- United States

- /

- Aerospace & Defense

- /

- NYSE:GE

General Electric (GE): Evaluating the Valuation Narrative After Recent Share Price Fluctuations

Reviewed by Simply Wall St

General Electric (GE) shares have moved modestly in recent trading, as investors digest the company’s performance and overall direction. Market participants are increasingly focused on how GE’s latest results and strategic updates may affect its longer-term outlook.

See our latest analysis for General Electric.

General Electric’s share price has seen some volatility lately, dipping about 5% over the past month. However, the bigger picture tells a more compelling story: the stock boasts a year-to-date share price return of over 70%, and its five-year total shareholder return tops 467%. Momentum may be cooling in the short run, but long-term holders have seen robust cumulative gains as the company’s restructuring and profit growth continue to shape investor sentiment.

If you’re weighing your next move after GE’s run, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares well off their recent highs, yet still up dramatically over the past year, the question now is whether General Electric is trading at a bargain or if expectations for future growth are already fully baked into the price.

Most Popular Narrative: 15.2% Undervalued

The consensus narrative sees General Electric's fair value at $339, a notable premium to its last close at $287.44. This sets up an ambitious runway for those following the widely watched Wall Street calculus.

Acceleration of next-generation engine programs (like CFM RISE with open fan technology and the GE9X), driven by airline demand for significantly improved fuel efficiency and lower emissions, positions GE to capture incremental orders and technology licensing revenue as decarbonization efforts intensify, positively impacting long-term revenue and earnings growth.

Want to know where this bold price target comes from? The forecast packs in aggressive assumptions about future profit margins and revenue growth, along with a hefty premium on future earnings. Wondering just how optimistic the scenario gets? Uncover the exact projections and logic driving this valuation in the full narrative.

Result: Fair Value of $339 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on commercial aviation and rising supply chain costs could disrupt GE’s growth trajectory if industry headwinds persist in the coming years.

Find out about the key risks to this General Electric narrative.

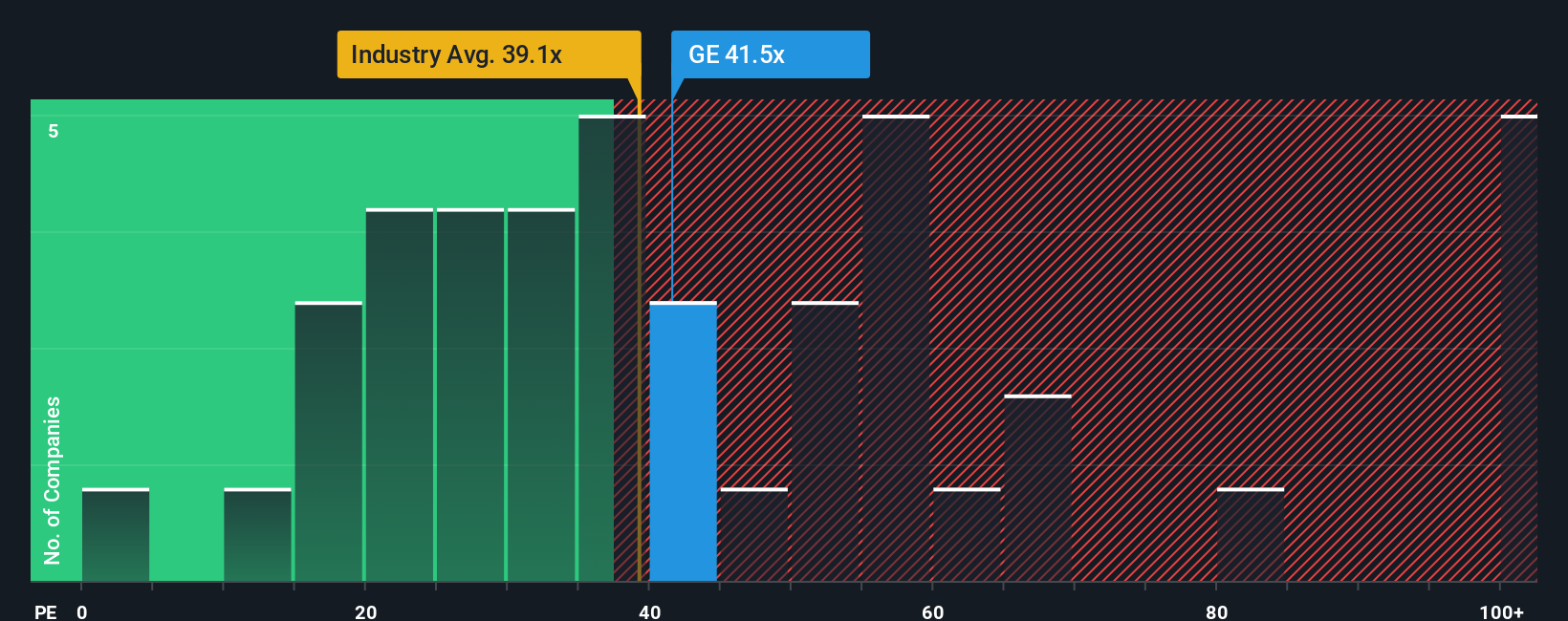

Another View: Looking Through the Lens of Market Ratios

While the narrative suggests General Electric is undervalued, a glance at its price-to-earnings ratio paints a different picture. GE trades at 37.6x earnings, making it pricier than both the US Aerospace & Defense industry (36.1x) and the peer average (25.5x), and even above its own fair ratio of 35.8x. This gap could mean the market is baking in a lot of optimism, raising questions about downside risk if expectations stumble. Does this premium signal future strength, or set a high bar that may be tough to clear?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own General Electric Narrative

If you see the numbers differently, or want to follow your own trail of evidence, you can assemble your own story in just a few minutes. Do it your way

A great starting point for your General Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself the edge by checking out smart stock picks beyond General Electric. These handpicked opportunities could put you ahead while others are left waiting.

- Accelerate your portfolio’s growth as you uncover undervalued gems with strong fundamentals through these 927 undervalued stocks based on cash flows before they catch everyone else’s attention.

- Boost your income potential and capitalize on attractive yields when you seize these 16 dividend stocks with yields > 3% offering over 3% returns and strong financial health.

- Ride the surge of artificial intelligence innovation as you tap into tomorrow’s leaders via these 26 AI penny stocks and advance automation and smarter tech solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GE

General Electric

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives