- United States

- /

- Trade Distributors

- /

- NYSE:GWW

Does Grainger’s (GWW) UK Exit and Guidance Shift Challenge Its Margin Strategy?

Reviewed by Sasha Jovanovic

- W.W. Grainger reported its third-quarter 2025 results, with sales rising to US$4.66 billion while net income fell materially year over year; at the same time, the company updated its full-year 2025 guidance, narrowing expectations for both sales and earnings.

- Ongoing pressure from tariff-related costs and the decision to exit the UK market, including selling its Cromwell business, reflect both margin challenges and a shift in regional priorities.

- With robust Q3 sales growth countered by softer profit and a more cautious outlook, we’ll examine how Grainger’s focused exit from the UK influences its investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

W.W. Grainger Investment Narrative Recap

W.W. Grainger shareholders are fundamentally betting on the company’s ability to capture secular growth in maintenance, repair, and operations (MRO) demand through its strong digital footprint and deep customer relationships. The recent quarterly update, featuring healthy sales growth but sharply lower net income, a strategic exit from the UK, and tightened guidance, leans more toward highlighting the near-term risk of margin and earnings compression tied to tariff and inventory cost pressures. These results do not materially shift the principal catalyst, which remains Grainger’s continued digital expansion in the U.S. MRO market.

The company’s announcement of a narrowed full-year guidance for both sales and earnings, now forecasting net sales of US$17.8 billion to US$18.0 billion, is particularly relevant as it signals more cautious management expectations in response to ongoing margin headwinds and market conditions. This adjustment highlights that, for now, visibility remains somewhat limited on how quickly profit trends might recover, even as top-line growth continues to advance.

However, investors should also be aware that, despite resilient revenue, profit pressures from tariffs and input costs may not ease quickly...

Read the full narrative on W.W. Grainger (it's free!)

W.W. Grainger's outlook forecasts $21.3 billion in revenue and $2.3 billion in earnings by 2028. This is based on an annual revenue growth rate of 6.7% and a $0.4 billion increase in earnings from the current $1.9 billion.

Uncover how W.W. Grainger's forecasts yield a $1042 fair value, a 6% upside to its current price.

Exploring Other Perspectives

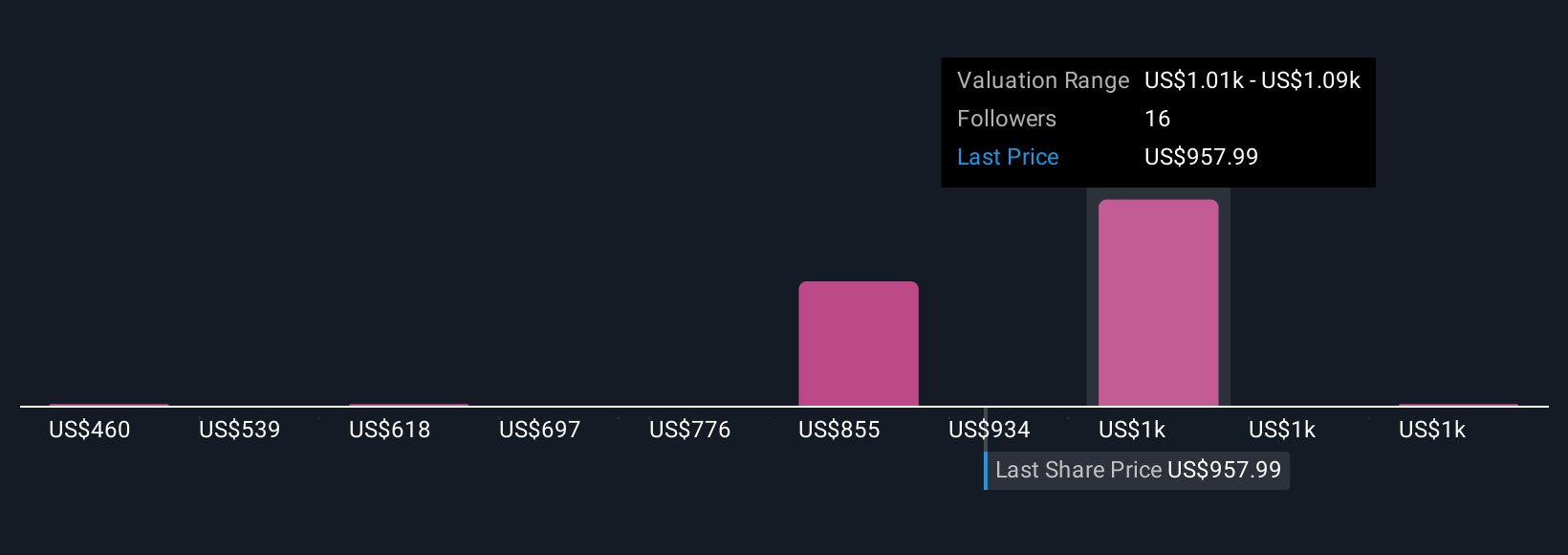

Simply Wall St Community members offered three fair value estimates for W.W. Grainger ranging from US$912.73 to US$1,250 per share. While you weigh that broad spread against recent guidance tightness and cost risks, remember your perspective can shape an entirely different outlook.

Explore 3 other fair value estimates on W.W. Grainger - why the stock might be worth as much as 28% more than the current price!

Build Your Own W.W. Grainger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W.W. Grainger research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free W.W. Grainger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W.W. Grainger's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives