- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (ETN): Evaluating Valuation After New Seattle Grid Partnership Highlights Growth in Utility Tech

Reviewed by Simply Wall St

Eaton (ETN) is partnering with Seattle City Light to upgrade and streamline the city's electrical grid planning. Surging power demand, driven by electrification and population growth, is reshaping needs across the region. This initiative highlights Eaton's expanding presence in utility technology solutions.

See our latest analysis for Eaton.

Eaton's momentum in grid technology comes as the stock has been on a wild ride. Despite its latest innovations and new utility partnerships, Eaton’s share price has dipped 8.5% over the past month and slipped 6.4% this week, but it’s still holding onto a 4.1% gain for the year. Looking broader, the one-year total shareholder return is slightly negative. However, the long-term numbers tell a different story, with total returns soaring over 200% in the last five years. This is clear evidence that the company has rewarded patient investors even as current sentiment wavers.

If you’re watching how infrastructure upgrades drive growth, it’s a good moment to broaden your view and discover fast growing stocks with high insider ownership

With shares pulled back from recent highs, but a powerful multi-year run behind it, the pressing question is whether Eaton now trades at a discount or if the market has already priced in all that future growth potential.

Most Popular Narrative: 15.8% Undervalued

With Eaton trading at $345.65, the most popular narrative from market analysts sees fair value about 16% higher than the current share price. This perspective weighs powerful long-term growth drivers against nearer-term uncertainty and recent share price volatility.

Strategic wins and technology leadership in the rapidly expanding data center end market are deepening Eaton's penetration and raising content per megawatt. Major partnerships (such as those with NVIDIA and Siemens Energy) and acquisitions (including Fibrebond and Resilient Power) are positioning Eaton as the primary provider for next-generation high-density and AI-centric infrastructure. These moves support outsized revenue growth and structurally higher margins due to a richer, more sophisticated product mix.

Curious about which bold financial forecasts justify this optimistic fair value? The real story reveals an aggressive path for revenue and earnings, powered by future profit margins typically seen in cutting edge industries. Want to see exactly what powers this valuation? Dive in for the full analysis and the narrative's key assumptions.

Result: Fair Value of $410.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in Eaton’s vehicle segments or delays in realizing expected cost synergies could quickly shift the direction of its growth narrative.

Find out about the key risks to this Eaton narrative.

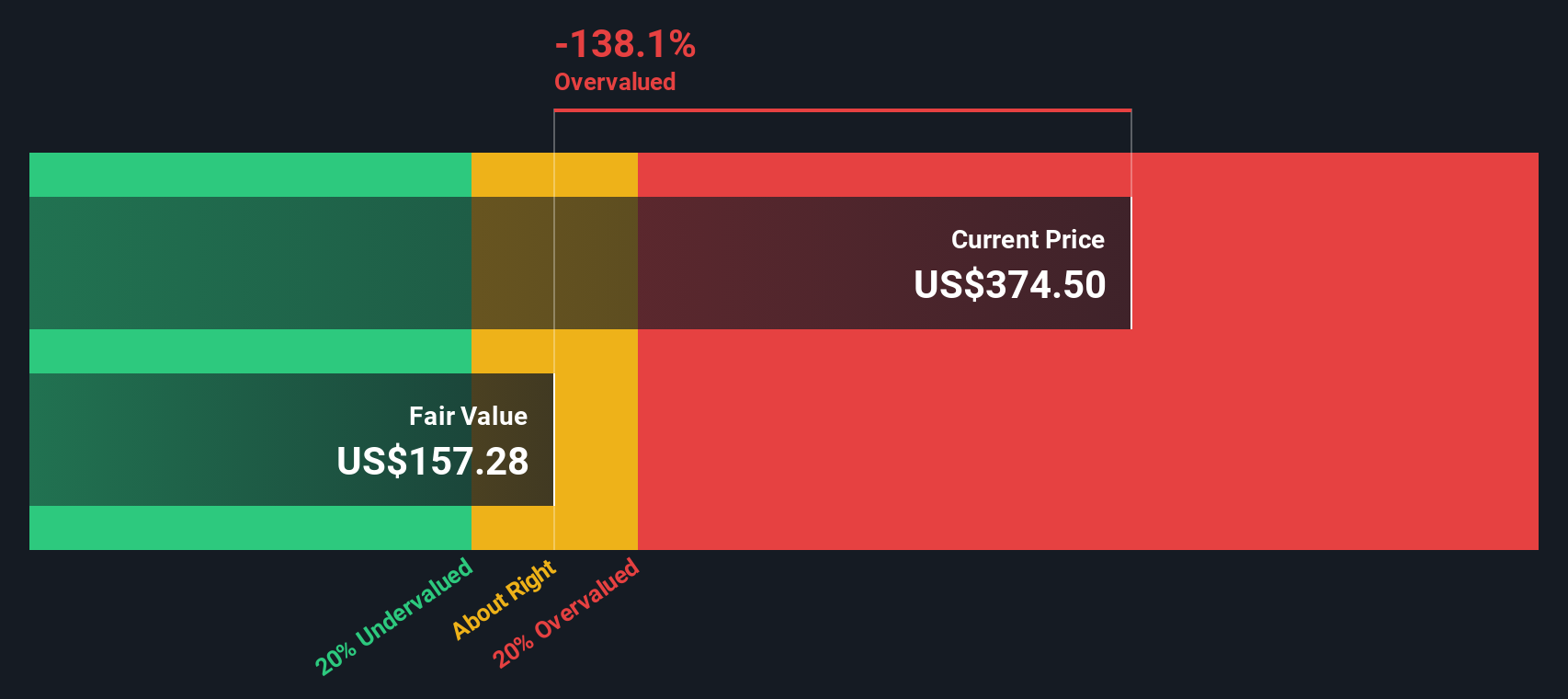

Another View: Our DCF Model Suggests a Very Different Story

While market analysts see Eaton as undervalued, our SWS DCF model tells a more cautious tale. Based on discounted future cash flows, Eaton’s current price of $345.65 is actually trading well above our estimated fair value of $149.53. This implies the stock may be overvalued if growth or efficiency stumbles. Which view will the market reward in the next leg?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eaton for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eaton Narrative

If you see the numbers differently or want to uncover your own insights, you can build out your unique take in just a few minutes, starting with Do it your way

A great starting point for your Eaton research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Level up your strategy and stay ahead of the crowd by searching for stocks capturing the latest trends and opportunities on Simply Wall Street.

- Uncover the next wave of digital health breakthroughs and spot market-movers leading the medical revolution with these 30 healthcare AI stocks.

- Supercharge your portfolio with regular income by targeting companies offering strong yields and financial resilience. Start with these 15 dividend stocks with yields > 3%.

- Capitalize on the AI boom before everyone else gets on board by checking out these 27 AI penny stocks, which are propelling innovation in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETN

Eaton

Operates as a power management company in the United States, Canada, Latin America, Europe, and the Asia Pacific.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives