- United States

- /

- Machinery

- /

- NYSE:FTV

How Investors Are Reacting To Fortive (FTV) Third-Quarter Results and Post-Spin Capital Strategy

Reviewed by Sasha Jovanovic

- Fortive Corporation reported earnings for the third quarter of 2025, highlighting focused execution on organic growth, margin expansion initiatives, and disciplined cost reductions following the Ralliance spin-off.

- The company also confirmed a quarterly dividend, completed a significant tranche of share repurchases totaling US$528.36 million, and outlined plans for smaller bolt-on acquisitions instead of transformational deals, signaling an ongoing commitment to balanced capital allocation and operational streamlining.

- We’ll examine how Fortive’s disciplined post-spin-off approach and emphasis on bolt-on acquisitions may influence the company’s investment outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Fortive Investment Narrative Recap

To be a Fortive shareholder, you need to believe in the company’s potential for steady revenue from recurring sources, disciplined margin expansion, and its ability to leverage bolt-on acquisitions for growth as it adapts post-spin-off. The latest news underscores continued buybacks and a maintained dividend, but does not materially shift the short-term focus: execution on organic growth remains the primary catalyst, while concentration risk across fewer segments is still the key vulnerability.

The recent confirmation of a substantial share repurchase program, US$528.36 million spent on buybacks in the latest quarter, stands out as particularly relevant, as it highlights Fortive's ongoing commitment to returning capital to shareholders. This action ties directly into management's pledge for balanced capital allocation, even as short-term growth drivers hinge on performance in core segments after the spin-off…

Read the full narrative on Fortive (it's free!)

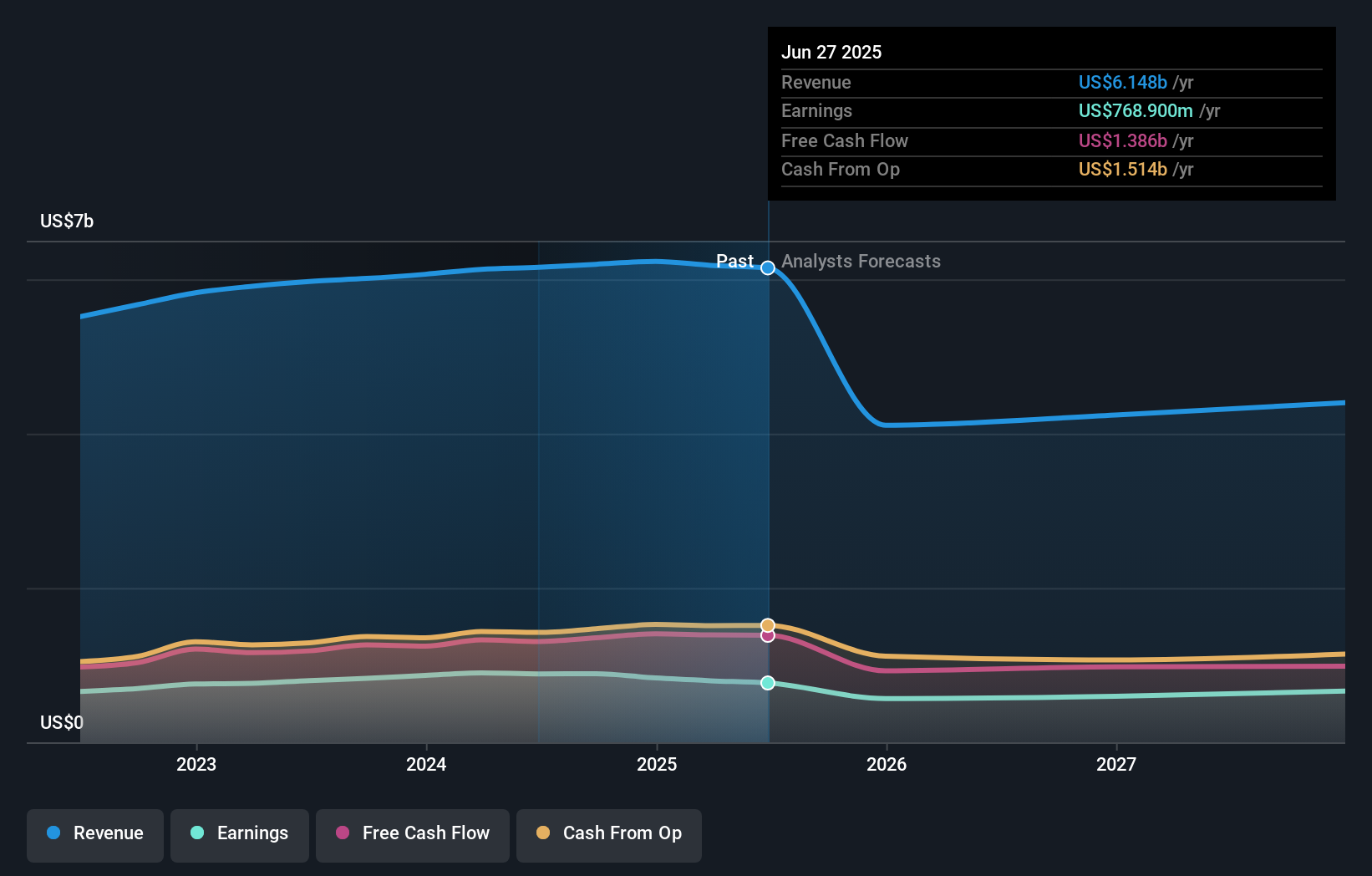

Fortive's narrative projects $4.5 billion revenue and $741.9 million earnings by 2028. This requires -9.8% yearly revenue growth and a $27 million decrease in earnings from $768.9 million currently.

Uncover how Fortive's forecasts yield a $56.12 fair value, a 10% upside to its current price.

Exploring Other Perspectives

All 10 Simply Wall St Community fair value estimates cluster at US$62.83 per share, suggesting a strong consensus. However, future performance could be shaped by risks around revenue concentration and earnings volatility stemming from the recent spin-off, reminding you that contrasting opinions exist and should be considered.

Explore another fair value estimate on Fortive - why the stock might be worth as much as 23% more than the current price!

Build Your Own Fortive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fortive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortive's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTV

Fortive

Designs, develops, manufactures, and markets products, software, and services in the United States, China, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives