- United States

- /

- Machinery

- /

- NYSE:ESE

What ESCO Technologies (ESE)'s Rising Pre-Earnings Short Interest Reveals for Shareholders

Reviewed by Sasha Jovanovic

- ESCO Technologies recently saw its short interest as a percentage of float rise 4.15% to 2.01%, ahead of the company's scheduled quarterly earnings announcement on November 20, 2025.

- Despite the increase, ESCO Technologies maintains significantly lower short interest compared to the sector average, pointing to less bearish sentiment among investors relative to its peers.

- With earnings and future guidance updates in focus, we'll explore how pre-earnings anticipation shapes ESCO Technologies' investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ESCO Technologies Investment Narrative Recap

To own ESCO Technologies, investors need to believe in the continued global demand for electric grid reliability, a strong aerospace and defense backlog, and the company’s ability to capitalize on multi-year modernization trends. The recent uptick in short interest appears minor compared to sector norms and is unlikely to materially change near-term catalysts, such as earnings releases and forward guidance, though operational risks around acquisition integration remain especially relevant.

Of the latest updates, the Q4 earnings announcement scheduled for November 20 stands out, as it puts both recent operational performance and management’s guidance for upcoming quarters under scrutiny. This event is closely watched by the market given forecasts of US$2.13 EPS, framing expectations just as investors weigh both growth momentum and integration risks with the Maritime acquisition.

By contrast, investors should be alert to the risk if integration of key acquisitions lags, as synergies or efficiencies...

Read the full narrative on ESCO Technologies (it's free!)

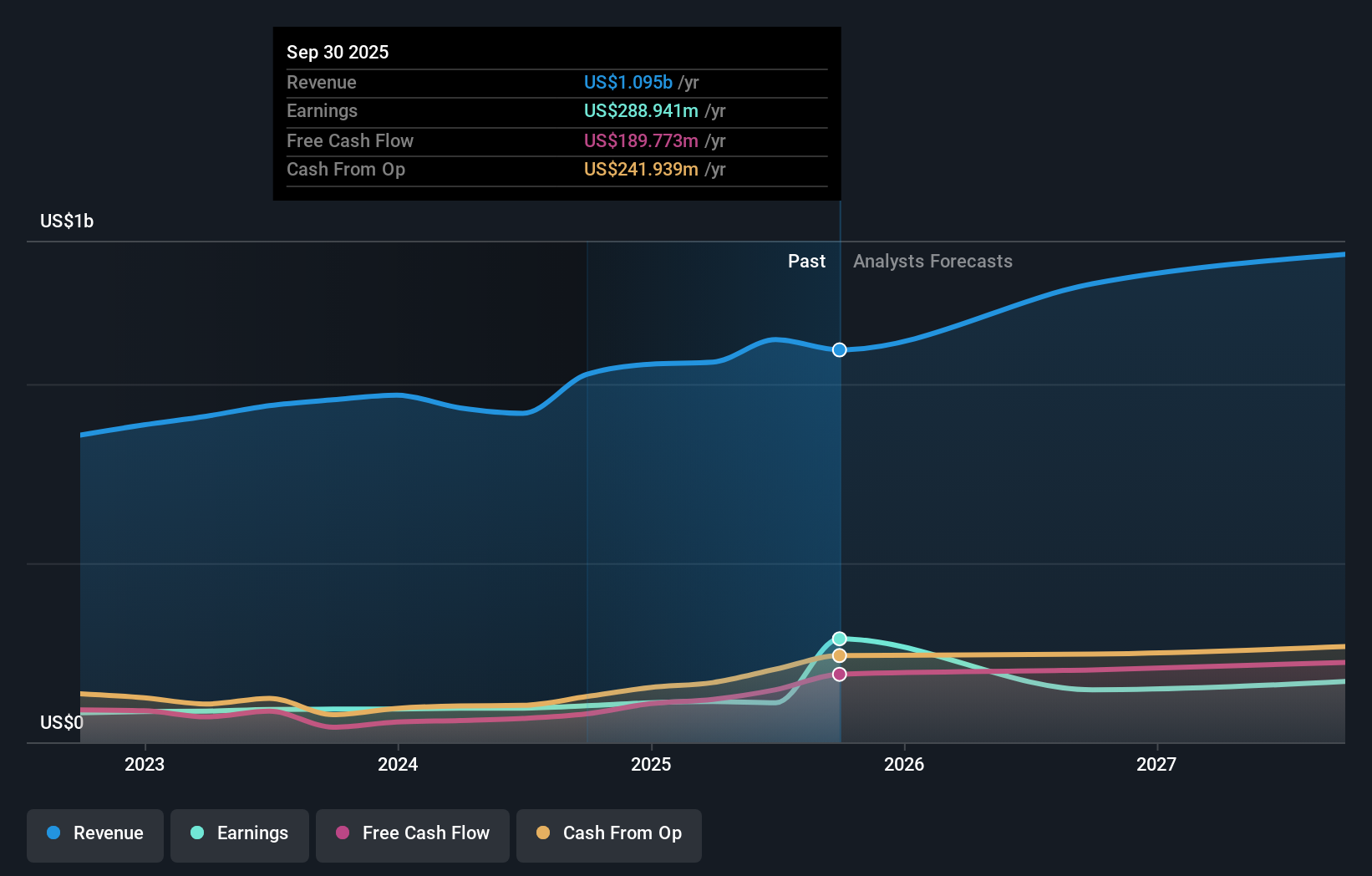

ESCO Technologies’ narrative projects $1.5 billion in revenue and $199.7 million in earnings by 2028. This requires 10.7% yearly revenue growth and an $89.7 million increase in earnings from the current $110.0 million.

Uncover how ESCO Technologies' forecasts yield a $225.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimated ESCO's fair value to range from US$175.58 up to US$225. While integration execution stands out as a key variable for future stability, these perspectives highlight just how varied opinions about the company’s outlook can be, consider exploring multiple viewpoints before forming your own expectations.

Explore 3 other fair value estimates on ESCO Technologies - why the stock might be worth as much as $225.00!

Build Your Own ESCO Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ESCO Technologies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ESCO Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ESCO Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESCO Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESE

ESCO Technologies

Provides engineered filtration and fluid control products, and integrated propulsion systems.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives