- United States

- /

- Electrical

- /

- NYSE:EMR

Evaluating Emerson Electric (EMR): Is the Stock Still Undervalued After Recent Gains?

Reviewed by Simply Wall St

See our latest analysis for Emerson Electric.

Emerson Electric’s share price has steadily advanced this year, shaking off short-term volatility and notching a 12.7% gain since January. Over the past year, total shareholder return reached an impressive 19%, which points to resilient longer-term momentum and growing investor confidence.

If broader industrial growth themes interest you, this could be the perfect moment to explore fast growing stocks with high insider ownership.

With steady gains and strong fundamentals, the question now becomes whether Emerson Electric’s stock is trading at an attractive valuation, or if the market has already factored in all of the company’s future growth potential.

Most Popular Narrative: 8.7% Undervalued

With Emerson Electric’s narrative fair value sitting well above its last close, current analyst consensus sees more room for upside than the market has priced in. The narrative points to powerful tailwinds that could transform the company's growth trajectory.

The accelerating adoption of digital automation and artificial intelligence solutions in global industrial markets is fueling strong demand for Emerson's advanced software platforms and AI-enabled products, such as Ovation 4.0 and Nigel AI adviser, which is resulting in robust order growth and positions the company for sustained revenue expansion.

Want to see what’s fueling analyst confidence? The foundation of this valuation is a bold transformation strategy, ambitious AI bets, and projected earnings growth that defies old industrial expectations. The numbers behind this narrative reveal a financial roadmap unlike anything in recent years. Don’t miss the full story. Discover just how analysts sized up these ambitious targets.

Result: Fair Value of $150.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including exposure to trade and currency volatility, as well as possible softness in key industrial end markets. These factors could challenge these upbeat outlooks.

Find out about the key risks to this Emerson Electric narrative.

Another View: Relative Valuation Challenges

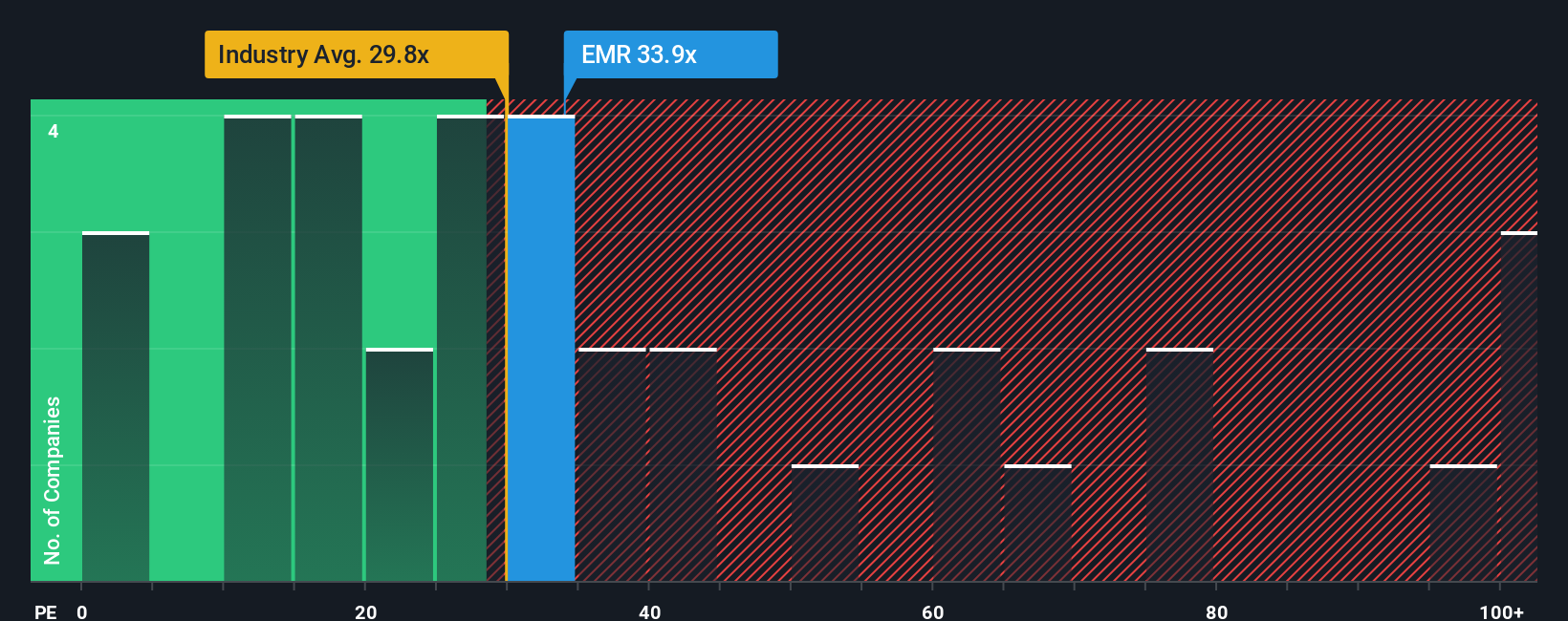

Looking at Emerson Electric through the lens of earnings multiples, the stock is trading at 35.1 times earnings. This is above both the US Electrical industry average of 31.1 and its fair ratio of 32.2. While the valuation seems stretched compared to the sector, against a peer group with a pricier average of 44.3, there may still be some relative value in current prices. Does this premium reflect lasting quality and growth, or is valuation risk building in the background?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Emerson Electric Narrative

If you want to look beyond the consensus numbers or bring your own perspective to the table, you can create your own narrative in just a few minutes. Do it your way.

A great starting point for your Emerson Electric research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next breakthrough stock pass you by. Give yourself an edge with investment ideas you may not have considered, handpicked for today’s market conditions.

- Boost your income potential and focus on companies generating steady payouts by checking out these 20 dividend stocks with yields > 3%.

- Take advantage of AI innovation and see which businesses are positioned to shape tomorrow’s technology by exploring these 26 AI penny stocks.

- Get a head start by identifying value the market might be missing in these 840 undervalued stocks based on cash flows, and find stocks with attractive upside right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerson Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMR

Emerson Electric

A technology and software company, provides various solutions in the Americas, Asia, the Middle East, Africa, and Europe.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives