- United States

- /

- Trade Distributors

- /

- NYSE:GATX

GATX (GATX): Assessing Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for GATX.

Despite this month's dip, GATX has posted a solid 15.2% total shareholder return over the past year and an impressive 56.2% over three years. This signals that long-term momentum remains intact even as short-term share price movements have cooled.

If you’re considering the next opportunity after GATX's long-term outperformance, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

This raises the key question: does GATX’s pullback make it undervalued with more upside ahead, or is the market simply factoring in its robust growth and rewarding long-term stability? Is an opportunity emerging, or is everything already priced in?

Most Popular Narrative: 16.9% Undervalued

Market watchers are buzzing as the narrative's fair value of $188.75 sits well above the latest close of $156.85, sparking debate over upside potential. With this premium valuation, the most-followed perspective suggests GATX’s strategic moves are being valued higher than what the current share price reflects.

Strategic deployment of new railcars via committed supply agreements and selective international expansion, particularly in India, position GATX to capitalize on long-term growth in commodity flows and diversified revenue streams. This is likely to improve future revenue and operating margins.

Curious what’s fueling this confident calculation? One hidden lever behind the price target is a set of bold growth and margin forecasts, forged from expansion bets and analyst consensus. Want to discover the exact projections propelling this value skyward? Don’t miss out on the deeper story inside the full narrative.

Result: Fair Value of $188.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on volatile remarketing gains and ongoing uncertainty in European rail markets may quickly change the outlook if trends shift unexpectedly.

Find out about the key risks to this GATX narrative.

Another View: DCF Model Puts a Different Spin on GATX

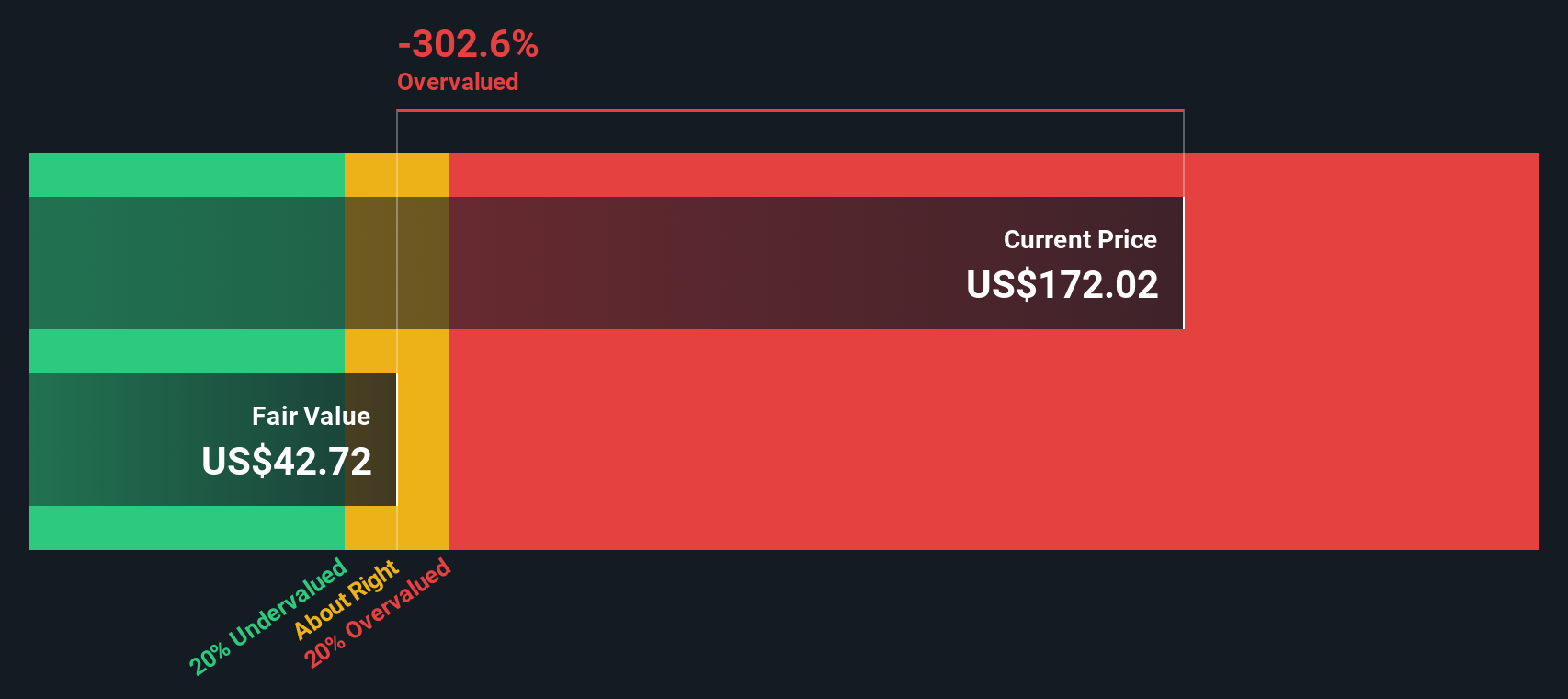

While analyst consensus and market multiples suggest GATX is undervalued, our SWS DCF model presents a more cautious perspective. The DCF estimate values shares well below the current market price, highlighting a clear tension between growth outlooks and intrinsic value. Which perspective will the market ultimately trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GATX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 833 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GATX Narrative

If you see the story differently or want to draw your own conclusions, it only takes a few minutes to craft your own perspective and dig into the numbers yourself. Do it your way

A great starting point for your GATX research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next opportunity pass you by. Take charge of your investing strategy by searching for standout stocks with strong financials, cutting-edge themes, and attractive valuation angles.

- Tap into tomorrow’s technology by choosing these 26 AI penny stocks that are powering advances in everything from automation to intelligent software.

- Strengthen your portfolio with reliable yield potential by targeting these 22 dividend stocks with yields > 3% that offer more than 3% returns backed by robust financials.

- Unlock value not yet priced in by zeroing in on these 833 undervalued stocks based on cash flows based on future cash flow potential and market-beating fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GATX

GATX

Together its subsidiaries, operates as railcar leasing company in the United States, Canada, Mexico, Europe, and India.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives