- United States

- /

- Machinery

- /

- NYSE:GTES

Gates Industrial (GTES) Margin Expansion Reinforces Bullish Narrative Despite Leverage Concerns

Reviewed by Simply Wall St

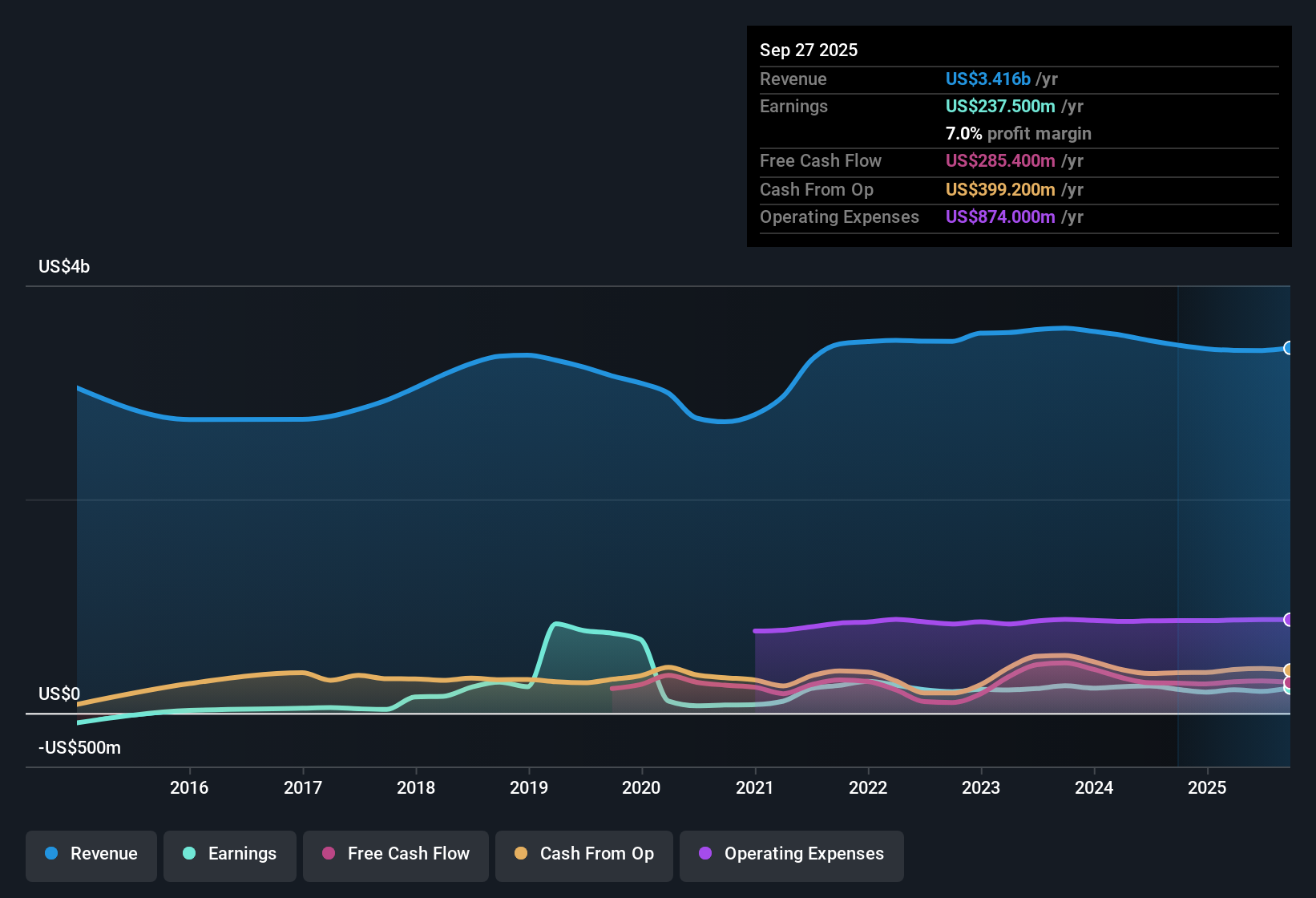

Gates Industrial (GTES) reported a net profit margin of 7% for the latest year, edging above the prior year’s 6.5%. Over the last five years, annual earnings growth has averaged 7.4%, with this year coming in at 6.9%. Revenue is forecast to grow at 4.2% per year, and estimates call for earnings growth of 11.5% annually going forward, even as the company’s price-to-earnings ratio remains below industry and peer averages. Despite not being in a strong financial position, a combination of profit and revenue growth, a comparatively attractive valuation, and a reputation for high-quality earnings means investors are likely to weigh the positives closely as Gates heads into another earnings season.

See our full analysis for Gates Industrial.Next, we will put these headline numbers up against the most widely followed narratives for Gates Industrial to see which stories hold up and where the consensus might get tested.

See what the community is saying about Gates Industrial

Margin Expansion Puts Focus on Costs

- Profit margins grew from 6.5% to 7% this year, while analysts predict an even bigger jump to 10.3% over the next three years, a notable acceleration compared to historical averages.

- Analysts' consensus view highlights several drivers for improved profitability:

- Consensus notes new design wins in high-growth markets (such as data centers and personal mobility) are positioned to fuel margin expansion opportunities, especially as demand for specialized power transmission increases.

- Analysts also see ongoing investment in R&D and innovation, such as the shift from chain to belt drives in automation, supporting future recurring revenue streams and incremental gross margin expansion.

- For the full context on how analysts see Gates riding this margin momentum, dive into the consensus narrative for more.

Balance Sheet Leverage Remains a Watch Item

- Despite margin and revenue growth, Gates Industrial continues to operate from a relatively weak financial position and faces high leverage that could pressure cash flow and limit investment flexibility if industry conditions worsen.

- Analysts' consensus narrative flags several risks tied to leverage:

- Critics highlight that revenue remains heavily concentrated in OEM and industrial channels that appear flat or are in structural decline, meaning any disappointment could magnify the impact of financial constraints.

- Consensus also notes persistent exposure to trade tensions and tariffs (potential $50 million annual cost swings) as ongoing risks, with leverage amplifying the downside in a tightening environment.

Valuation Discount Versus Industry and Peers

- With a price-to-earnings ratio of 23.8x, lower than both the US Machinery industry average of 24.6x and its peer average of 31.2x, plus a share price of $21.86 versus an analyst target of $29.18, Gates is trading at a visible discount.

- Analysts' consensus view sees this valuation gap as a mix of opportunity and necessary caution:

- What is notable is that while the company's profitability profile and profit quality back its relative undervaluation, the discount also reflects analysts' awareness of ongoing leverage and market concentration risks.

- The consensus ultimately sees potential for upside if forecasted revenue and margin gains are met, but notes the share price discount factors in required execution on those ambitions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Gates Industrial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these results from a new angle? Share your perspective and build your own narrative in just a few minutes by using Do it your way.

A great starting point for your Gates Industrial research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite rebounding profitability and a discounted valuation, Gates Industrial’s high leverage and financial constraints remain a significant vulnerability that could limit future growth flexibility.

If you want to prioritize companies with robust financial health and reduced debt exposure, use our solid balance sheet and fundamentals stocks screener (1984 results) to discover firms structured for resilience in any market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTES

Gates Industrial

Manufactures and sells engineered power transmission and fluid power solutions worldwide.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives