- United States

- /

- Machinery

- /

- NYSE:GGG

Graco (GGG) Valuation in Focus After Q3 Growth Driven by Acquisitions and Mixed Organic Performance

Reviewed by Simply Wall St

Graco (GGG) recently posted its third quarter results, showing year-over-year growth in sales and net income. However, the conversation among investors is focused on the details that are driving these numbers.

See our latest analysis for Graco.

Despite Graco’s upbeat sales and earnings numbers, the market’s response has been muted, with the share price sitting at $81.77 and showing a 1-year total shareholder return of -0.46%. Momentum has faded in the short term as recent results and news, including the appointment of a new board member and modest full-year sales guidance, have investors weighing growth potential against softer core performance and cautious management commentary.

If you’re interested in broadening your investment outlook, now is the perfect moment to discover fast growing stocks with high insider ownership.

With Graco’s recent gains rooted in acquisitions rather than strong organic growth, investors are left to consider whether this leaves the stock undervalued or if the market has already accounted for future prospects, leaving limited room for upside.

Most Popular Narrative: 11.5% Undervalued

With Graco’s latest close at $81.77, the most closely followed narrative sees fair value notably higher. This suggests upside from current levels based on strategic catalysts and future earnings potential.

The strategic decision to maintain a strong U.S. manufacturing footprint may give Graco an advantage over competitors who manufacture offshore. Especially in light of ongoing trade tensions and tariffs, this approach could improve net margins through cost control and pricing power. The company is expecting benefits from the integration of the COROB acquisition, aiming to capture more revenue and expand its presence in North America, which should contribute to earnings growth.

Curious about what propels this positive outlook? There is a bold mix of next-generation products, anticipated margin gains, and a surprising future earnings target at the heart of the full narrative. Find out which ambitious projections fuel the fair value calculation—what might the market be missing?

Result: Fair Value of $92.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain disruptions or unexpected tariff changes could threaten Graco’s margins and undermine the optimistic view held by analysts.

Find out about the key risks to this Graco narrative.

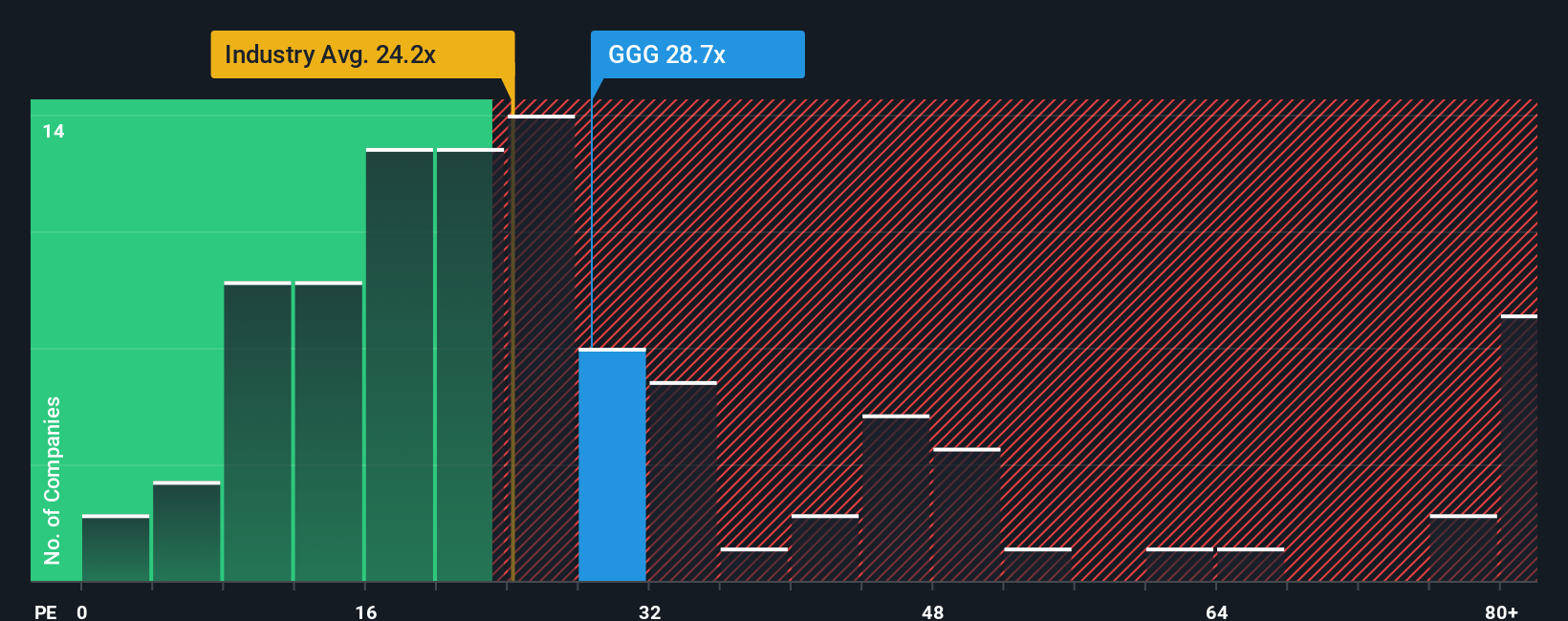

Another View: Comparing Valuation Multiples

While some analysts see Graco as undervalued, looking at its current price-to-earnings ratio tells a different story. Graco’s P/E of 27.2x is notably higher than both the US Machinery industry average of 23.5x and its peer average of 24x. The fair ratio, which reflects what Graco could trade at if the market reverts, sits even lower at 21.7x. This gap suggests that investors are paying a premium and implies little margin for error if future growth disappoints. Is the market optimism warranted, or could the stock be vulnerable if expectations are not met?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Graco Narrative

If you believe in a different perspective or want to dive deeper into the numbers on your own, you can shape your own investment story in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Graco.

Looking for more investment ideas?

Don’t let great opportunities slip away. Use the right tools to spot potential winners, diversify your portfolio, and get ahead of the curve with these handpicked investing angles:

- Capitalize on trends in artificial intelligence by browsing these 27 AI penny stocks that stand out for strong growth and innovation in the booming AI sector.

- Secure reliable income streams and reduce risk by choosing from these 20 dividend stocks with yields > 3% offering attractive yields above 3% and robust financials.

- Tap into future-shaping breakthroughs as you assess these 28 quantum computing stocks paving the way for advancements in computing power and real-world applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GGG

Graco

Designs, manufactures, and markets systems and equipment used to move, measure, mix, control, dispense, and spray fluid and powder materials in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives