- United States

- /

- Building

- /

- NYSE:GFF

Is Griffon’s Recent Pullback a Signal for Opportunity in 2025?

Reviewed by Bailey Pemberton

- Curious if Griffon is worth your attention right now? Let's dig into the numbers and see if there's real value here, or if the stock's price has run too far ahead.

- Even after a slight pullback of -3.7% over the last week and -5.1% in the past month, Griffon's stock is still up 2.6% year-to-date and an impressive 15.2% over the past year. This suggests possible growth momentum, but it also indicates shifting market sentiment around its future prospects.

- Recent headlines highlight Griffon's strategic positioning in the capital goods sector, with industry news focusing on infrastructure investments and evolving supply chain dynamics. This context may provide both tailwinds and challenges that have played into the stock's short-term price swings.

- According to Simply Wall St's valuation checks, Griffon scores 4 out of 6 for undervaluation, which means it meets the mark on most key value indicators. We'll break down what this score really means and explore various ways analysts assess value, so stick around for a deeper perspective on valuation that goes beyond just the checkboxes.

Approach 1: Griffon Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This approach helps gauge whether a stock’s current price aligns with its underlying fundamentals.

For Griffon, the most recent Free Cash Flow is $296.9 million. Analysts forecast that Free Cash Flow will climb steadily over the next five years, with Simply Wall St extrapolating these estimates out to 2035. By 2027, projections put annual Free Cash Flow at $332.05 million, and these are expected to reach around $440.34 million by 2035, indicating modest but consistent growth over the next decade.

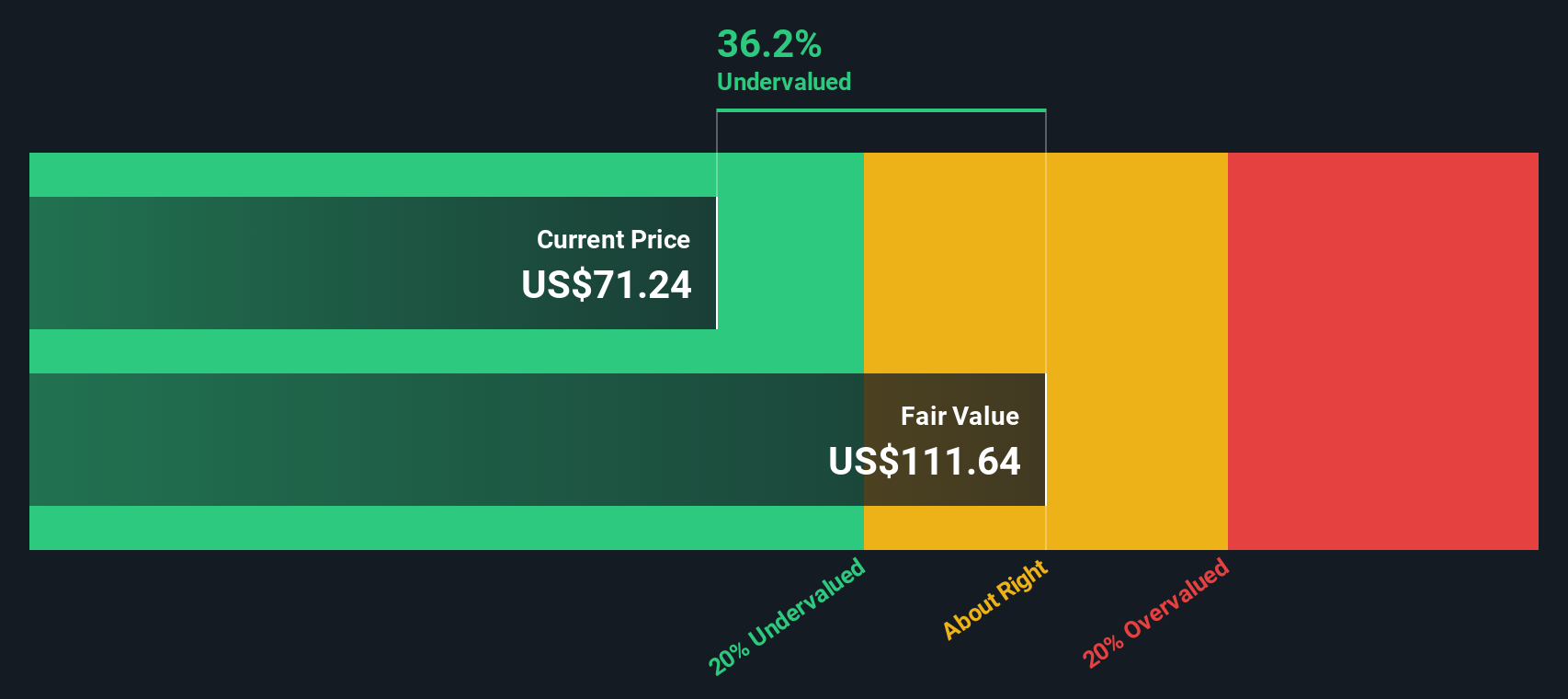

All cash flows are calculated in USD and reflect the company's ability to generate cash from its operations year after year. Using these projections, the DCF model estimates Griffon's intrinsic value to be $112.94 per share. This suggests the current market price is 34.6% below this fair value, indicating that Griffon may be meaningfully undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Griffon is undervalued by 34.6%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Griffon Price vs Earnings

The Price-to-Earnings (PE) ratio is widely considered the go-to metric for valuing profitable companies like Griffon, as it shows how much investors are willing to pay for each dollar of earnings. It is especially relevant when a business is consistently generating profits, providing a straightforward comparison against its own history or other companies.

However, what constitutes a “normal” or “fair” PE ratio depends on the outlook for growth and risk. If investors expect higher earnings growth or stability, a higher PE may be justified. Conversely, lower growth or greater risks typically lead to lower PE ratios being considered reasonable.

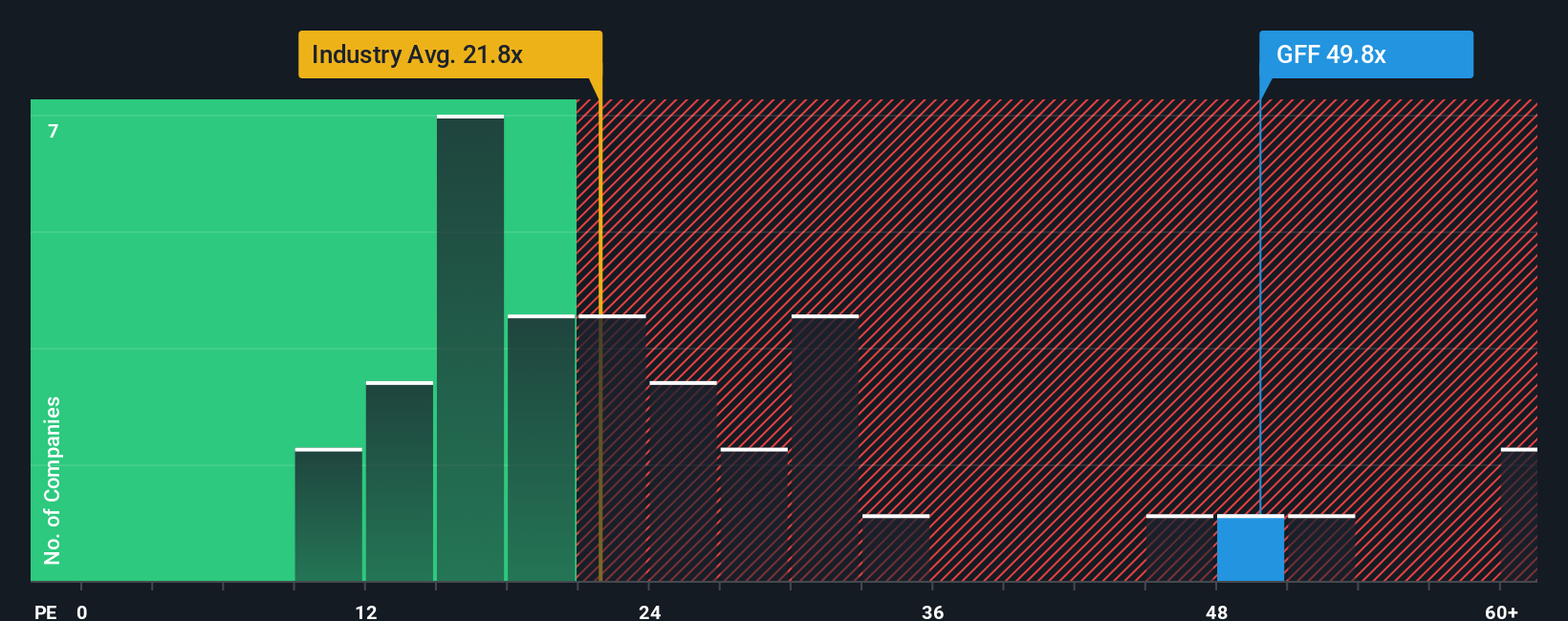

Currently, Griffon trades at a PE ratio of 49.2x. This is substantially higher than both the building industry average of 20.5x and the average of its peer group at 22.4x. At first glance, this premium could raise eyebrows about overvaluation. However, these simple comparisons do not take into account company-specific factors that affect fair value, such as profitability, margin trends, or future prospects.

To address this, Simply Wall St's “Fair Ratio” model incorporates a range of fundamental metrics, including Griffon's expected earnings growth, risk, market cap, profit margins, and sector dynamics. This proprietary calculation arrives at a fair PE ratio of 78.2x for Griffon, which is notably above both the current market multiple and general industry levels. As a result, the stock's actual PE is well below its calculated fair value multiple, suggesting that concerns about overvaluation may be misplaced when factoring in all the key variables.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Griffon Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a powerful, user-friendly tool that lets you create and explore a story behind a company. It combines your unique expectations for Griffon’s revenue, earnings, and margins with your view of its business strengths and risks. Narratives connect the dots from a company’s real-world story and drivers to a financial forecast and ultimately to a calculated fair value, helping you see not just what a company is worth but why.

With Narratives, available right within Simply Wall St’s Community page, you can quickly craft your perspective or learn from what millions of other investors think. This approach allows you to compare your fair value estimate to the current price, so you can objectively judge if it's time to buy or sell. What makes Narratives especially useful is that they update dynamically when new news, earnings, or catalysts emerge, making sure your story always reflects the latest information.

For Griffon, some investors might argue that resilient home remodeling trends, automation, and disciplined capital allocation justify a bullish fair value as high as $115. Others take a more cautious view, setting their fair value closer to $90 because of ongoing margin pressures and weak consumer demand. This highlights how different Narratives can shape smarter, more contextual investing decisions.

Do you think there's more to the story for Griffon? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GFF

Griffon

Through its subsidiaries, provides consumer and professional, and home and building products in the United States, Europe, Canada, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives