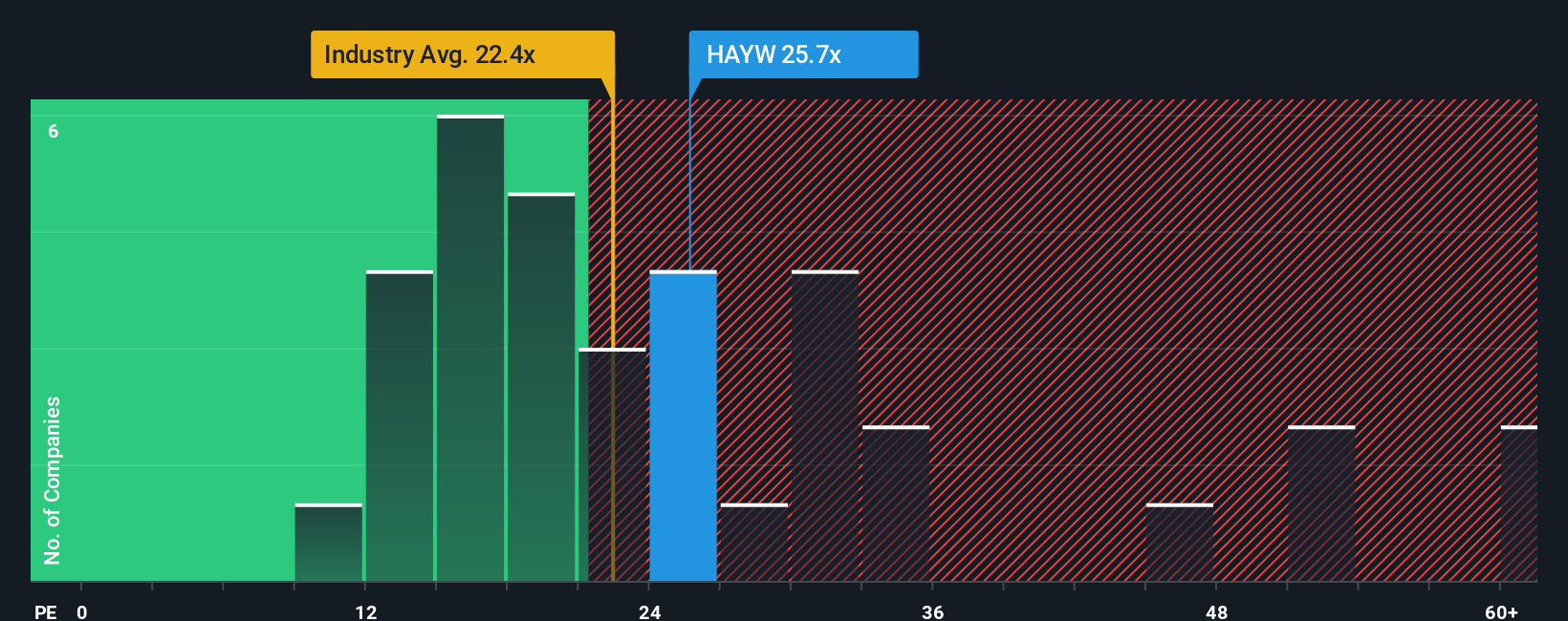

Another View: What Multiples Suggest

A second look at Hayward Holdings' valuation, using the price-to-earnings ratio, raises some caution. The stock currently trades at 25.3x earnings, which is pricier than both its industry average of 20.4x and its peer average of 22.7x. The fair ratio analysis also points to 21.6x as a reasonable target. This means shares could be considered expensive by several yardsticks. Does this premium reflect future potential or simply a valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hayward Holdings Narrative

If you prefer to investigate the facts and assemble your own perspective, you can quickly craft a personalized narrative in just a few minutes as well, so why not Do it your way?

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hayward Holdings.

Looking for more investment ideas?

Tap into tomorrow’s biggest opportunities by searching beyond Hayward Holdings. The best investors always keep an eye out for fresh trends and hidden gems.

- Maximize your passive income strategy by checking out these 18 dividend stocks with yields > 3%, which offers steady yields and robust payout histories.

- Stay ahead of the next wave in tech by browsing these 24 AI penny stocks, powering innovative breakthroughs in artificial intelligence and automation.

- Seize bargain opportunities by reviewing these 878 undervalued stocks based on cash flows, which is poised for potential upside based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hayward Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAYW

Hayward Holdings

Designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives