- United States

- /

- Building

- /

- NYSE:GFF

Griffon (GFF): Assessing Valuation After Recent Share Price Decline and Investor Interest

Reviewed by Simply Wall St

Griffon (GFF) shares have been moving quietly over the past month, dropping about 3%. Recently, the stock’s valuation has caught the eye of some investors, who are weighing whether this downswing presents a reasonable entry opportunity.

See our latest analysis for Griffon.

Griffon has seen some momentum fade lately, with its share price off nearly 3% this month and about 8% down over the past quarter, even as the stock sits at $74.01. That said, investors with a long lens will notice Griffon’s one-year total shareholder return is still a solid 18%, and its five-year total return stands at an impressive 281%. This reflects real value growth through the cycle.

If you like the idea of finding under-the-radar companies before the crowd, now could be the perfect time to broaden your research with our screen for fast growing stocks with high insider ownership.

After this stretch of sideways trading, is Griffon now undervalued with room to run or has the market already factored in all of its future growth potential? Could this weakness be a genuine buying opportunity?

Most Popular Narrative: 26.2% Undervalued

Griffon's most widely followed narrative signals that the current share price of $74.01 sits well below the narrative's fair value estimate of $100.29. This sets the stage for a bold outlook rooted in home remodeling tailwinds and future profit growth expectations.

Ongoing investments in automation and modernization projects, particularly in HBP, are expected to further improve operating efficiencies and gross margins over the next several years. This could bolster future earnings and cash generation.

Want to know the story behind this potential bargain? This narrative hints at high future earnings, rising margins, and a strategic transformation that could reset Griffon's market value. See which aggressive financial leaps underpin the fair value calculation and why many believe major upside is next.

Result: Fair Value of $100.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak consumer demand or increasing tariffs in Griffon's key business lines could easily derail these optimistic long-term projections.

Find out about the key risks to this Griffon narrative.

Another View: Richer Than Peers on Earnings Ratio

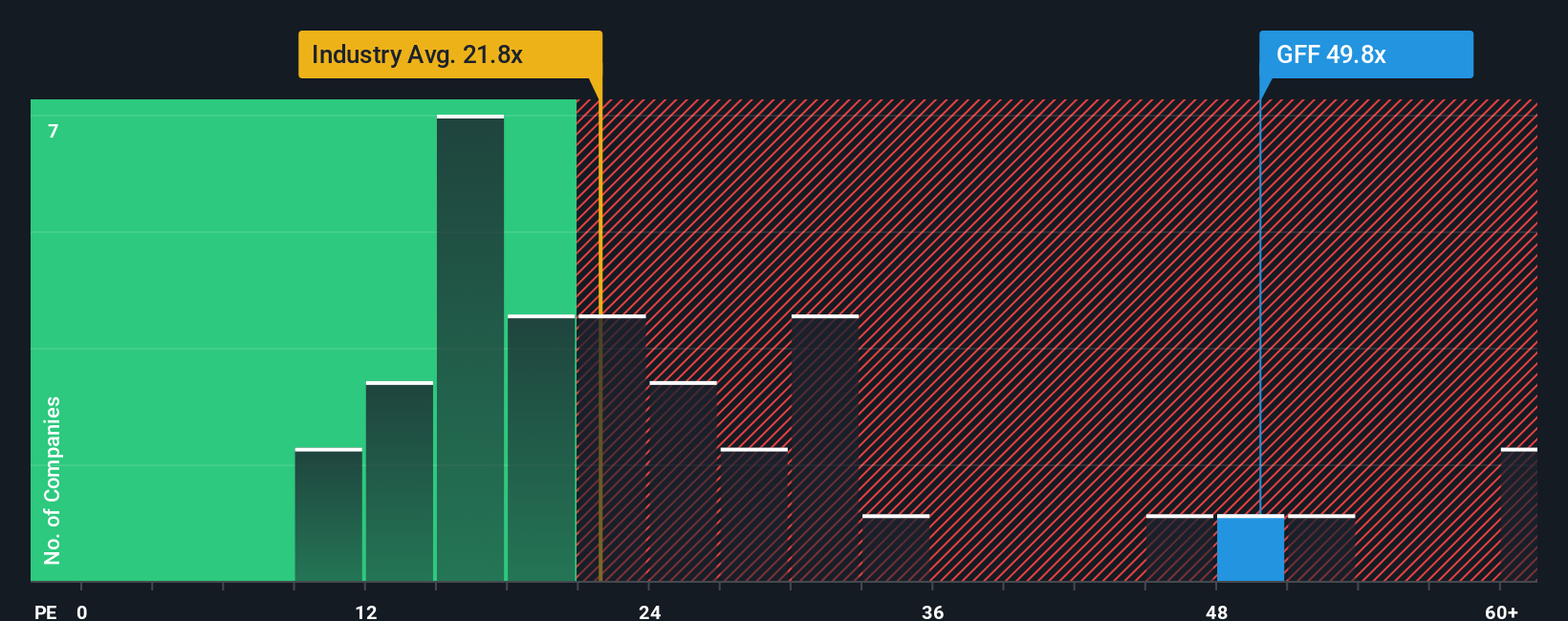

Looking at Griffon through the lens of its earnings ratio tells a different story. At 49.3 times earnings, Griffon's valuation is much steeper than both its industry average (19.4x) and peer average (23.3x). Even compared with the fair ratio of 80.8x, Griffon trades below where it could be. However, the premium versus rivals hints at valuation risk if the expected growth does not materialize. So, is this premium justified, or is caution in order?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Griffon Narrative

If you see Griffon's story differently or want to dig into the numbers at your own pace, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Griffon research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your investing toolkit right now by checking out hand-picked opportunities across the market. Don’t let the next big trend pass you by. See what’s possible.

- Tap into the stability of companies generating reliable income by scanning these 22 dividend stocks with yields > 3% with strong yields above 3%.

- Ride the digital wave and spot potential market movers among these 81 cryptocurrency and blockchain stocks set to shape the future of fintech and blockchain adoption.

- Unlock bargains with significant upside by searching these 832 undervalued stocks based on cash flows based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GFF

Griffon

Through its subsidiaries, provides consumer and professional, and home and building products in the United States, Europe, Canada, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives