- United States

- /

- Aerospace & Defense

- /

- NYSE:GE

Is It Too Late to Consider GE Stock After Its 83% Run in 2025?

Reviewed by Bailey Pemberton

- Curious about whether General Electric stock is truly worth today's price? You are not alone. Investors across the market are asking the same question amid its dramatic run.

- Shares have surged, gaining 1.7% this week, 4.0% in the last month, and an eye-popping 83.3% so far this year. This adds to a staggering 521.7% return over three years.

- The latest headlines spotlight General Electric's progress on its multi-year transformation plan and the separation of its business units. This has fueled optimism and intense market attention. Industry watchers have also pointed out renewed investor enthusiasm around infrastructure and energy themes, which has clearly influenced the stock's price action.

- However, according to our valuation checks, General Electric earns a score of 0 out of 6 for being undervalued. This raises some eyebrows about its current price. We will break down what goes into these scores, explore different ways to look at value, and finish with a perspective you will not want to miss.

General Electric scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: General Electric Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors gauge the present value of a business based on its expected financial performance over time.

For General Electric, the latest reported Free Cash Flow stands at $6.45 billion. Analyst estimates suggest that this figure will see steady growth, reaching $10.59 billion by 2029. While analyst forecasts typically extend five years out, further projections are extrapolated. This provides insight into the company’s financial trajectory over the next decade.

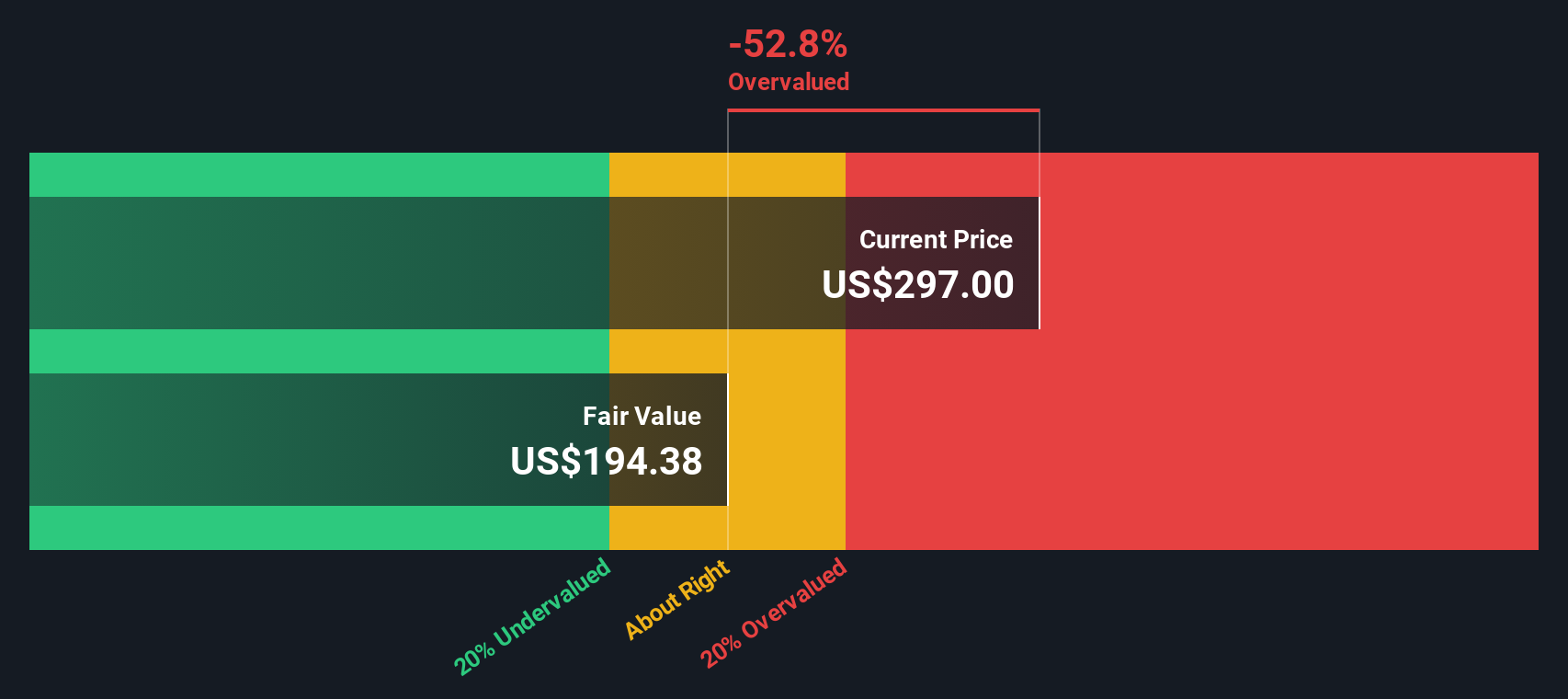

Using the DCF method, General Electric’s fair value is calculated at $200.56 per share. However, the analysis also implies that the current market price is 54.0% above this estimated intrinsic value. In other words, according to this widely used valuation technique, General Electric’s stock appears overvalued based on the company’s predicted ability to generate future cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests General Electric may be overvalued by 54.0%. Discover 839 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: General Electric Price vs Earnings

For established, profitable companies like General Electric, the Price-to-Earnings (PE) ratio is a widely used valuation tool. The PE ratio helps investors understand how much they are paying for each dollar of earnings, giving a quick sense of how the market values the company’s current profitability.

Growth expectations and perceived risk both play major roles in what is considered a “normal” or “fair” PE ratio. Faster-growing or lower-risk companies tend to warrant higher PE multiples, while slower-growing or riskier businesses trade at lower ratios. This context is essential when comparing GE to benchmarks.

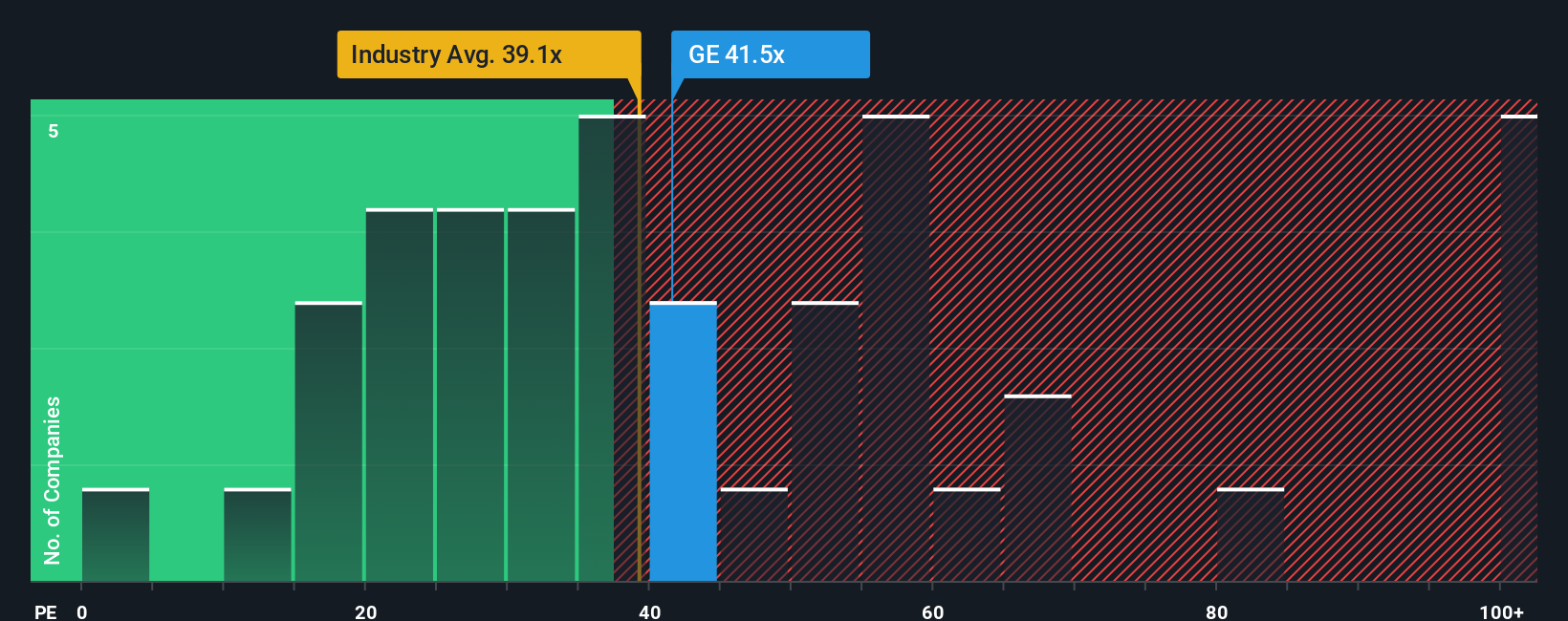

Currently, General Electric trades at a PE ratio of 40.5x. For context, the average PE ratio among its industry peers in Aerospace and Defense is 38.9x, and GE’s peer group sits at 26.5x. By these measures, GE’s stock commands a premium compared to both the industry and direct peers.

However, the “Fair Ratio,” calculated by Simply Wall St, considers not only industry averages but also GE’s growth prospects, profit margins, market cap, and company-specific risks. For GE, the Fair Ratio is 36.2x. This proprietary metric provides a more tailored benchmark for what the stock should ideally trade at and is typically more insightful than simple peer or industry comparisons.

With GE's actual PE at 40.5x, compared to a Fair Ratio of 36.2x, the stock trades noticeably above its tailored fair value on this metric. This suggests General Electric is currently overvalued when considering these fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your General Electric Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your perspective or story about a company—how you think it will perform, what could influence its future, and what all of this means for a fair value.

Unlike traditional metrics that only look at numbers, Narratives allow you to tie together your view of the business with specific forecasts for revenue, earnings, and margins. This approach then automatically converts your story into a fair value estimate. Narratives are available on the Community page of Simply Wall St’s platform and are widely used by millions of investors to clarify why they think a company is under- or overvalued.

With Narratives, it is easy to compare your assumed fair value with the current price and see if now could be the right time to buy, hold, or sell. As new information comes in, such as news, earnings releases, or analyst updates, Narratives are updated dynamically to ensure your outlook and fair value stay current.

For example, some investors see General Electric’s aerospace upgrades and strong demand as justifying a fair value as high as $343, while others focus on execution risks and competition, supporting a more cautious figure of $266.

Do you think there's more to the story for General Electric? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GE

General Electric

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives