- United States

- /

- Building

- /

- NYSE:GFF

Griffon (GFF): Assessing Valuation After Recent Loss in Momentum

Reviewed by Simply Wall St

Griffon (GFF) has seen its stock move largely in line with broader trends, reflecting shifting momentum over the past month. Recent trading activity gives investors a new angle to assess its long-term prospects.

See our latest analysis for Griffon.

After climbing for several years, Griffon's momentum has cooled recently. The company has a one-year total shareholder return of -11.3% and a year-to-date share price return of -7.1%. Still, its five-year total return stands out, showing significant long-term value creation even amid short-term pressure.

If you’re weighing your next moves, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and robust long-term gains in the rearview, the question now is whether Griffon is undervalued at current levels or if the market is already factoring in its future growth potential.

Most Popular Narrative: 33% Undervalued

Griffon's current trading price sits well below the narrative fair value of $100.29, prompting close attention from followers chasing a significant upside. The latest consensus embraces both optimism for margin gains and caution around demand headwinds as the next phase unfolds.

The asset-light, flexible global sourcing model and cost optimization initiatives in Consumer and Professional Products (CPP) are expected to drive long-term margin expansion once consumer demand rebounds. This would enable eventual recovery in segment EBITDA and overall earnings power.

Want to know how rapid margin expansion and a shift in operating leverage could reshape Griffon's profit outlook? The entire fair value narrative rests on some ambitious, quantified jumps in key financial metrics. Ready to see which bold assumptions are behind the double-digit upside? Dive deeper for the story behind these numbers.

Result: Fair Value of $100.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak consumer demand and ongoing margin pressure could undermine the recovery narrative and present risks to Griffon's earnings outlook.

Find out about the key risks to this Griffon narrative.

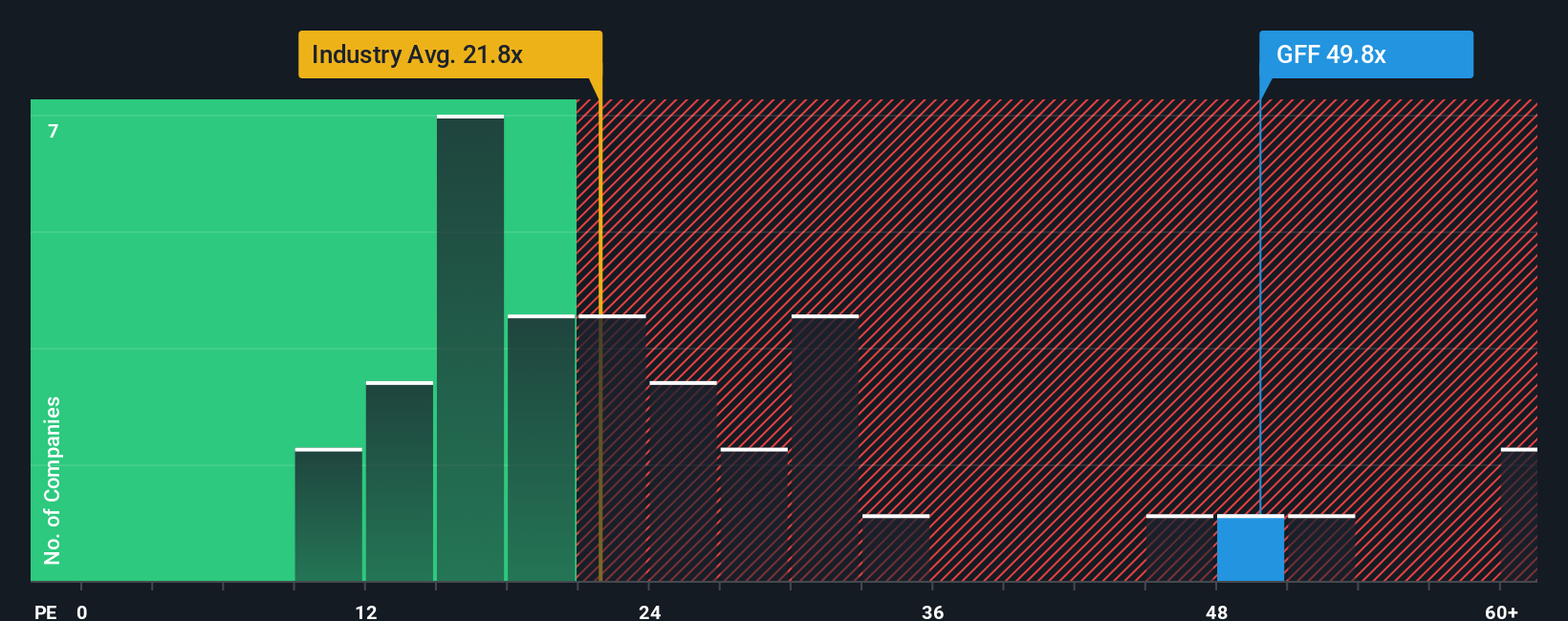

Another View: High Multiple Raises Questions

Looking from another angle, Griffon is currently priced at 44.5 times earnings, which is a steep premium compared to the US Building industry average of 17.1 and a peer average of 19.6. Even when compared to a fair ratio of 72.7, this gap signals investors are paying up for future growth that is far from guaranteed. Does this premium reflect real potential or expose buyers to valuation risk as industry sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Griffon Narrative

If you want a different perspective or enjoy delving into the details yourself, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Griffon research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Opportunities?

Seize your advantage by finding stocks that meet clear winning criteria. Let Simply Wall Street’s powerful Screener help you spot what others might miss before the market moves.

- Tap into steady cash flow with these 18 dividend stocks with yields > 3% offering yields above 3% for long-term income seekers.

- Accelerate your strategy by researching these 27 AI penny stocks set to surge from artificial intelligence breakthroughs across multiple industries.

- Future-proof your portfolio by acting on these 906 undervalued stocks based on cash flows based on real cash flows, finding undervalued gems trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GFF

Griffon

Through its subsidiaries, provides home and building, and consumer and professional products in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives