- United States

- /

- Trade Distributors

- /

- NYSE:GIC

Does Global Industrial’s (GIC) Margin Focus Reflect a Strategic Shift or Temporary Response to Demand Challenges?

Reviewed by Sasha Jovanovic

- Global Industrial Company recently reported its third-quarter 2025 financial results, revealing sales of US$353.6 million and net income of US$18.8 million, both increasing year over year but missing analyst expectations.

- Despite growing sales and improved margins, management pointed to weak demand among small and medium business customers, intentional reductions in less profitable accounts, and tariff pressures as key challenges impacting results.

- We will explore how lower-than-expected quarterly earnings and revenue might shift the investment narrative for Global Industrial moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Global Industrial Investment Narrative Recap

To be a shareholder in Global Industrial, you need to believe the company can successfully pivot its customer base towards larger strategic accounts and manage volatility in demand and costs, particularly in a challenging tariff environment. The recent earnings miss doesn’t materially alter the most important short-term catalyst, continued focus on margin improvement through operational efficiency and customer mix, but it reinforces the biggest risk: persistent gross margin variability if tariff and cost headwinds persist.

Among recent announcements, the Board’s decision to maintain the quarterly dividend at US$0.2600 per share stands out. This signals management's confidence in the company’s underlying cash generation and could help support shareholder sentiment amid heightened short-term earnings uncertainty.

However, it’s important for investors to be aware that, while margin gains were recognized last quarter, some of these improvements were tied to non-recurring factors such as favorable inventory timing...

Read the full narrative on Global Industrial (it's free!)

Global Industrial's narrative projects $1.5 billion revenue and $102.1 million earnings by 2028. This requires 4.4% yearly revenue growth and a $36.7 million earnings increase from $65.4 million today.

Uncover how Global Industrial's forecasts yield a $38.00 fair value, a 35% upside to its current price.

Exploring Other Perspectives

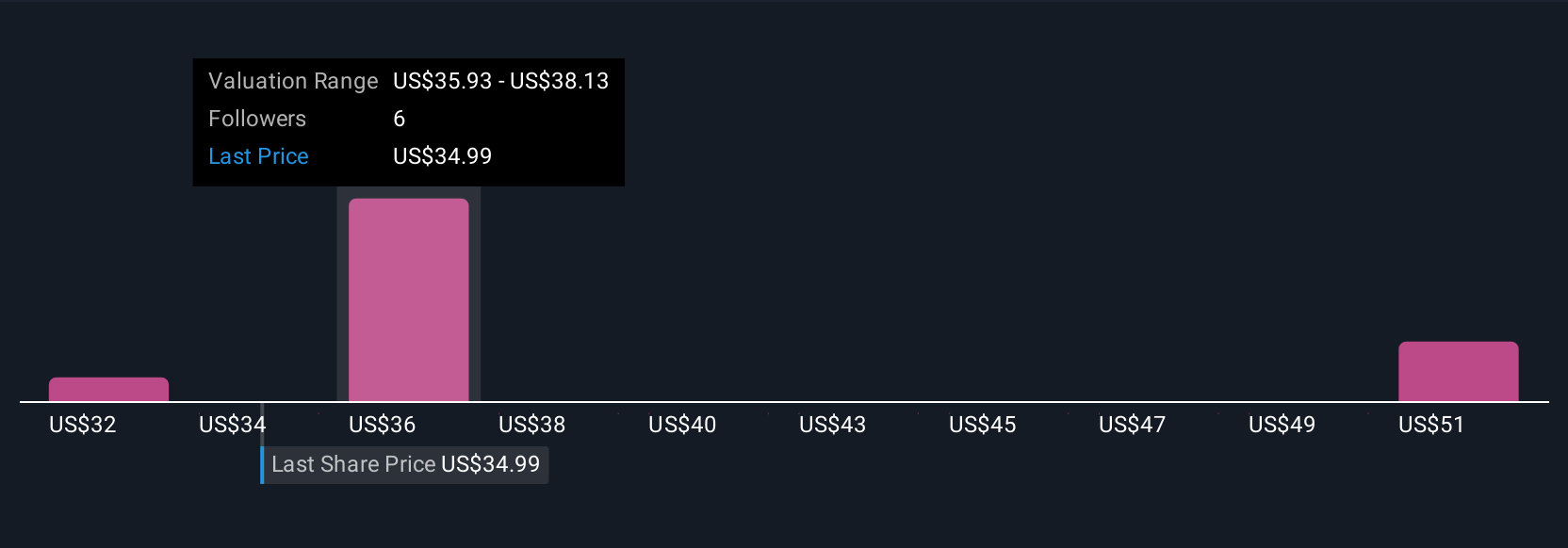

Simply Wall St Community members put fair value for Global Industrial between US$38 and US$48.54, with three distinct estimates. Persistent cost pressures from tariffs remain top of mind and may shape broader performance, so it pays to explore the full range of market viewpoints before deciding.

Explore 3 other fair value estimates on Global Industrial - why the stock might be worth as much as 72% more than the current price!

Build Your Own Global Industrial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Industrial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Global Industrial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Industrial's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GIC

Global Industrial

Through its subsidiaries, operates as an industrial distributor of various industrial and maintenance, repair, and operation (MRO) products in the United States and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives