- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (ETN): Reviewing Valuation After Q3 Results and Upbeat 2025 Growth Guidance

Reviewed by Simply Wall St

Eaton (ETN) just shared its third quarter earnings along with fresh guidance for the rest of 2025. Investors have been watching closely as the company projects organic growth in both the upcoming quarter and over the full year.

See our latest analysis for Eaton.

Eaton's upbeat earnings and encouraging guidance seem to have fueled fresh interest, with its share price climbing 3.51% over the past month and up 16.45% year-to-date. Long-term shareholders have been handsomely rewarded, enjoying a total shareholder return of nearly 18% over the past 12 months and an impressive 155% over three years. This suggests real momentum has built around the company's growth story.

If this kind of sustained trajectory has you wondering what else the market has to offer, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with Eaton's shares trading near record highs and guidance suggesting more growth ahead, investors must now decide if future upside remains or if the market has already priced in these strong expectations.

Most Popular Narrative: 4% Undervalued

According to the most widely followed analyst narrative, Eaton’s fair value sits slightly above its most recent share price, signaling mild upside potential from current levels. The estimate synthesizes analyst projections and market momentum, while also reflecting divergent views on longer-term growth expectations.

Strategic wins and technology leadership in the rapidly expanding data center end market are deepening Eaton's penetration and raising content per megawatt, with major partnerships (e.g., NVIDIA, Siemens Energy) and acquisitions (Fibrebond, Resilient Power) positioning Eaton as the go-to provider for next-generation high-density and AI-centric infrastructure. This supports outsized revenue growth and structurally higher margins due to a richer, more sophisticated product mix.

What really drives this higher valuation? The key factors are ambitious earnings expansion, bolder margin targets, and a profit multiple typically associated with market leaders. Want the full story and the big unknowns behind this price before the street catches up?

Result: Fair Value of $404.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering risks such as underperformance in key segments or a slowdown in AI-driven demand could quickly challenge analysts’ upbeat outlook for Eaton.

Find out about the key risks to this Eaton narrative.

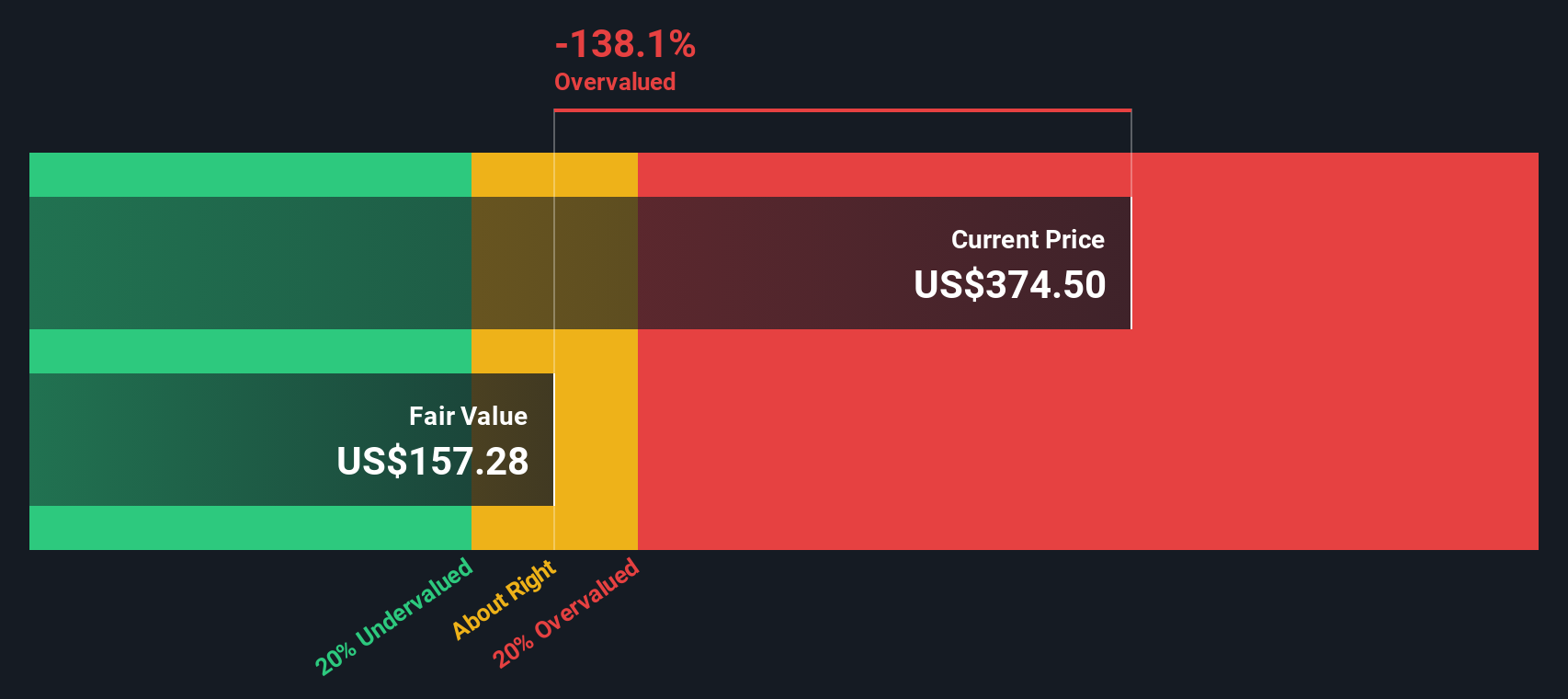

Another View: Discounted Cash Flow Model Tells a Different Story

Switching gears from the analyst narrative, our DCF model pegs Eaton's fair value at just $150.39 per share, which is well below the current price. This suggests the optimistic outlook reflected in today’s share price may not hold up under a stricter cash flow lens. Are investors overlooking downside risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eaton for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eaton Narrative

If the above perspectives do not align with your own, or if you would rather dive into the numbers yourself, you can shape your own perspective in under three minutes, starting here: Do it your way

A great starting point for your Eaton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one winning opportunity? Accelerate your investing journey by choosing stocks that stand out in today’s market using Simply Wall Street’s powerful tools.

- Target long-term income growth by checking out these 18 dividend stocks with yields > 3% with consistent yields above 3% and strong financials.

- Get ahead of the AI revolution when you tap into these 26 AI penny stocks that are shaping tomorrow’s industries with intelligent, fast-moving innovation.

- Position yourself for outsized returns by seeking out these 843 undervalued stocks based on cash flows that analysts believe are trading below their real potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Eaton

Operates as a power management company in the United States, Canada, Latin America, Europe, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives