- United States

- /

- Electrical

- /

- NYSE:ETN

Is Eaton’s Recent 8% Drop a Chance for Investors in 2025?

Reviewed by Bailey Pemberton

- Curious if Eaton is a smart buy right now? You are not alone, as many investors are re-examining its value given recent market moves.

- Eaton's stock has dipped by 5.9% over the past week and is down 8.0% for the last month. Its long-term trajectory includes an impressive 108.5% gain over three years and 196.1% over five years.

- A lot of investor attention has focused on sector-wide shifts in industrials and evolving infrastructure policies. Both have influenced Eaton's share price recently, and several news stories have highlighted how these macro trends could shape growth prospects and risk assessments for the company.

- Currently, Eaton scores a 3 out of 6 on our valuation checks, suggesting there is more to uncover beneath the surface. Next, we will look at several valuation approaches to unpack this story further, and reveal a perspective at the end that might just change how you think about figuring out a stock's fair value.

Find out why Eaton's -11.0% return over the last year is lagging behind its peers.

Approach 1: Eaton Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future free cash flows and discounting them back to today. This calculation provides a present value for all expected future earnings.

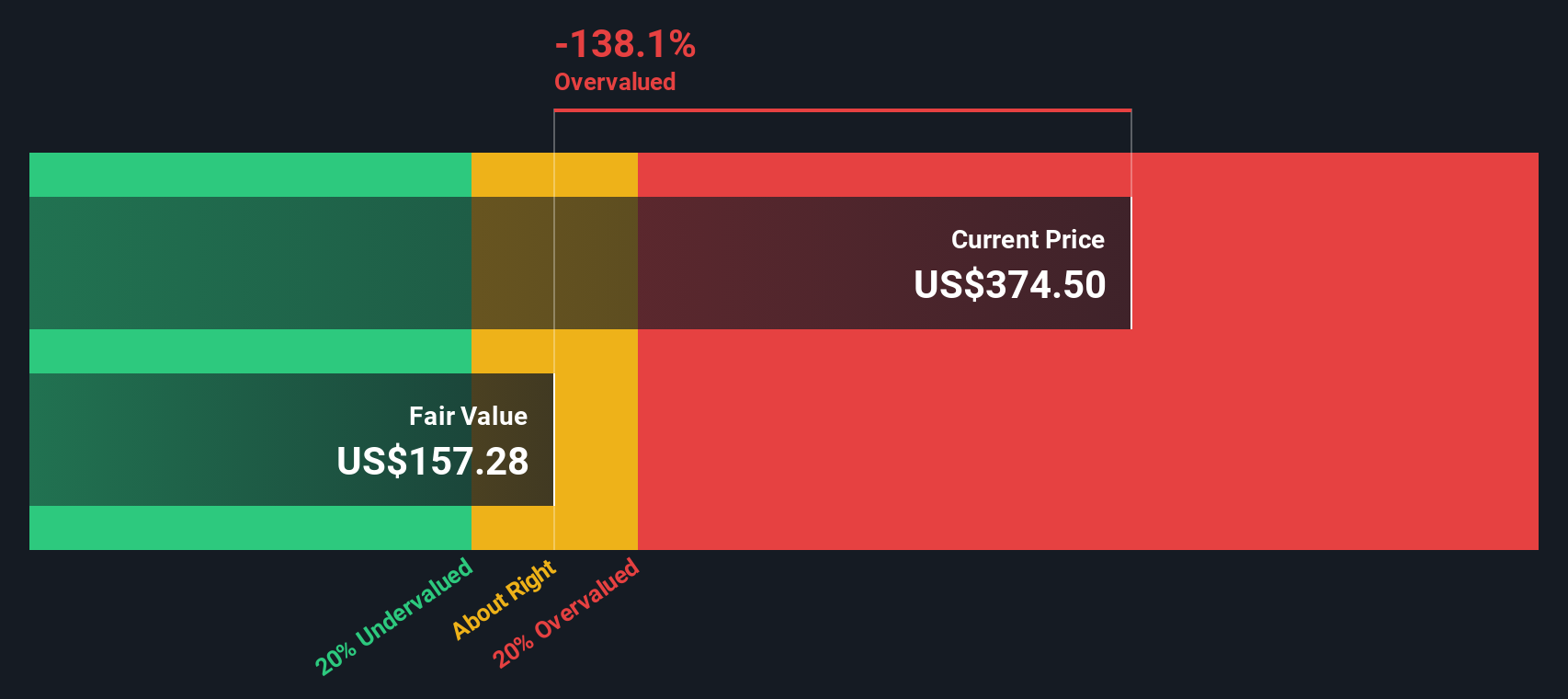

For Eaton, the latest reported Free Cash Flow stands at $3.27 billion. Analysts forecast steady growth, with projected free cash flow reaching $5.49 billion by 2029. Beyond 2029, further increases are extrapolated, but with decreasing growth rates, as estimated by Simply Wall St.

Using the 2 Stage Free Cash Flow to Equity method, this DCF analysis arrives at an intrinsic value of $150.26 per Eaton share. Comparing this to the current share price, the calculation suggests that the stock is trading at a 120.8% premium to its intrinsic value, which implies a significant level of overvaluation at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eaton may be overvalued by 120.8%. Discover 918 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Eaton Price vs Earnings

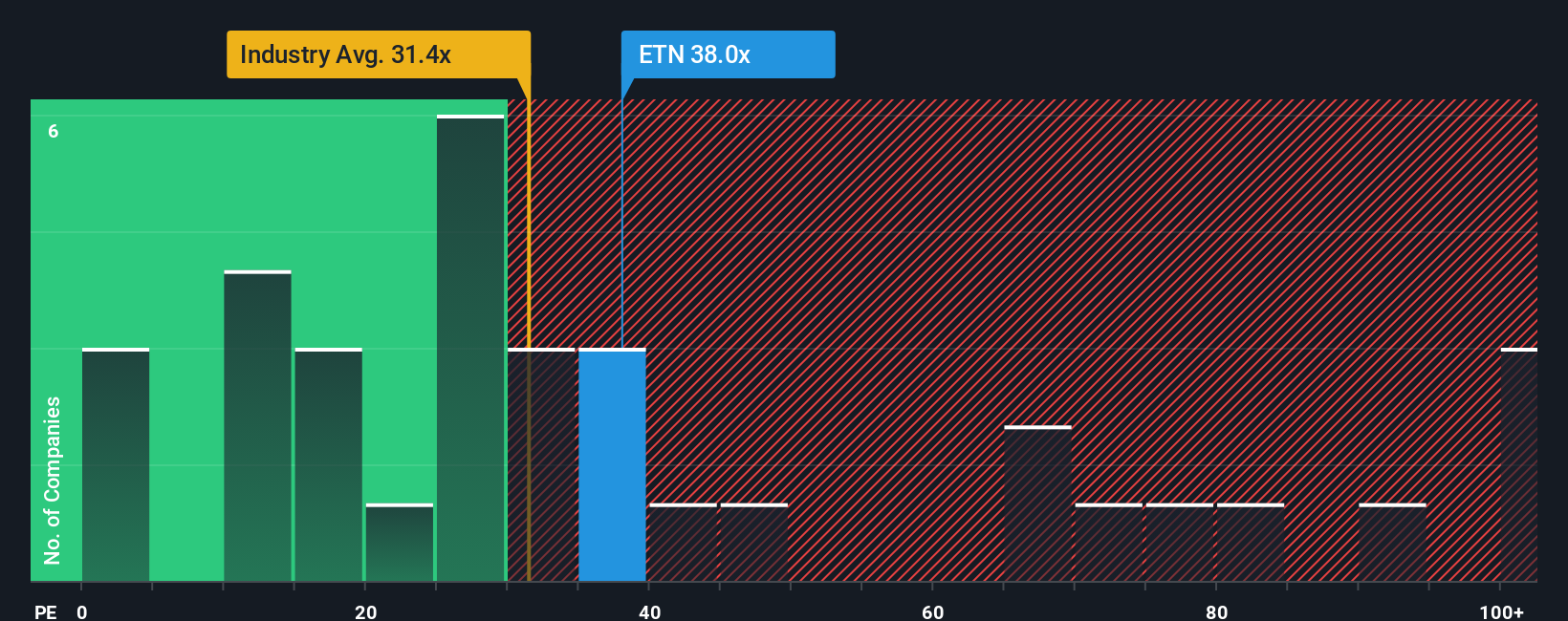

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Eaton, as it relates a company's current market price to its underlying earnings. The PE ratio is popular with investors because it gives an immediate sense of how much the market is willing to pay for a dollar of current profit.

What constitutes a "normal" or fair PE ratio is shaped by several factors, including expectations for future earnings growth and perceived risks facing the business. Companies expected to grow faster or with more robust profit margins typically justify higher PE multiples. In contrast, higher risks or business uncertainties may pull them lower.

Right now, Eaton trades at a PE ratio of 32.8x. This stands above its industry average of 30.6x, but below the average among its peer group, which is 42.6x. While industry and peer comparisons are useful, they do not always paint the full picture of what the company deserves based on its own unique strengths and risks.

Simply Wall St's proprietary "Fair Ratio" seeks to address this by estimating the most appropriate multiple for Eaton, taking into account factors like its earnings growth, industry trends, profit margins, market cap, and company-specific risks. This approach provides a more tailored and insightful benchmark than simply looking at sector averages.

For Eaton, the Fair PE Ratio is calculated to be 38.1x. Since this is moderately higher than Eaton's current PE of 32.8x, it suggests the stock may be undervalued at current levels, as the market is valuing it below what its fundamentals might warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eaton Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives: a smarter, more dynamic way to make investment decisions that goes beyond comparing numbers. Narratives allow investors to shape their own story around a company by bringing together their expectations for Eaton’s future revenue, earnings, and profit margins to estimate a fair value based on what they believe is most likely to happen. In this way, each Narrative turns your perspective into a forecast and links it directly to a fair value, so you can clearly see how your outlook compares to the current market price.

Narratives are easy to access using Simply Wall St’s Community page, where millions of investors can explore, create, and update their forecasts with every new piece of news or earnings report. This real-time feature helps you make investment decisions by always comparing the Fair Value from your Narrative to today’s price. For example, when looking at Eaton, some investors may focus on the company’s data center growth and see a fair value as high as $440 per share, while others who worry about cyclical industry risks may estimate a much lower fair value, closer to $288. This demonstrates how Narratives empower you to invest based on your own conviction and insights.

Do you think there's more to the story for Eaton? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Eaton

Operates as a power management company in the United States, Canada, Latin America, Europe, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives