- United States

- /

- Electrical

- /

- NYSE:GNRC

A Fresh Look at Generac Holdings (GNRC) Valuation After Quarterly Miss and Lowered Sales Outlook

Reviewed by Simply Wall St

Generac Holdings (GNRC) delivered third-quarter financial results that came in below expectations, as a stretch of unusually light power outages dampened residential generator demand. The company also lowered its 2025 sales growth outlook.

See our latest analysis for Generac Holdings.

Following the disappointing quarter and reduced guidance, Generac's share price tumbled 15.3% right after results but is still up 7% year-to-date. The stock’s 1-year total shareholder return is now slightly negative at -0.53%. Its impressive 65.95% three-year total shareholder return hints at strong historical growth, even as short-term momentum has clearly faded.

If recent news has you reassessing your strategy, this is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

So with the stock well off its highs and analyst price targets still implying meaningful upside, is Generac now trading at a discount, or is the market already factoring in the company's growth potential?

Most Popular Narrative: 19.8% Undervalued

Generac's most followed narrative values the stock notably above its latest close, suggesting investors may be overlooking the longer-term path to higher margins and market expansion. The latest consensus points to meaningful growth drivers that could reshape outlooks for years to come.

“Accelerating demand for backup power solutions in data centers driven by AI adoption and global digitalization has resulted in a structural supply deficit for large commercial generators. Generac's rapid entry and over $150 million backlog position it to capture significant revenue growth and operating leverage over the next several years, with further potential upside as the company expands capacity to address 2027+ demand.”

What exactly is fueling this bullish narrative? The secret lies in projections for margin expansion, transformative growth in key segments, and forward-looking multiples that hint at a possible rerating. Click through to see which numbers make the difference between today’s valuation and tomorrow’s opportunity.

Result: Fair Value of $209.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in home standby generator demand and uncertainty surrounding the residential solar market could limit Generac's potential to achieve these optimistic targets.

Find out about the key risks to this Generac Holdings narrative.

Another View: What Do the Ratios Say?

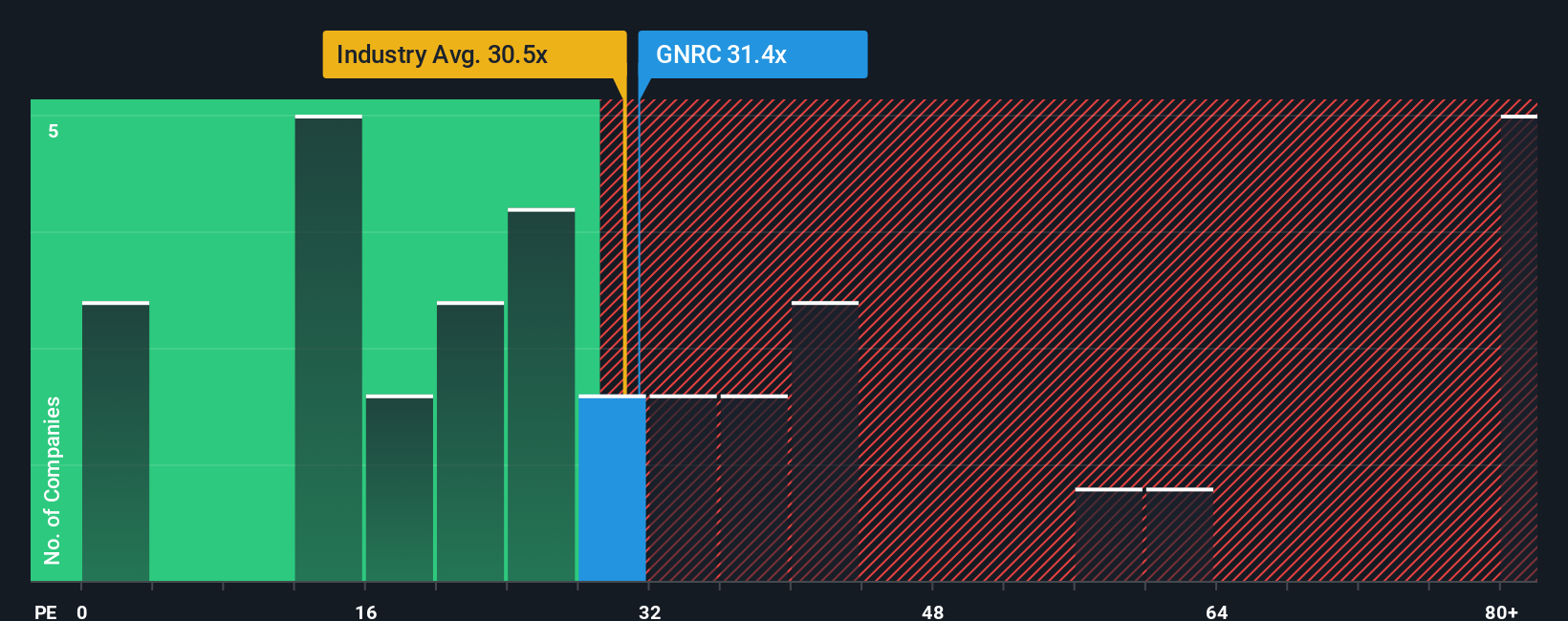

Looking at Generac through the lens of price-to-earnings, its ratio of 31.8x actually overshoots both the US Electrical industry average (31.4x) and peer average (40.6x), yet sits comfortably below the fair ratio of 35.7x. This suggests there is some built-in margin for safety, but also underlines ongoing valuation risks. Will the market see this as a future opportunity or a red flag?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Generac Holdings Narrative

Keep in mind, if these perspectives do not fully align with your own analysis, you can quickly dig into the data and craft a personalized outlook in just a few minutes. Do it your way

A great starting point for your Generac Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take charge of your next move and elevate your watchlist with opportunities other investors are still overlooking. Check out these unique stock lists right now.

- Unlock growth potential with these 26 AI penny stocks featuring companies breaking new ground in artificial intelligence innovation and applications.

- Capture long-term value by targeting these 833 undervalued stocks based on cash flows that the market may have missed based on robust cash flow metrics.

- Boost your portfolio with attractive yields. Start with these 22 dividend stocks with yields > 3% that offer consistent income above 3% annually.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNRC

Generac Holdings

Designs, manufactures, and distributes energy technology products and solution worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives