- United States

- /

- Aerospace & Defense

- /

- NYSE:EVEX

Eve Holding (EVEX): Evaluating Valuation Perspectives After Recent Share Price Volatility

Reviewed by Simply Wall St

Eve Holding (EVEX) shares recently moved lower, catching the attention of investors tracking broader trends in advanced air mobility. The drop comes as market participants weigh the company’s long-term growth prospects in comparison to recent volatility.

See our latest analysis for Eve Holding.

While Eve Holding’s share price has pulled back sharply in recent weeks, including a 33.6% slide over the last three months, the company still boasts a remarkable one-year total shareholder return of 48.5%. This highlights both the high volatility and ongoing belief in its long-term story.

If this kind of dramatic shift sparks your curiosity, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

Amid sharp swings and strong long-term returns, the key question now is whether Eve Holding’s recent weakness signals an undervalued opportunity, or if the market has already factored in all of its anticipated future growth.

Price-to-Book of 7.5x: Is it justified?

With Eve Holding trading at a price-to-book ratio of 7.5x and a last close price of $3.98, the stock appears significantly more expensive than its peers.

The price-to-book multiple is a standard valuation tool for capital-intensive sectors such as Aerospace and Defense because it compares a company's market capitalization to its net assets. This ratio is especially relevant for Eve Holding given its lack of profitability and early-stage business profile. A higher ratio can indicate that investors are pricing in substantial future growth or assets not fully captured on the balance sheet, but it can also signal over-expectation.

In comparison, the US Aerospace and Defense industry averages a price-to-book ratio of just 3.7x, which highlights the premium the market is placing on Eve Holding. Among its immediate peers, the average sits at 5.5x, further establishing Eve as an expensive outlier in this metric.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 7.5x (OVERVALUED)

However, the lack of revenue and ongoing net losses present real risks, particularly if growth projections take longer to materialize than investors expect.

Find out about the key risks to this Eve Holding narrative.

Another View: DCF Model Offers a Different Perspective

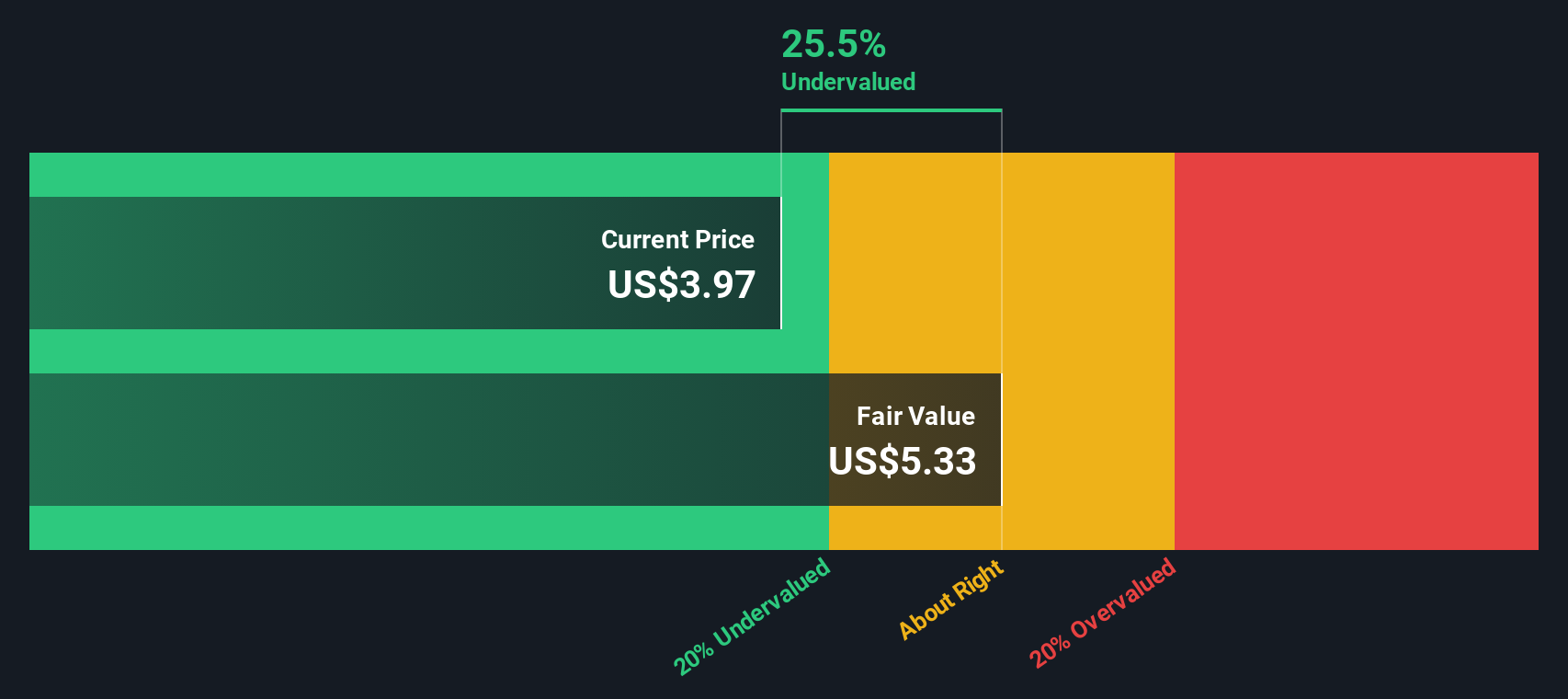

While the price-to-book ratio paints Eve Holding as an expensive outlier, our DCF model suggests a more optimistic scenario. According to this approach, EVEX is trading at a 33% discount to its estimated fair value. Does this signal a hidden opportunity, or are risks behind the numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eve Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 844 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eve Holding Narrative

If you have different insights or want to dive deeper into the numbers yourself, you can quickly build your own perspective in just a few minutes. Do it your way

A great starting point for your Eve Holding research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Don’t stop at just one stock. Unlock the potential to spot opportunities others might miss by taking advantage of tailored investment lists proven to deliver powerful insights.

- Catch the momentum of cutting-edge companies at the intersection of healthcare and technology by checking out these 33 healthcare AI stocks.

- Boost your portfolio with the potential for steady returns. Jump into these 20 dividend stocks with yields > 3% offering attractive yields above 3%.

- Be among the first to seize emerging tech trends with these 28 quantum computing stocks showcasing innovators transforming possibilities in computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eve Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVEX

Excellent balance sheet with slight risk.

Market Insights

Community Narratives