- United States

- /

- Electrical

- /

- NYSE:ENS

Should Shifting Margin Focus in EnerSys (ENS) Earnings Prompt a Reassessment of Its Profit Story?

Reviewed by Sasha Jovanovic

- EnerSys reported its Q2 2026 earnings on November 5, 2025, with analysts previously anticipating flat year-on-year revenue and adjusted earnings of US$2.35 per share, following a quarter where the company exceeded revenue expectations but missed on earnings per share.

- Analysts recently raised full-year revenue estimates while trimming earnings projections, reflecting a market pivot toward operational performance and forward guidance as key areas of investor attention.

- We'll explore how the focus on profit margins and forward guidance in this earnings report could alter the investment narrative for EnerSys.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

EnerSys Investment Narrative Recap

To own shares in EnerSys, you need to believe in the company’s ability to grow through new markets, technology upgrades, and cost reductions, even as organic growth and margin pressures pose ongoing challenges. The latest earnings preview doesn’t significantly change the short-term story: margin trends and forward guidance remain in focus, with policy risk around tariffs and trade still the key uncertainty. The main catalyst investors are watching is whether recent cost-saving initiatives will translate to sustained profit margin gains in the upcoming quarters.

Among recent company actions, EnerSys’s implementation of a 575-employee workforce reduction stands out, targeting US$80 million in annualized savings starting fiscal 2026. This move is closely tied to the current earnings focus, as the company aims to offset flat revenue growth and protect margins through operational efficiencies, a theme that now factors heavily into investor expectations as short-term catalysts take precedence. In contrast, what many might miss is how continuing tariff uncertainty could...

Read the full narrative on EnerSys (it's free!)

EnerSys' narrative projects $3.9 billion revenue and $394.7 million earnings by 2028. This requires 1.9% yearly revenue growth and a $43.6 million earnings increase from $351.1 million today.

Uncover how EnerSys' forecasts yield a $120.00 fair value, a 3% downside to its current price.

Exploring Other Perspectives

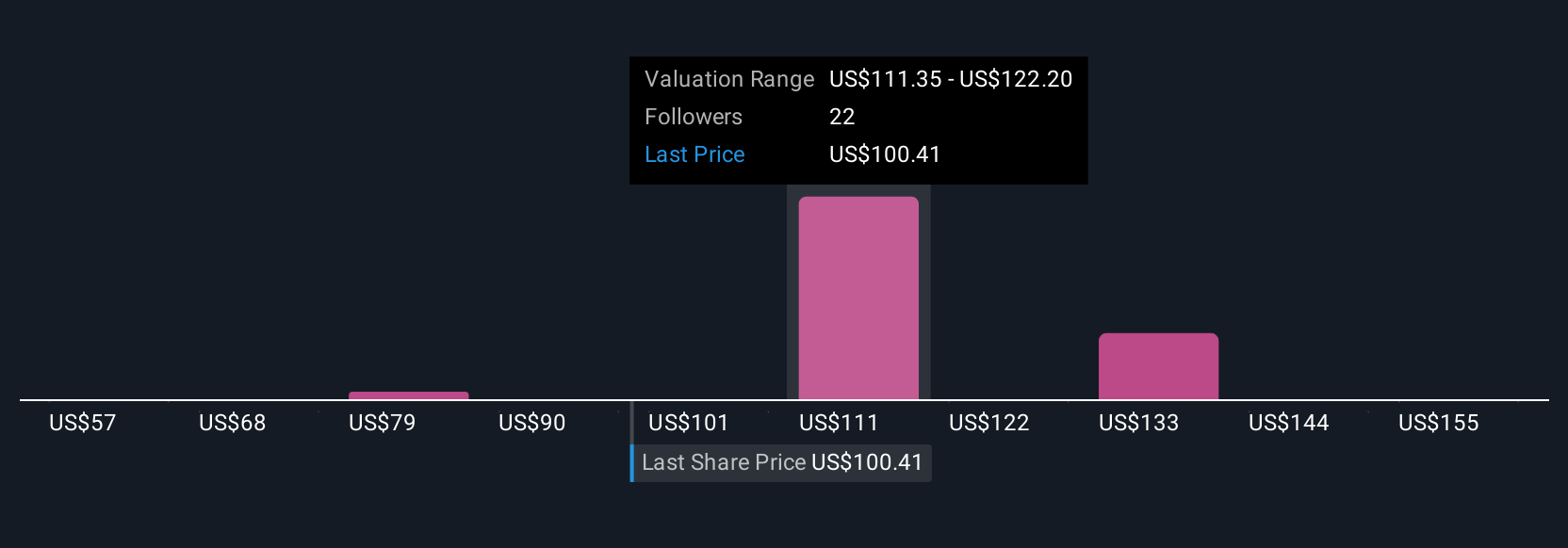

Six members of the Simply Wall St Community value EnerSys between US$85 and US$165.59 per share, showing a wide spread of opinion. While many are focused on cost savings as a profit driver, the risk from policy uncertainty could be a headwind to longer-term performance, check these varied viewpoints for deeper insight.

Explore 6 other fair value estimates on EnerSys - why the stock might be worth as much as 35% more than the current price!

Build Your Own EnerSys Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EnerSys research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EnerSys' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnerSys might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENS

EnerSys

Engages in the provision of stored energy solutions for industrial applications worldwide.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives