- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (ETN): Is the Stock’s Valuation Supported by Recent Factory Expansion and Lighthouse Recognition?

Reviewed by Kshitija Bhandaru

Eaton (NYSE:ETN) is turning heads after its Changzhou smart factory earned recognition as a World Economic Forum Lighthouse. This distinction is given to only a select group of advanced manufacturing sites globally.

Alongside the Lighthouse achievement in China, Eaton wrapped up a $100 million expansion at its Nacogdoches, Texas plant. The move more than doubles production capacity for voltage regulators and transformers, boosting the company’s ability to serve growing demand for power solutions.

See our latest analysis for Eaton.

Amid Eaton's push for innovation and expansion, investor momentum has been steady, with the stock posting an 11.2% share price return year to date and 9.5% total shareholder return over the last 12 months. Long-term returns have been even more impressive, underscoring a strong track record and investors’ confidence in Eaton’s growth story.

If these kinds of growth-driven stories interest you, consider using this moment to discover fast growing stocks with high insider ownership.

With shares already up notably and analysts signaling upside, is the current momentum a signal that Eaton is undervalued, or is the market fully pricing in future growth and recent achievements?

Most Popular Narrative: 7.4% Undervalued

With the most-watched narrative estimating fair value at $398.71, Eaton’s last close of $369.08 suggests real room to run. This signals lingering optimism from analysts, who have nudged fair value projections upward on the back of accelerating demand and capacity expansion.

Strategic wins and technology leadership in the rapidly expanding data center end market are deepening Eaton's penetration and raising content per megawatt. Major partnerships (e.g., NVIDIA, Siemens Energy) and acquisitions (Fibrebond, Resilient Power) are positioning Eaton as the go-to provider for next-generation high-density and AI-centric infrastructure. This supports outsized revenue growth and structurally higher margins due to a richer, more sophisticated product mix.

Want to know what earnings and revenue trends give this fair value its power? This narrative hinges on bold projections and game-changing deals. The exact assumptions will surprise you, so deeper insights await inside.

Result: Fair Value of $398.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, some analysts caution that slowing margin expansion or weaker performance in certain segments could challenge Eaton’s current growth narrative if trends shift.

Find out about the key risks to this Eaton narrative.

Another View: DCF Model Offers a Reality Check

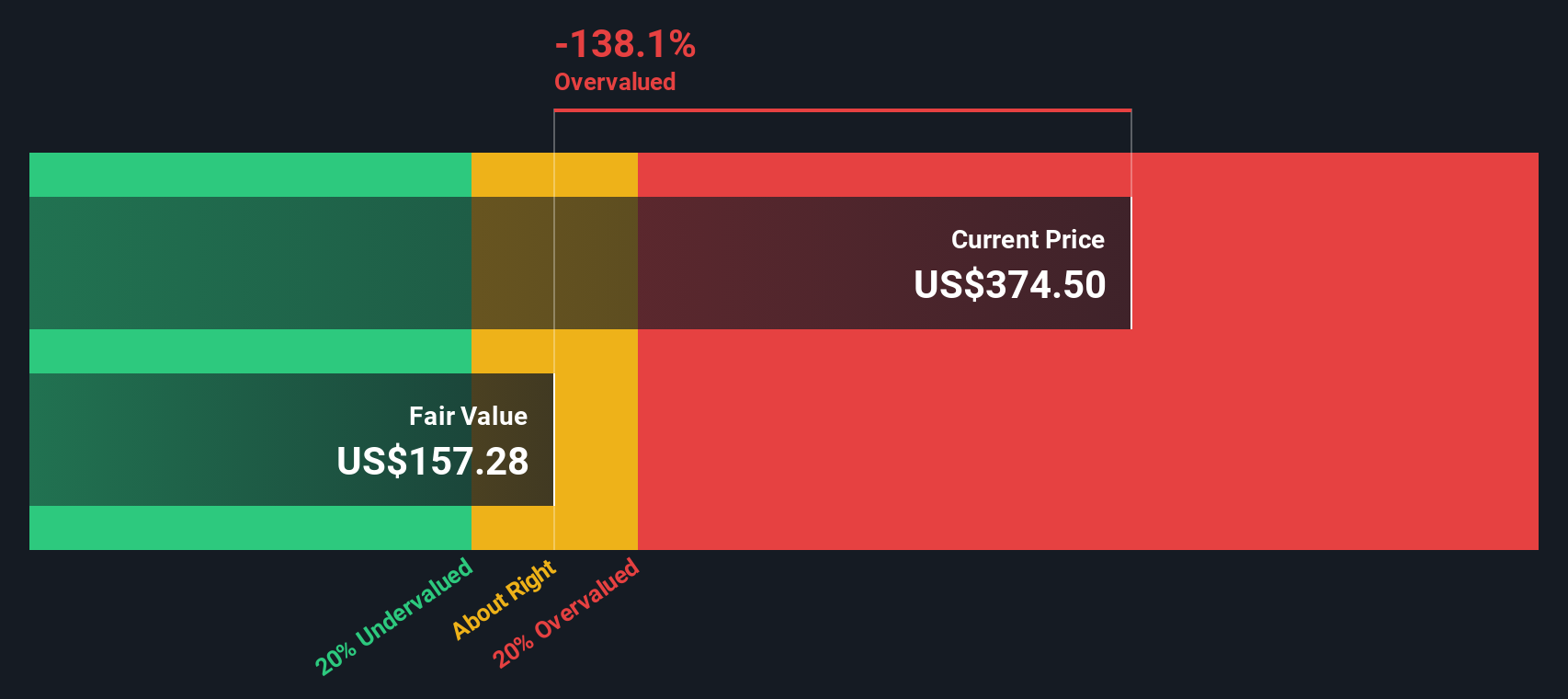

While analysts are bullish, our DCF model suggests a much lower fair value of $153.72 for Eaton, which is far below today's share price. This raises questions about whether momentum and projected growth could be overstating the company’s intrinsic worth. Could the market be overlooking important risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eaton for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eaton Narrative

If you think differently, or want to dive into the numbers yourself, you can craft your own perspective on Eaton in just a few minutes. Do it your way.

A great starting point for your Eaton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never rely on a single angle. Give yourself an edge by seeking out unique stocks using targeted strategies from the Simply Wall Street Screener.

- Cement your portfolio’s stability with steady cash flow by targeting companies offering strong yields through these 19 dividend stocks with yields > 3%.

- Tap into the future of medicine by identifying breakthroughs and innovative leaders with these 33 healthcare AI stocks.

- Seize undervalued opportunities others might overlook by putting these 893 undervalued stocks based on cash flows to work for you right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Eaton

Operates as a power management company in the United States, Canada, Latin America, Europe, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives