- United States

- /

- Electrical

- /

- NYSE:EMR

Is Emerson Electric Still a Bargain After Automation Acquisitions and a 29.7% Stock Surge?

Reviewed by Bailey Pemberton

- Thinking about whether Emerson Electric stock is a bargain or just riding the latest wave? Let’s dig into what’s really driving the numbers before you make your next move.

- The stock has climbed an impressive 29.7% over the past year and more than doubled over five years, grabbing the attention of growth-watchers and value-seekers alike.

- In recent weeks, Emerson Electric has been in the spotlight as it made headlines with strategic acquisitions in the industrial automation sector and expanded its digital solutions. These moves are shifting industry perceptions and may be fueling the stock’s momentum.

- Emerson Electric currently earns a 3 out of 6 on our valuation score, suggesting the company appears undervalued in some areas but not others. We will break down the classic valuation approaches in a moment. Stay tuned to discover a smarter perspective on what these numbers actually mean for your decision-making.

Find out why Emerson Electric's 29.7% return over the last year is lagging behind its peers.

Approach 1: Emerson Electric Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is really worth by forecasting its future cash flows and discounting them back to today's value. This approach is especially helpful for companies with predictable cash generation like Emerson Electric.

Currently, Emerson Electric generates $2.8 Billion in Free Cash Flow. According to consensus estimates, analysts expect the company’s annual cash flow to keep growing, reaching $9.7 Billion by 2029. While direct analyst projections stop at 2029, Simply Wall St extrapolates future values, extending estimates for the following years based on expected growth rates.

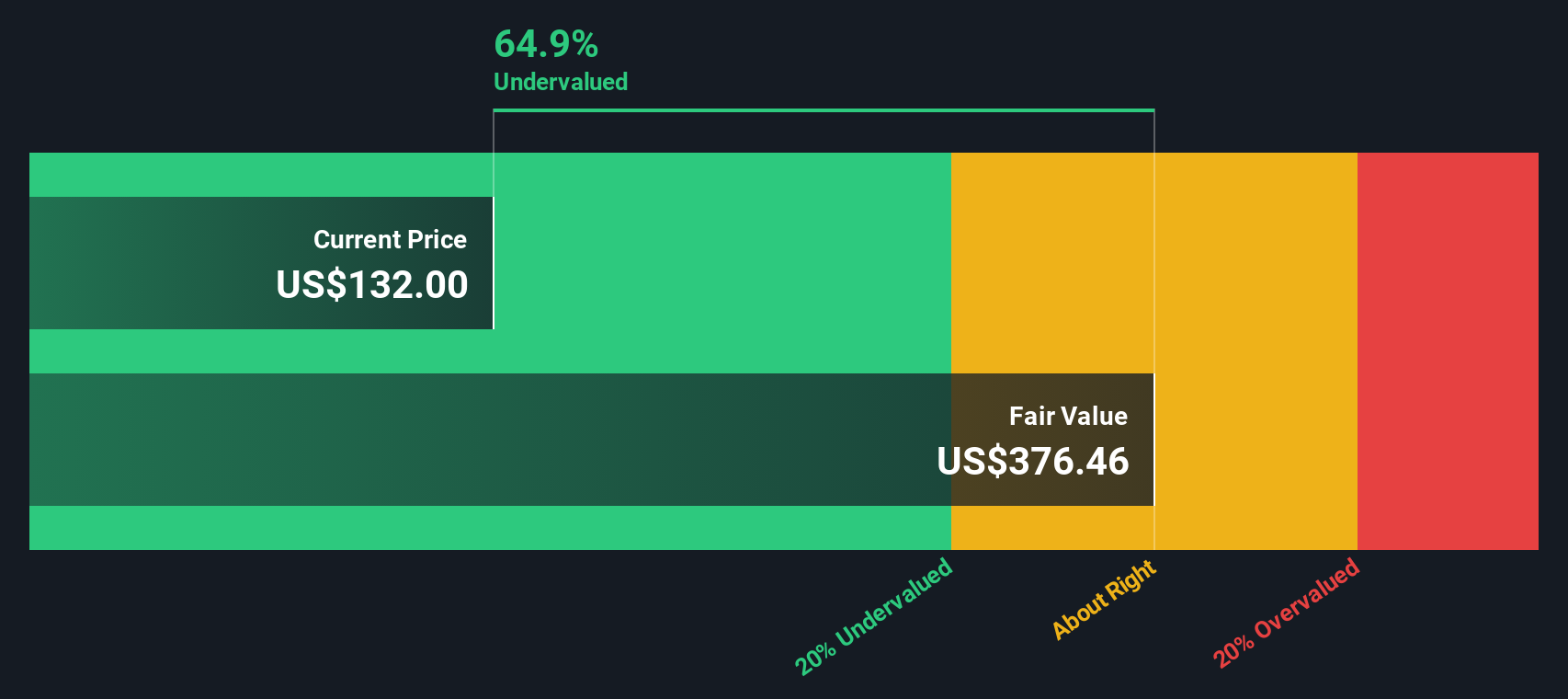

Using this method, the DCF model arrives at an intrinsic fair value of $352.34 per share. With the current stock price trading at a 60.3% discount to that calculated value, the implication is clear: the shares are significantly undervalued based on projected future performance and present-day price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Emerson Electric is undervalued by 60.3%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Emerson Electric Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is one of the most trusted tools for valuing established, profitable companies. Since it measures the price investors are willing to pay for each dollar of earnings, it is especially useful for companies like Emerson Electric, which produce steady profits year after year.

It is important to note that a "fair" PE ratio can vary depending on growth expectations and how risky the company's future looks. A higher PE often reflects confidence in future earnings growth or a company perceived as lower risk, while a lower PE could signal more uncertainty or below-average prospects.

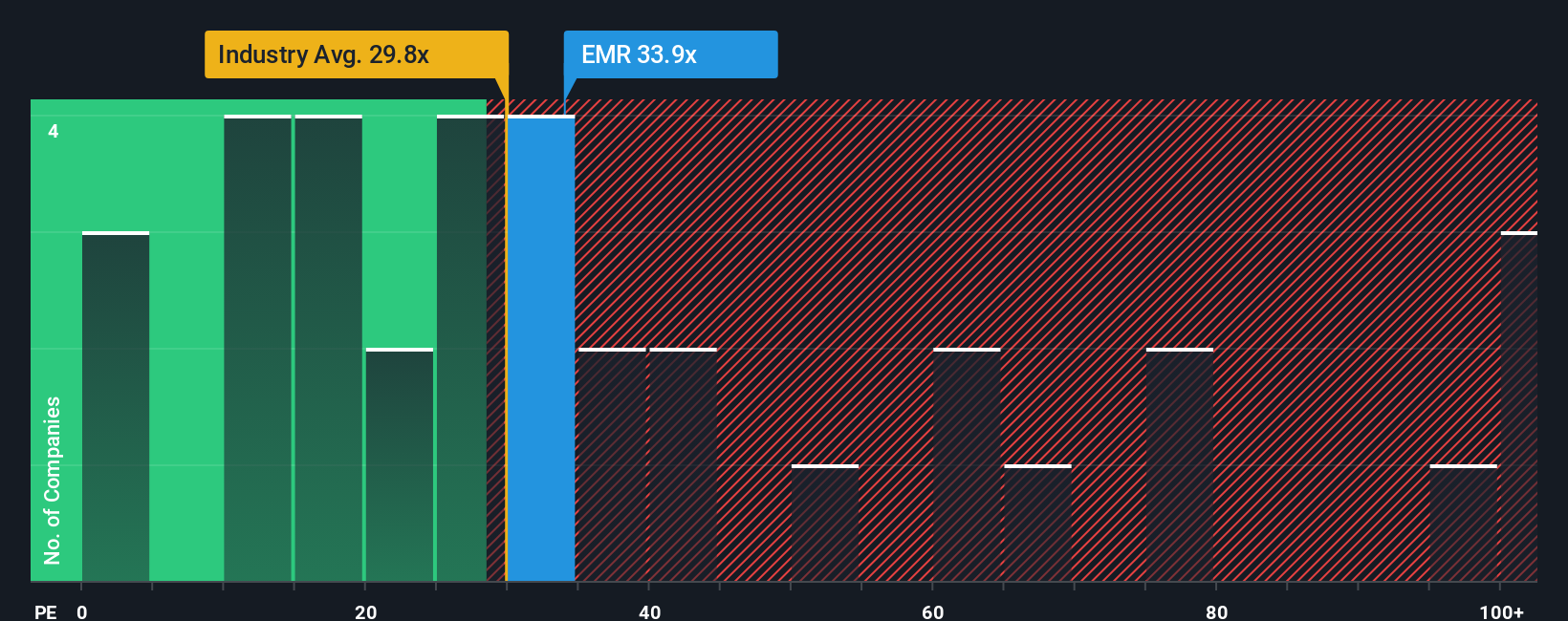

Emerson Electric currently trades at a PE of 35.7x. This is above the Electrical industry average of 31.7x, yet notably below the average of its close peers at 45.7x. These benchmarks provide essential context, but they do not account for specific factors unique to Emerson Electric.

Simply Wall St’s Fair Ratio is a proprietary calculation that blends important aspects such as earnings growth, profit margins, industry traits, market cap, and risk. Unlike simple peer or industry comparisons, the Fair Ratio sets a tailored benchmark based on the company’s individual profile.

For Emerson Electric, the Fair Ratio sits at 32.5x, just a touch below the stock’s actual PE of 35.7x. This suggests Emerson shares are trading at a small premium to their tailored fair value, but not enough to be meaningfully overvalued given the company’s quality and growth outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Emerson Electric Narrative

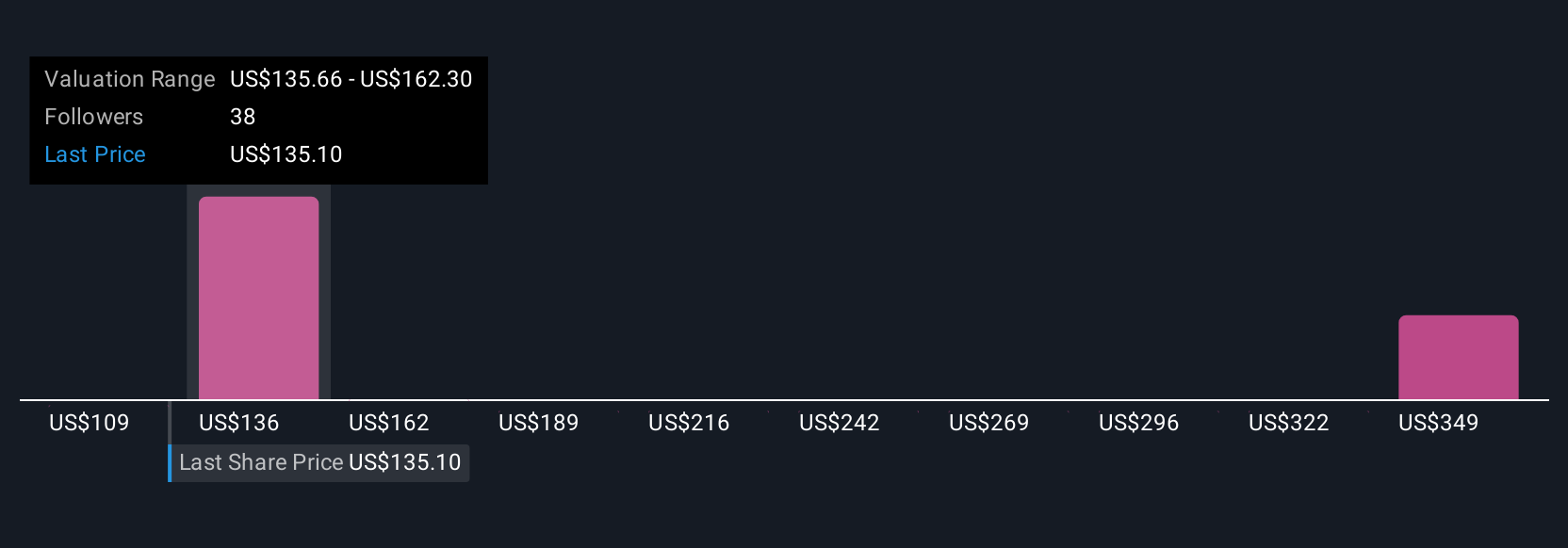

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. Instead of focusing solely on numbers, Narratives allow you to craft your own story for a company, connecting your personal outlook to projected financials and a fair value. A Narrative is your concise view of the business: it ties together key drivers like revenue growth, profit margins, and company strategy, then calculates what you think the shares are truly worth based on those beliefs.

Simply Wall St’s Community page makes it easy for anyone. Millions of investors already do this and can create and update Narratives, helping you express your perspective and track how it stacks up against market prices. Narratives also respond dynamically to breaking news or new earnings, so your views and fair value adjust automatically as new information becomes available.

This approach empowers you to decide whether to buy or sell by comparing your Narrative's fair value to the current share price, making the process both accessible and practical. For example, one Narrative on Emerson Electric projects rapid AI-driven automation adoption and robust recurring software revenues, suggesting a higher fair value around $185. Another, more cautious Narrative points to risks in integration and cyclical markets, arriving at a lower estimate near $111.

Do you think there's more to the story for Emerson Electric? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives