- United States

- /

- Construction

- /

- NYSE:FIX

A Fresh Look at Comfort Systems USA (FIX) Valuation After Record Backlog and Growth-Fueled Acquisitions

Reviewed by Simply Wall St

Comfort Systems USA (FIX) delivered a standout third-quarter report, posting its largest ever backlog and notable year-over-year growth driven by public infrastructure projects. The company also closed two electrical firm acquisitions, which may contribute to higher annual revenues and EBITDA.

See our latest analysis for Comfort Systems USA.

Comfort Systems USA’s share price has surged an impressive 123% so far this year, supported by climbing revenues, acquisitions, and bullish trading signals like recent Power Inflow alerts. The company’s long-term momentum is clear, with a 107% total shareholder return over the past year and an exceptional 1,841% total return across five years. These are clear signs that sentiment remains strong and growth potential is commanding attention.

If recent momentum inspires you to explore more dynamic market leaders, now is a timely moment to discover fast growing stocks with high insider ownership

With shares at record highs and future revenue growth widely anticipated, the key question now is whether Comfort Systems USA is still undervalued or if the market has already priced in its next phase of expansion.

Most Popular Narrative: 5% Undervalued

Comfort Systems USA’s most widely followed valuation narrative sees fair value above the latest closing price, highlighting an ongoing gap between analyst expectations and market action. The focus now shifts to whether current fundamentals justify this edge over the market rate.

Robust and expanding project backlog, currently at a record $8.1 billion with 37% same-store growth year-over-year, demonstrates sustained customer demand for new builds and retrofit/modernization projects, directly supporting future revenue and earnings growth as the company executes on this pipeline.

Curious what powers this optimistic view? The bold narrative is underpinned by forecasts of double-digit sales growth and rising margins, hinting at financial assumptions that could reshape investor expectations. Want to see how these projections stack up? The full story unpacks just how aggressive the numbers and profit drivers really are.

Result: Fair Value of $1,007.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing industrial reshoring or persistent skilled labor shortages could challenge growth and margins. This may test the resilience of Comfort Systems USA's current outlook.

Find out about the key risks to this Comfort Systems USA narrative.

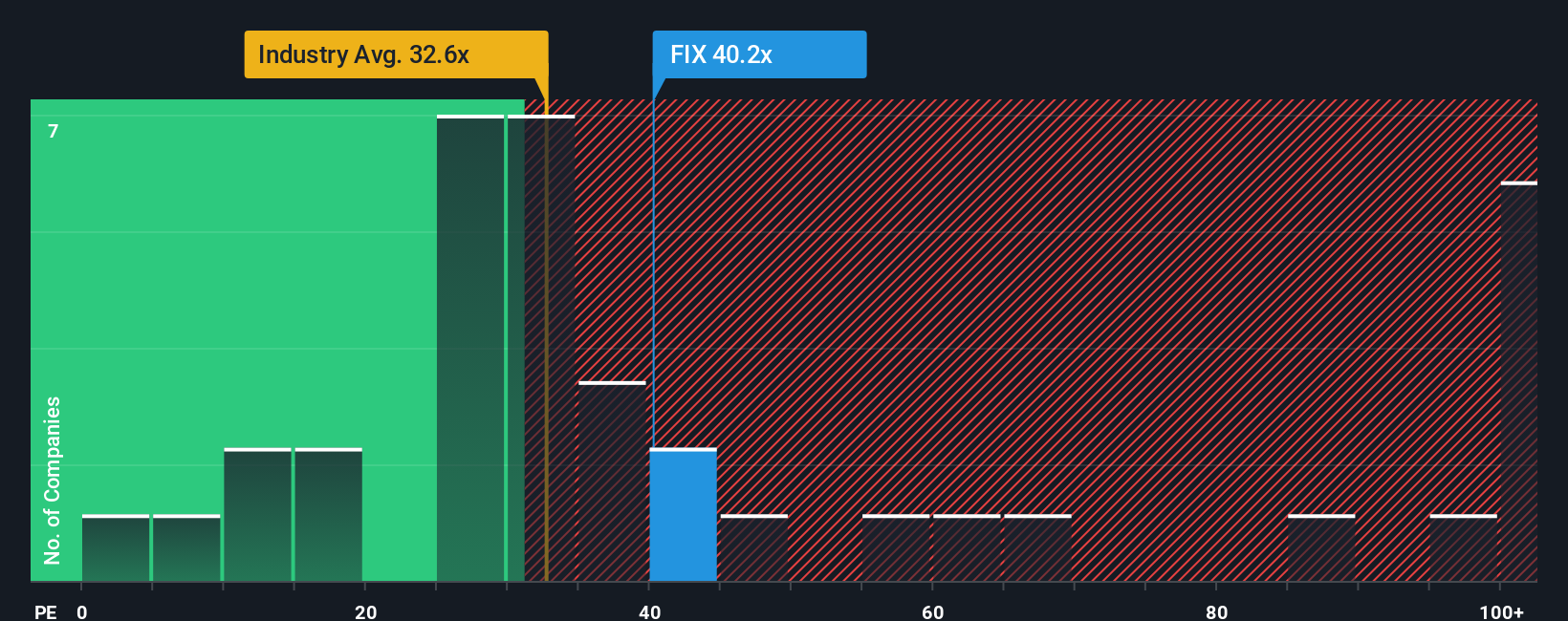

Another View: Looking Through the Lens of Price-to-Earnings

While the most popular narrative points to Comfort Systems USA being undervalued, looking at its price-to-earnings ratio offers some caution. The company currently trades at 40.1x, higher than the US Construction industry’s 33.6x. Compared to peers at 40.9x and a fair ratio of 46.2x, it sits in the middle. This suggests reasonable value but less upside if growth slows. Does this higher valuation leave less room for error, or could market momentum push the stock even higher?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Comfort Systems USA Narrative

If you see things differently, or want to dive deeper into the numbers yourself, it's easy to build your own take in just a couple of minutes: Do it your way.

A great starting point for your Comfort Systems USA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t settle for just one opportunity when you can uncover more game-changing stocks that match your financial goals and risk appetite using Simply Wall Street’s powerful screener tools.

- Access exciting potential in bleeding-edge medicine by reviewing these 32 healthcare AI stocks, which unlocks tomorrow’s healthcare breakthroughs today.

- Supercharge your portfolio’s income with steady yield by checking out these 16 dividend stocks with yields > 3%, which offers attractive returns above 3%.

- Capitalize on tomorrow’s technology by researching these 27 quantum computing stocks, featuring innovation leaders at the forefront of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIX

Comfort Systems USA

Provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives